North Face 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

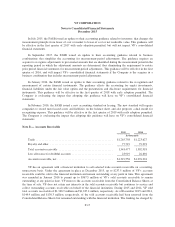

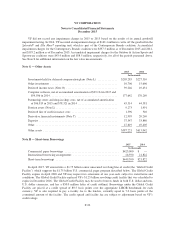

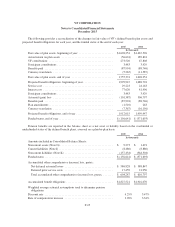

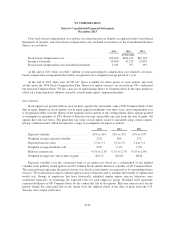

Accumulated benefit obligations at any measurement date are the present value of vested and unvested

pension benefits earned, without considering projected future compensation increases. Projected benefit

obligations are the present value of vested and unvested pension benefits earned, considering projected future

compensation increases.

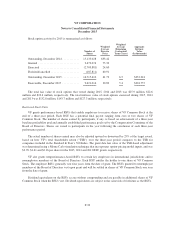

At the end of fiscal 2015, the Company changed to the spot rate approach to measure service and interest

costs for our defined benefit plans. Previously, the same single equivalent discount rate determined for measuring

the projected benefit obligation was also used to determine service cost and interest cost. Under the new spot rate

approach, the full yield curve is applied separately to cash flows for each projected benefit obligation, service

cost, and interest cost for a more precise calculation. The Company has accounted for this as a change in

accounting estimate and, accordingly, has applied it on a prospective basis.

VF recorded $4.1 million in settlement charges during 2015, related to the recognition of deferred actuarial

losses resulting from lump-sum payments of retirement benefits to participants in VF’s supplemental defined

benefit pension plan.

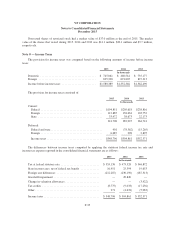

Deferred actuarial gains and losses are changes in the amount of either the benefit obligation or the value of

plan assets resulting from differences between expected amounts for a year using actuarial assumptions and the

actual results for that year. These amounts are deferred as a component of accumulated OCI and amortized to

pension expense in future years as follows: amounts in excess of 20% of projected benefit obligations at the

beginning of the year are amortized over five years; amounts between (i) 10% of the greater of projected benefit

obligations or plan assets and (ii) 20% of projected benefit obligations are amortized over the expected average

remaining years of service of active participants; and amounts less than the greater of 10% of projected benefit

obligations or plan assets are not amortized. Deferred prior service costs related to plan amendments are also

recorded in accumulated OCI and amortized to pension expense on a straight-line basis over the average

remaining years of service for active employees. The estimated amounts of accumulated OCI to be amortized to

pension expense in 2016 are $65.2 million of deferred actuarial losses and $2.6 million of deferred prior service

costs.

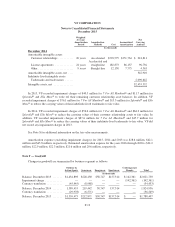

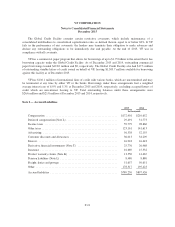

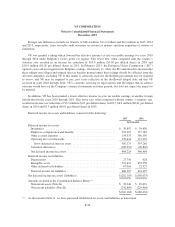

Management’s investment objectives are to invest plan assets in a diversified portfolio of securities to

provide long-term growth, minimize the volatility of the value of plan assets relative to plan liabilities, and to

ensure plan assets are sufficient to pay the benefit obligations. Investment strategies focus on diversification

among multiple asset classes, a balance of long-term investment return at an acceptable level of risk, and

liquidity to meet benefit payments. The primary objective of the investment strategies is to more closely align

plan assets with plan liabilities by utilizing dynamic asset allocation targets dependent upon changes in the plan’s

funded ratio, capital market expectations, and risk tolerance.

Plan assets are primarily composed of common collective trust funds that invest in liquid securities

diversified across equity, fixed-income, real estate and other asset classes. Fund assets are allocated among

independent investment managers who have full discretion to manage their portion of the fund’s assets, subject to

strategy and risk guidelines established with each manager. The overall strategy, the resulting allocations of plan

assets, and the performance of funds and individual investment managers are continually monitored. Derivative

financial instruments may be used by investment managers for hedging purposes to gain exposure to alternative

asset classes through the futures markets. There are no investments in VF debt or equity securities and no

significant concentrations of security risk.

The expected long-term rate of return on plan assets was based on an evaluation of the weighted average

expected returns for the major asset classes in which the plans have invested. Expected returns by asset class

were developed through analysis of historical market returns, current market conditions, inflation expectations,

and equity and credit risks. Inputs from various investment advisors on long-term capital market returns and

other variables were also considered where appropriate.

F-26