North Face 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

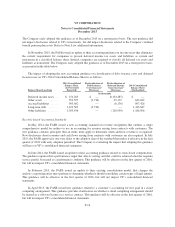

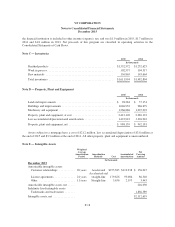

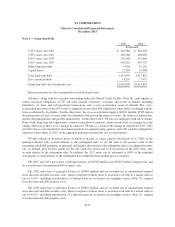

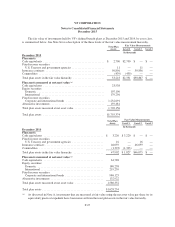

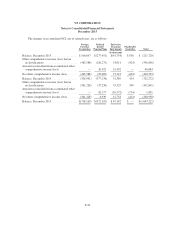

Activity relating to accrued product warranty claims is summarized as follows:

2015 2014 2013

In thousands

Balance, beginning of year ............................... $62,288 $ 57,139 $ 50,395

Accrual for products sold during the year ................... 16,673 20,971 20,199

Repair or replacement costs incurred ....................... (14,136) (13,660) (13,923)

Currency translation .................................... (1,711) (2,162) 468

Balance, end of year .................................... 63,114 62,288 57,139

Less current portion (Note I) ............................. 13,550 14,467 14,787

Long-term portion ..................................... $49,564 $ 47,821 $ 42,352

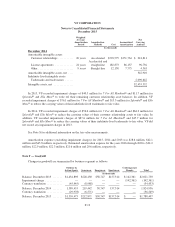

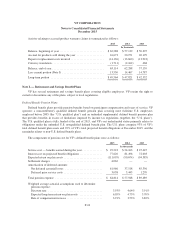

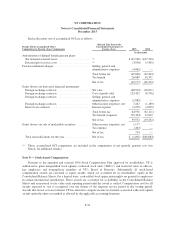

Note L — Retirement and Savings Benefit Plans

VF has several retirement and savings benefit plans covering eligible employees. VF retains the right to

curtail or discontinue any of the plans, subject to local regulations.

Defined Benefit Pension Plans

Defined benefit plans provide pension benefits based on participant compensation and years of service. VF

sponsors a noncontributory qualified defined benefit pension plan covering most full-time U.S. employees

employed before 2005 (the “U.S. qualified plan”) and an unfunded supplemental defined benefit pension plan

that provides benefits in excess of limitations imposed by income tax regulations (together, the “U.S. plans”).

The U.S. qualified plan is fully funded at the end of 2015, and VF’s net underfunded status primarily relates to

obligations under the unfunded U.S. nonqualified defined benefit plan. The U.S. plans comprise 93% of VF’s

total defined benefit plan assets and 92% of VF’s total projected benefit obligations at December 2015, and the

remainder relates to non-U.S. defined benefit plans.

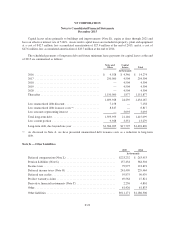

The components of pension cost for VF’s defined benefit plans were as follows:

2015 2014 2013

In thousands

Service cost — benefits earned during the year .............. $ 29,223 $ 24,163 $ 25,445

Interest cost on projected benefit obligations ................ 77,620 81,496 72,003

Expected return on plan assets ........................... (111,095) (90,674) (94,585)

Settlement charges .................................... 4,062 — —

Amortization of deferred amounts:

Net deferred actuarial losses .......................... 61,966 37,518 85,356

Deferred prior service costs ........................... 3,038 5,445 1,270

Total pension expense ................................. $ 64,814 $ 57,948 $ 89,489

Weighted average actuarial assumptions used to determine

pension expense:

Discount rate ...................................... 3.93% 4.64% 3.91%

Expected long-term return on plan assets ................ 6.05% 4.73% 5.70%

Rate of compensation increase ......................... 3.91% 3.53% 3.82%

F-24