North Face 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

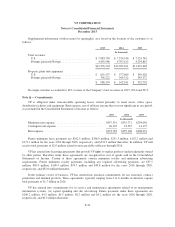

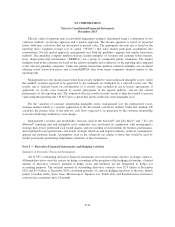

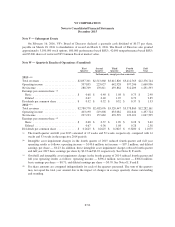

Note V — Subsequent Events

On February 16, 2016, VF’s Board of Directors declared a quarterly cash dividend of $0.37 per share,

payable on March 18, 2016 to shareholders of record on March 8, 2016. The Board of Directors also granted

approximately 3,100,000 stock options, 600,000 performance-based RSUs, 42,000 nonperformance-based RSUs

and 85,000 shares of restricted VF Common Stock at market value.

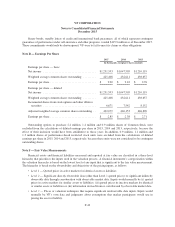

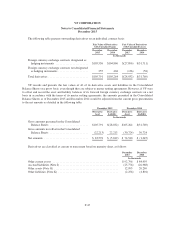

Note W — Quarterly Results of Operations (Unaudited)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

In thousands, except per share amounts

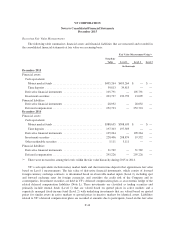

2015 (a)(b)

Total revenues ......................... $2,837,301 $2,513,860 $3,612,820 $3,412,763 $12,376,744

Operating income ...................... 397,835 223,027 642,928 397,206 1,660,996

Net income ........................... 288,709 170,811 459,864 312,209 1,231,593

Earnings per common share: (d)

Basic .............................. $ 0.68 $ 0.40 $ 1.08 $ 0.73 $ 2.90

Diluted ............................. 0.67 0.40 1.07 0.72 2.85

Dividends per common share ............. $ 0.32 $ 0.32 $ 0.32 $ 0.37 $ 1.33

2014 (a)(c)

Total revenues ......................... $2,780,778 $2,402,076 $3,520,447 $3,578,860 $12,282,161

Operating income ...................... 403,190 219,808 633,082 181,644 1,437,724

Net income ........................... 297,193 157,682 470,529 122,101 1,047,505

Earnings per common share: (d)

Basic .............................. $ 0.68 $ 0.37 $ 1.09 $ 0.28 $ 2.42

Diluted ............................. 0.67 0.36 1.08 0.28 2.38

Dividends per common share ............. $ 0.2625 $ 0.2625 $ 0.2625 $ 0.3200 $ 1.1075

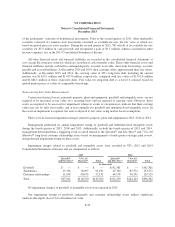

(a) The fourth quarter and full year 2015 consisted of 13 weeks and 52 weeks, respectively, compared with 14

weeks and 53 weeks in the respective 2014 periods.

(b) Intangible asset impairment charges in the fourth quarter of 2015 reduced fourth quarter and full year

operating results as follows: operating income — $143.6 million; net income — $97.1 million; and diluted

earnings per share — $0.23. In addition, these intangible asset impairment charges reduced fourth quarter

and full year 2015 basic earnings per share by $0.23 and $0.22, respectively. See Notes E, F and S.

(c) Goodwill and intangible asset impairment charges in the fourth quarter of 2014 reduced fourth quarter and

full year operating results as follows: operating income — $396.4 million; net income — $306.8 million;

basic earnings per share — $0.71; and diluted earnings per share — $0.70. See Notes E, F and S.

(d) Per share amounts are computed independently for each of the quarters presented. The sum of the quarters

may not equal the total year amount due to the impact of changes in average quarterly shares outstanding

and rounding.

F-50