North Face 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

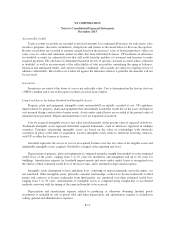

limits its exposure in the aggregate and to any single counterparty, and adjusts its hedging positions as

appropriate. The impact of VF’s credit risk and the credit risk of its counterparties, as well as the ability of each

party to fulfill its obligations under the contracts, is considered in determining the fair value of the derivative

contracts. Credit risk has not had a significant effect on the fair value of VF’s derivative contracts. VF does not

have any credit risk-related contingent features or collateral requirements with its derivative contracts.

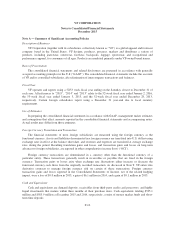

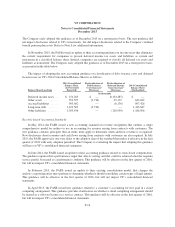

Revenue Recognition

Revenue is recognized when (i) there is a contract or other arrangement of sale, (ii) the sales price is fixed or

determinable, (iii) title and the risks of ownership have been transferred to the customer and (iv) collection of the

receivable is reasonably assured. Sales to wholesale customers and e-commerce sales are generally recognized

when the product has been received by the customer. Sales at VF-operated retail stores are recognized at the time

products are purchased by consumers. Revenue from the sale of gift cards is deferred until the gift card is

redeemed by the customer or the Company determines that the likelihood of redemption is remote and that it

does not have a legal obligation to remit the value of the unredeemed gift card to any jurisdiction under

unclaimed property regulations.

Net sales reflect adjustments for estimated allowances for trade terms, sales incentive programs, discounts,

markdowns, chargebacks and returns. These allowances are estimated based on evaluations of specific product

and customer circumstances, historical and anticipated trends, and current economic conditions.

Shipping and handling costs billed to customers are included in net sales. Sales taxes and value added taxes

collected from customers and remitted directly to governmental authorities are excluded from net sales.

Royalty income is recognized as earned based on the greater of the licensees’ sales of licensed products at

rates specified in the licensing contracts or contractual minimum royalty levels.

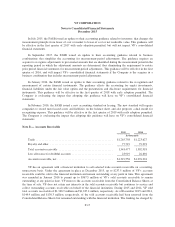

Cost of Goods Sold

Cost of goods sold for VF-manufactured goods includes all materials, labor and overhead costs incurred in

the production process. Cost of goods sold for purchased finished goods includes the purchase costs and related

overhead. In both cases, overhead includes all costs related to manufacturing or purchasing finished goods,

including costs of planning, purchasing, quality control, depreciation, freight, duties, royalties paid to third

parties and shrinkage. For product lines with a warranty, a provision for estimated future repair or replacement

costs, based on historical and anticipated trends, is recorded when these products are sold.

Selling, General and Administrative Expenses

Selling, general and administrative expenses include costs of product development, selling, marketing and

advertising, VF-operated retail stores, concession retail stores, warehousing, distribution, shipping and handling,

licensing and administration. Advertising costs are expensed as incurred and totaled $712.6 million in 2015,

$713.7 million in 2014 and $671.3 million in 2013. Advertising costs include cooperative advertising payments

made to VF’s customers as reimbursement for their costs of advertising VF’s products, and totaled $61.9 million

in 2015, $62.6 million in 2014 and $58.6 million in 2013. Shipping and handling costs for delivery of products to

customers totaled $348.1 million in 2015, $309.9 million in 2014 and $298.5 million in 2013. Expenses related to

royalty income, including amortization of licensed intangible assets, were $13.0 million in 2015, $13.2 million in

2014 and $13.4 million in 2013.

F-13