North Face 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

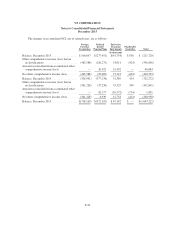

VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

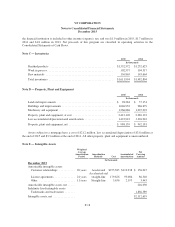

VF did not record any impairment charges in 2015 or 2013 based on the results of its annual goodwill

impairment testing. In 2014, VF recorded an impairment charge of $142.4 million to write off the goodwill in the

Splendid®and Ella Moss®reporting unit, which is part of the Contemporary Brands coalition. Accumulated

impairment charges for the Contemporary Brands coalition were $337.5 million as of December 2015 and 2014,

and $195.2 million as of December 2013. Accumulated impairment charges for the Outdoor & Action Sports and

Sportswear coalitions were $43.4 million and $58.5 million, respectively, for all of the periods presented above.

See Note S for additional information on the fair value measurements.

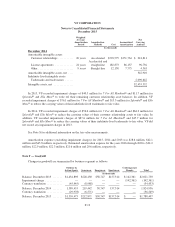

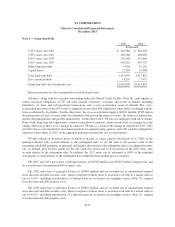

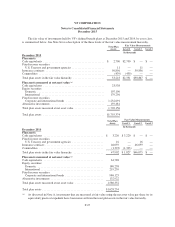

Note G — Other Assets

2015 2014

In thousands

Investments held for deferred compensation plans (Note L) .............. $205,283 $227,510

Other investments ............................................... 10,706 15,666

Deferred income taxes (Note O) .................................... 39,246 49,431

Computer software, net of accumulated amortization of $99,124 in 2015 and

$54,936 in 2014 ............................................... 177,642 170,269

Partnership stores and shop-in-shop costs, net of accumulated amortization

of $96,819 in 2015 and $78,321 in 2014 ............................ 45,514 44,581

Pension assets (Note L) ........................................... 9,273 1,491

Deferred line of credit issuance costs ................................ 1,596 540

Derivative financial instruments (Note T) ............................ 12,995 20,269

Deposits ....................................................... 37,347 33,880

Other ......................................................... 47,619 49,405

Other assets .................................................... $587,221 $613,042

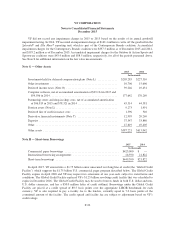

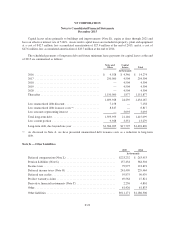

Note H — Short-term Borrowings

2015 2014

In thousands

Commercial paper borrowings ...................................... $423,000 $ —

International borrowing arrangements ................................ 26,590 21,822

Short-term borrowings ............................................ $449,590 $21,822

In April 2015, VF entered into a $1.75 billion senior unsecured revolving line of credit (the “Global Credit

Facility”) which supports the $1.75 billion U.S. commercial paper program described below. The Global Credit

Facility expires in April 2020 and VF may request two extensions of one year each, subject to stated terms and

conditions. The Global Credit Facility replaced VF’s $1.25 billion revolving credit facility that was scheduled to

expire in December 2016. The Global Credit Facility may be used to borrow funds in both U.S. dollar and non-

U.S. dollar currencies, and has a $50.0 million letter of credit sublimit. Borrowings under the Global Credit

Facility are priced at a credit spread of 80.5 basis points over the appropriate LIBOR benchmark for each

currency. VF is also required to pay a facility fee to the lenders, currently equal to 7.0 basis points of the

committed amount of the facility. The credit spread and facility fee are subject to adjustment based on VF’s

credit ratings.

F-20