North Face 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

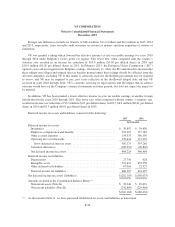

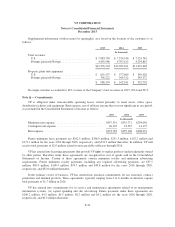

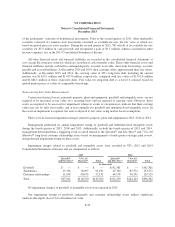

The fair value of reporting units for goodwill impairment testing is determined using a combination of two

valuation methods: an income approach and a market approach. The income approach is based on projected

future (debt-free) cash flows that are discounted to present value. The appropriate discount rate is based on the

reporting unit’s weighted average cost of capital (“WACC”) that takes market participant assumptions into

consideration. For the market approach, management uses both the guideline company and similar transaction

methods. The guideline company method analyzes market multiples of revenues and earnings before interest,

taxes, depreciation and amortization (“EBITDA”) for a group of comparable public companies. The market

multiples used in the valuation are based on the relative strengths and weaknesses of the reporting unit compared

to the selected guideline companies. Under the similar transactions method, valuation multiples are calculated

utilizing actual transaction prices and revenue/EBITDA data from target companies deemed similar to the

reporting unit.

Management uses the income-based relief-from-royalty method to value trademark intangible assets. Under

this method, revenues expected to be generated by the trademark are multiplied by a selected royalty rate. The

royalty rate is selected based on consideration of i) royalty rates included in active license agreements, if

applicable, ii) royalty rates received by market participants in the apparel industry, and iii) the current

performance of the reporting unit. The estimated after-tax royalty revenue stream is then discounted to present

value using the reporting unit’s WACC plus a spread that factors in the risk of the intangible asset.

For the valuation of customer relationship intangible assets, management uses the multi-period excess

earnings method which is a specific application of the discounted cash flows method. Under this method, VF

calculates the present value of the after-tax cash flows expected to be generated by the customer relationship

asset after deducting contributory asset charges.

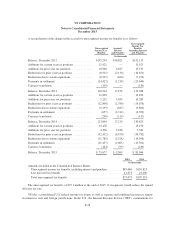

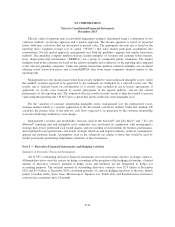

Management’s revenue and profitability forecasts used in the Splendid®and Ella Moss®and 7 For All

Mankind®reporting unit and intangible asset valuations were developed in conjunction with management’s

strategic plan review performed each fourth quarter, and our resulting revised outlook for business performance,

and considered recent performance and trends, strategic initiatives and negative industry trends in contemporary

apparel and premium denim. Assumptions used in the valuations are similar to those that would be used by

market participants performing independent valuations of these businesses.

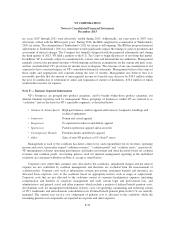

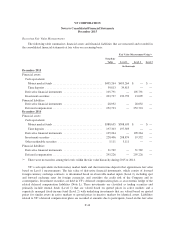

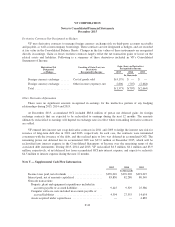

Note T — Derivative Financial Instruments and Hedging Activities

Summary of Derivative Financial Instruments

All of VF’s outstanding derivative financial instruments are forward foreign currency exchange contracts.

Although derivatives meet the criteria for hedge accounting at the inception of the hedging relationship, a limited

number of derivative contracts intended to hedge assets and liabilities are not designated as hedges for

accounting purposes. The notional amounts of outstanding derivative contracts were $2.4 billion at December

2015 and $1.9 billion at December 2014, consisting primarily of contracts hedging exposures to the euro, British

pound, Canadian dollar, Swiss franc, Mexican peso, Japanese yen, Polish zloty and Swedish krona. Derivative

contracts have maturities up to 24 months.

F-46