North Face 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

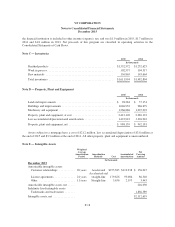

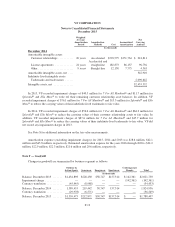

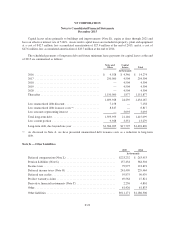

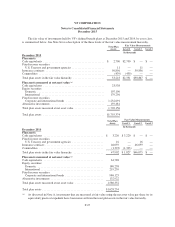

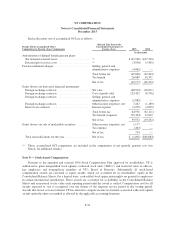

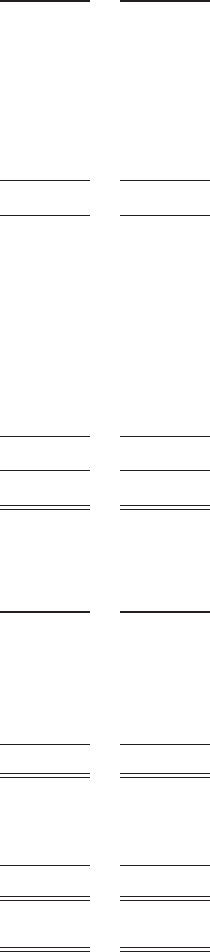

The following provides a reconciliation of the changes in fair value of VF’s defined benefit plan assets and

projected benefit obligations for each year, and the funded status at the end of each year:

2015 2014

In thousands

Fair value of plan assets, beginning of year ........................ $1,628,254 $1,467,526

Actual return on plan assets .................................... (56,624) 189,824

VF contributions ............................................. 273,520 67,808

Participant contributions ....................................... 3,483 3,429

Benefits paid ................................................ (87,994) (88,746)

Currency translation .......................................... (5,265) (11,587)

Fair value of plan assets, end of year ............................. 1,755,374 1,628,254

Projected benefit obligations, beginning of year ..................... 1,999,947 1,688,701

Service cost ................................................. 29,223 24,163

Interest cost ................................................. 77,620 81,496

Participant contributions ....................................... 3,483 3,429

Actuarial (gain) loss .......................................... (101,387) 306,797

Benefits paid ................................................ (87,994) (88,746)

Plan amendments ............................................. (1,510) 263

Currency translation .......................................... (7,367) (16,156)

Projected benefit obligations, end of year .......................... 1,912,015 1,999,947

Funded status, end of year ...................................... $ (156,641) $ (371,693)

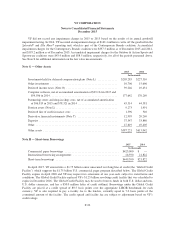

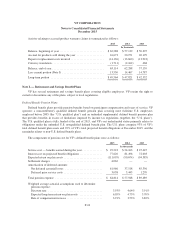

Pension benefits are reported in the balance sheet as a net asset or liability based on the overfunded or

underfunded status of the defined benefit plans, assessed on a plan-by-plan basis.

2015 2014

In thousands

Amounts included in Consolidated Balance Sheets:

Noncurrent assets (Note G) ..................................... $ 9,273 $ 1,491

Current liabilities (Note I) ...................................... (8,480) (8,880)

Noncurrent liabilities (Note K) .................................. (157,434) (364,304)

Funded status ................................................ $ (156,641) $ (371,693)

Accumulated other comprehensive (income) loss, pretax:

Net deferred actuarial losses .................................. $ 586,828 $ 588,847

Deferred prior service costs .................................. 17,459 21,950

Total accumulated other comprehensive (income) loss, pretax ....... $ 604,287 $ 610,797

Accumulated benefit obligations ................................. $1,827,521 $1,916,070

Weighted average actuarial assumptions used to determine pension

obligations:

Discount rate ................................................ 4.29% 3.47%

Rate of compensation increase .................................. 3.90% 3.34%

F-25