North Face 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

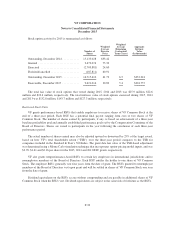

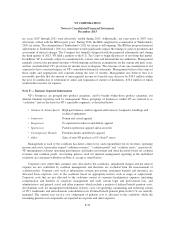

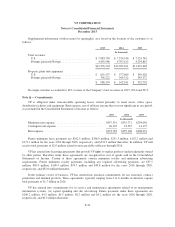

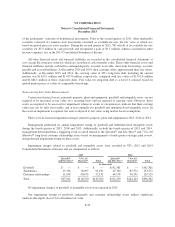

As of the end of 2015, VF has not provided deferred taxes on $3,657.2 million of undistributed earnings

from international subsidiaries where the earnings are considered to be permanently reinvested. VF’s intent is to

continue to reinvest these earnings to support the strategic priority for growth in international markets. If

management decides at a later date to repatriate these funds to the U.S., VF would be required to provide taxes on

these amounts based on applicable U.S. tax rates, net of foreign taxes already paid. VF has not determined the

deferred tax liability associated with these undistributed earnings, as such determination is not practicable.

VF has potential tax benefits totaling $106.0 million for foreign operating loss carryforwards, of which

$103.3 million have an unlimited carryforward life. In addition, there are $3.0 million of potential tax benefits for

federal operating loss carryforwards that expire between 2017 and 2026, and $30.6 million of potential tax

benefits for state operating loss and credit carryforwards that expire between 2016 and 2031.

A valuation allowance has been provided where it is more likely than not that the deferred tax assets related

to those operating loss carryforwards will not be realized. Valuation allowances totaled $83.0 million for

available foreign operating loss carryforwards, $12.4 million for available state operating loss and credit

carryforwards, and $5.6 million for other foreign deferred income tax assets. During 2015, VF had a net increase

in valuation allowances of $3.1 million related to state operating loss and credit carryforwards, and an increase of

$1.0 million related to foreign operating loss carryforwards and other foreign deferred tax assets, inclusive of

foreign currency effects.

F-37