North Face 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

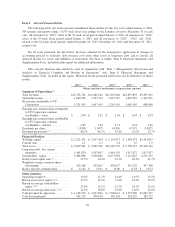

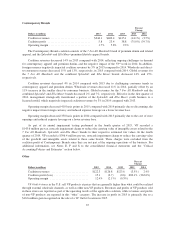

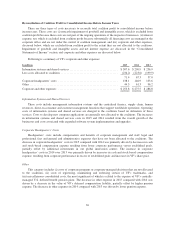

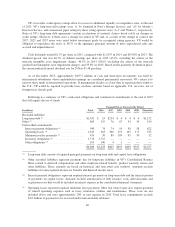

Reconciliation of Coalition Profit to Consolidated Income Before Income Taxes

There are three types of costs necessary to reconcile total coalition profit to consolidated income before

income taxes. These costs are (i) noncash impairment of goodwill and intangible assets, which is excluded from

coalition profit because these costs are not part of the ongoing operations of the respective businesses, (ii) interest

expense, net, which is excluded from coalition profit because substantially all financing costs are managed at the

corporate office and are not under the control of coalition management, and (iii) corporate and other expenses,

discussed below, which are excluded from coalition profit to the extent they are not allocated to the coalitions.

Impairment of goodwill and intangible assets and net interest expense are discussed in the “Consolidated

Statements of Income” section, and corporate and other expenses are discussed below.

Following is a summary of VF’s corporate and other expenses:

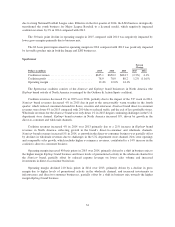

In millions 2015 2014 2013

Information systems and shared services .................................. $307.6 $ 290.9 $ 256.9

Less costs allocated to coalitions ........................................ (236.2) (223.6) (199.9)

71.4 67.3 57.0

Corporate headquarters’ costs .......................................... 138.1 146.9 133.6

Other .............................................................. 44.3 61.3 96.2

Corporate and other expenses .......................................... $253.8 $ 275.5 $ 286.8

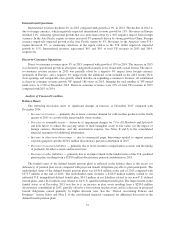

Information Systems and Shared Services

These costs include management information systems and the centralized finance, supply chain, human

resources, direct-to-consumer and customer management functions that support worldwide operations. Operating

costs of information systems and shared services are charged to the coalitions based on utilization of those

services. Costs to develop new computer applications are generally not allocated to the coalitions. The increases

in information systems and shared services costs in 2015 and 2014 resulted from the overall growth of the

businesses and costs associated with expanded software system implementations and upgrades.

Corporate Headquarters’ Costs

Headquarters’ costs include compensation and benefits of corporate management and staff, legal and

professional fees and general and administrative expenses that have not been allocated to the coalitions. The

decrease in corporate headquarters’ costs in 2015 compared with 2014 was primarily driven by decreases in cash

and stock-based compensation expense resulting from lower corporate performance versus established goals,

partially offset by additional investments in our global innovation centers. The increase in corporate

headquarters’ costs in 2014 over 2013 was primarily driven by increases in cash and stock-based compensation

expense, resulting from corporate performance in excess of established goals and increases in VF’s share price.

Other

This category includes (i) costs of corporate programs or corporate-managed decisions that are not allocated

to the coalitions, (ii) costs of registering, maintaining and enforcing certain of VF’s trademarks, and

(iii) miscellaneous consolidated costs, the most significant of which is related to the expense of VF’s centrally-

managed U.S. defined benefit pension plans. The decrease in other expense in 2015 compared with 2014 was

driven by a decrease in the value of VF’s deferred compensation liability, partially offset by higher pension

expense. The decrease in other expenses in 2014 compared with 2013 was driven by lower pension expense.

36