North Face 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

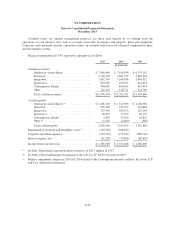

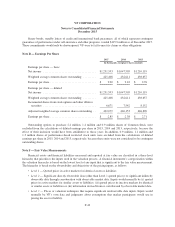

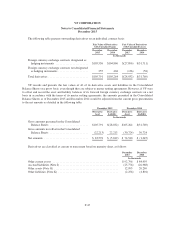

Derivative Contracts Not Designated as Hedges

VF uses derivative contracts to manage foreign currency exchange risk on third-party accounts receivable

and payable, as well as intercompany borrowings. These contracts are not designated as hedges, and are recorded

at fair value in the Consolidated Balance Sheets. Changes in the fair values of these instruments are recognized

directly in earnings. Gains or losses on these contracts largely offset the net transaction gains or losses on the

related assets and liabilities. Following is a summary of these derivatives included in VF’s Consolidated

Statements of Income:

Derivatives Not

Designated

as Hedges

Location of Gain (Loss) on

Derivatives

Recognized in Income

Gain (Loss) on Derivatives

Recognized in Income

2015 2014 2013

In thousands

Foreign currency exchange ...... Cost of goods sold $(4,179) $ — $ —

Foreign currency exchange ...... Other income (expense), net 2,806 (707) (2,664)

Total ........................ $(1,373) $(707) $(2,664)

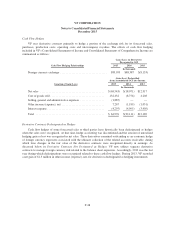

Other Derivative Information

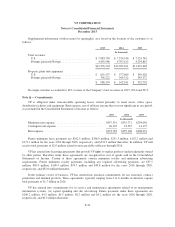

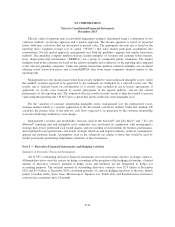

There were no significant amounts recognized in earnings for the ineffective portion of any hedging

relationships during 2015, 2014 and 2013.

At December 2015, accumulated OCI included $88.6 million of pretax net deferred gains for foreign

exchange contracts that are expected to be reclassified to earnings during the next 12 months. The amounts

ultimately reclassified to earnings will depend on exchange rates in effect when outstanding derivative contracts

are settled.

VF entered into interest rate swap derivative contracts in 2011 and 2003 to hedge the interest rate risk for

issuance of long-term debt due in 2021 and 2033, respectively. In each case, the contracts were terminated

concurrent with the issuance of the debt, and the realized gain or loss was deferred in accumulated OCI. The

remaining pretax net deferred loss in accumulated OCI was $27.2 million at December 2015, which will be

reclassified into interest expense in the Consolidated Statements of Income over the remaining terms of the

associated debt instruments. During 2015, 2014 and 2013, VF reclassified $4.3 million, $4.1 million and $3.9

million, respectively, of net deferred loss from accumulated OCI into interest expense, and expects to reclassify

$4.5 million to interest expense during the next 12 months.

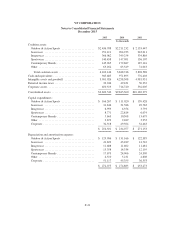

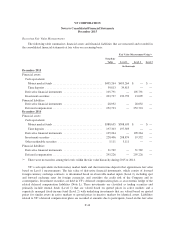

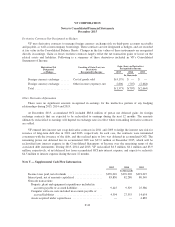

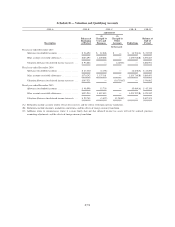

Note U — Supplemental Cash Flow Information

2015 2014 2013

In thousands

Income taxes paid, net of refunds ........................ $339,010 $370,202 $291,027

Interest paid, net of amounts capitalized ................... 83,850 82,280 80,349

Noncash transactions:

Property, plant and equipment expenditures included in

accounts payable or accrued liabilities ................. 9,445 9,529 25,586

Computer software costs included in accounts payable or

accrued liabilities ................................. 4,394 27,555 14,654

Assets acquired under capital lease ..................... — — 4,882

F-49