North Face 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

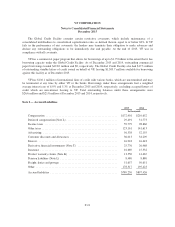

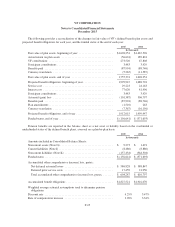

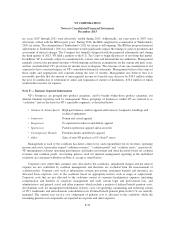

the primary reason for the difference in carrying value of the deferred compensation assets and liabilities.

Realized and unrealized gains and losses on these deferred compensation assets (other than VF Common Stock)

are recorded in compensation expense in the Consolidated Statements of Income and substantially offset losses

and gains resulting from changes in deferred compensation liabilities to participants.

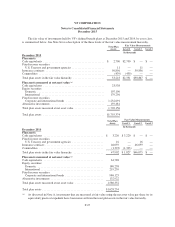

VF sponsors 401(k) plans as well as other domestic and foreign retirement and savings plans. Expense for

these plans totaled $47.0 million in 2015, $31.6 million in 2014 and $22.0 million in 2013.

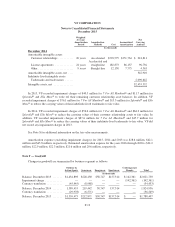

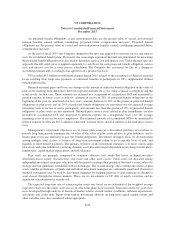

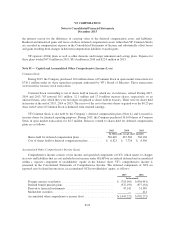

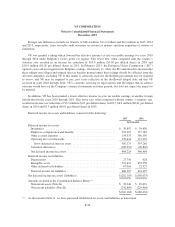

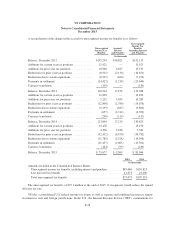

Note M — Capital and Accumulated Other Comprehensive Income (Loss)

Common Stock

During 2015, the Company purchased 10.0 million shares of Common Stock in open market transactions for

$730.1 million under its share repurchase program authorized by VF’s Board of Directors. These transactions

were treated as treasury stock transactions.

Common Stock outstanding is net of shares held in treasury which are, in substance, retired. During 2015,

2014 and 2013, VF restored 10.1 million, 12.1 million and 17.0 million treasury shares, respectively, to an

unissued status, after which they were no longer recognized as shares held in treasury. There were no shares held

in treasury at the end of 2015, 2014 or 2013. The excess of the cost of treasury shares acquired over the $0.25 per

share stated value of Common Stock is deducted from retained earnings.

VF Common Stock is also held by the Company’s deferred compensation plans (Note L) and is treated as

treasury shares for financial reporting purposes. During 2015, the Company purchased 36,100 shares of Common

Stock in open market transactions for $2.5 million. Balances related to shares held for deferred compensation

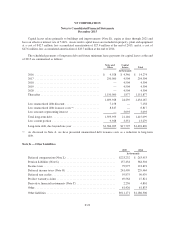

plans are as follows:

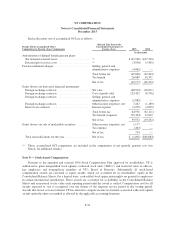

2015 2014 2013

In thousands, except share amounts

Shares held for deferred compensation plans ................ 562,649 637,504 704,104

Cost of shares held for deferred compensation plans .......... $ 6,823 $ 7,724 $ 8,396

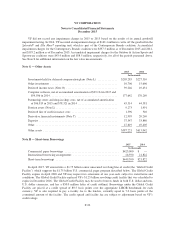

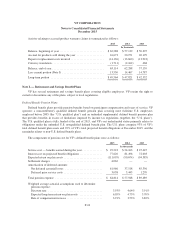

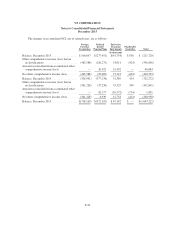

Accumulated Other Comprehensive Income (Loss)

Comprehensive income consists of net income and specified components of OCI, which relates to changes

in assets and liabilities that are not included in net income under GAAP but are instead deferred and accumulated

within a separate component of stockholders’ equity in the balance sheet. VF’s comprehensive income is

presented in the Consolidated Statements of Comprehensive Income. The deferred components of OCI are

reported, net of related income taxes, in accumulated OCI in stockholders’ equity, as follows:

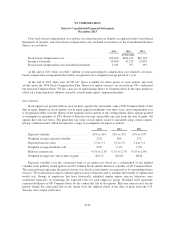

2015 2014

In thousands

Foreign currency translation .................................... $ (718,169) $(356,941)

Defined benefit pension plans ................................... (372,195) (377,134)

Derivative financial instruments ................................. 47,142 31,389

Marketable securities .......................................... — 414

Accumulated other comprehensive income (loss) .................... $(1,043,222) $(702,272)

F-29