North Face 2015 Annual Report Download - page 60

Download and view the complete annual report

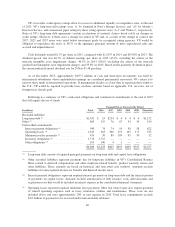

Please find page 60 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.available and reviewed by coalition management. In the first step of the quantitative goodwill impairment test,

VF compares the carrying value of a reporting unit, including its recorded goodwill, to the estimated fair value of

the reporting unit.

For goodwill impairment testing, VF estimates the fair value of a reporting unit using both income-based

and market-based valuation methods. The income-based approach is based on the reporting unit’s forecasted

future cash flows that are discounted to present value using the reporting unit’s WACC discussed above. For the

market-based approach, management uses both the guideline company and similar transaction methods. The

guideline company method analyzes market multiples of revenues and earnings before interest, taxes,

depreciation and amortization (“EBITDA”) for a group of comparable public companies. The market multiples

used in the valuation are based on the relative strengths and weaknesses of the reporting unit compared to the

selected guideline companies. Under the similar transactions method, valuation multiples are calculated utilizing

actual transaction prices and revenue/EBITDA data from target companies deemed similar to the reporting unit.

Based on the range of estimated fair values developed from the income and market-based methods, VF

determines the estimated fair value for the reporting unit. If the estimated fair value of the reporting unit exceeds

its carrying value, the goodwill is not impaired and no further review is required. However, if the estimated fair

value of the reporting unit is less than its carrying value, VF performs the second step of the goodwill impairment

test to determine the impairment charge, if any. The second step involves a hypothetical allocation of the

estimated fair value of the reporting unit to its tangible and intangible assets (excluding goodwill) and liabilities

as if the reporting unit were newly acquired, which results in an implied fair value of the goodwill. The amount

of the impairment charge is the excess of the recorded goodwill, if any, over the implied fair value of the

goodwill.

The income-based fair value methodology requires management’s assumptions and judgments regarding

economic conditions in the markets in which VF operates and conditions in the capital markets, many of which

are outside of management’s control. At the reporting unit level, fair value estimation requires management’s

assumptions and judgments regarding the effects of overall economic conditions on the specific reporting unit,

along with assessment of the reporting unit’s strategies and forecasts of future cash flows. Forecasts of individual

reporting unit cash flows involve management’s estimates and assumptions regarding:

• Annual cash flows, on a debt-free basis, arising from future revenues and profitability, changes in

working capital, capital spending and income taxes for at least a 10-year forecast period.

• A terminal growth rate for years beyond the forecast period. The terminal growth rate is selected based on

consideration of growth rates used in the forecast period, historical performance of the reporting unit and

economic conditions.

• A discount rate that reflects the risks inherent in realizing the forecasted cash flows. A discount rate

considers the risk-free rate of return on long-term treasury securities, the risk premium associated with

investing in equity securities of comparable companies, the beta obtained from comparable companies

and the cost of debt for investment grade issuers. In addition, the discount rate may consider any

company-specific risk in achieving the prospective financial information.

Under the market-based fair value methodology, judgment is required in evaluating market multiples and

recent transactions. Management believes that the assumptions used for its impairment tests are representative of

those that would be used by market participants performing similar valuations of VF’s reporting units.

Management concluded that there were no triggering events that caused us to test goodwill or indefinite-

lived intangible assets prior to our annual impairment testing date on the first day of the fourth quarter, which

coincided with the timing of the severe performance decline in the Contemporary Brands coalition. As such,

management performed its annual goodwill and indefinite-lived intangible asset impairment testing as of the

beginning of the fourth quarter of 2015. VF elected to bypass the qualitative assessment and perform a

quantitative analysis for the Timberland®and Reef®reporting units, and for the Timberland®, Reef®, Rock &

46