North Face 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VF CORPORATION

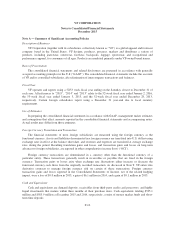

Notes to Consolidated Financial Statements

December 2015

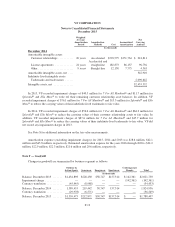

Accounts Receivable

Trade accounts receivable are recorded at invoiced amounts, less estimated allowances for trade terms, sales

incentive programs, discounts, markdowns, chargebacks and returns as discussed below in Revenue Recognition.

Royalty receivables are recorded at amounts earned based on the licensees’ sales of licensed products, subject in

some cases to contractual minimum annual royalties due from individual licensees. VF maintains an allowance

for doubtful accounts for estimated losses that will result from the inability of customers and licensees to make

required payments. The allowance is determined based on review of specific customer accounts where collection

is doubtful, as well as an assessment of the collectability of total receivables considering the aging of balances,

historical and anticipated trends, and current economic conditions. All accounts are subject to ongoing review of

ultimate collectability. Receivables are written off against the allowance when it is probable the amounts will not

be recovered.

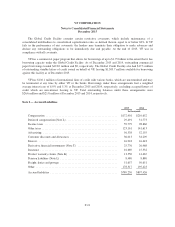

Inventories

Inventories are stated at the lower of cost or net realizable value. Cost is determined on the first-in, first-out

(“FIFO”) method and is net of discounts or rebates received from vendors.

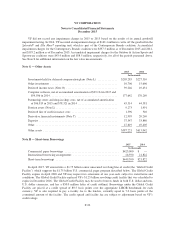

Long-lived Assets, Including Goodwill and Intangible Assets

Property, plant and equipment, intangible assets and goodwill are initially recorded at cost. VF capitalizes

improvements to property, plant and equipment that substantially extend the useful life of the asset, and interest

cost incurred during construction of major assets. Assets under capital leases are recorded at the present value of

minimum lease payments. Repair and maintenance costs are expensed as incurred.

Cost for acquired intangible assets is fair value, based generally on the present value of expected cash flows.

Trademark intangible assets represent individual acquired trademarks, some of which are registered in multiple

countries. Customer relationship intangible assets are based on the value of relationships with wholesale

customers in place at the time of acquisition. License intangible assets relate to numerous licensing contracts,

with VF as either the licensor or licensee.

Goodwill represents the excess of cost of an acquired business over the fair value of net tangible assets and

identifiable intangible assets acquired. Goodwill is assigned at the reporting unit level.

Depreciation of property, plant and equipment is computed using the straight-line method over the estimated

useful lives of the assets, ranging from 3 to 10 years for machinery and equipment and up to 40 years for

buildings. Amortization expense for leasehold improvements and assets under capital leases is recognized over

the shorter of their estimated useful lives or the lease terms, and is included in depreciation expense.

Intangible assets determined to have indefinite lives, consisting of major trademarks and trade names, are

not amortized. Other intangible assets, primarily customer relationships, contracts to license trademarks to third

parties and contracts to license trademarks from third parties, are amortized over their estimated useful lives

ranging from 3 to 30 years. Amortization of intangible assets is computed using straight-line or accelerated

methods consistent with the timing of the expected benefits to be received.

Depreciation and amortization expense related to producing or otherwise obtaining finished goods

inventories is included in cost of goods sold, and other depreciation and amortization expense is included in

selling, general and administrative expenses.

F-11