North Face 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

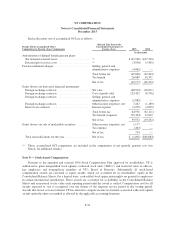

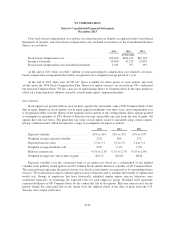

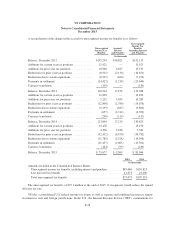

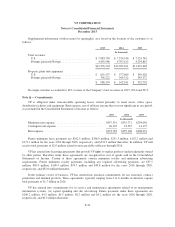

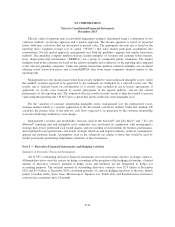

A reconciliation of the change in the accrual for unrecognized income tax benefits is as follows:

Unrecognized

Income Tax

Benefits

Accrued

Interest

and Penalties

Unrecognized

Income Tax

Benefits

Including Interest

and Penalties

In thousands

Balance, December 2012 ........................ $135,294 $16,821 $152,115

Additions for current year tax positions ............. 11,921 — 11,921

Additions for prior year tax positions .............. 10,908 4,627 15,535

Reductions for prior year tax positions ............. (8,521) (2,130) (10,651)

Reductions due to statute expirations .............. (6,527) (626) (7,153)

Payments in settlement ......................... (24,422) (1,218) (25,640)

Currency translation ............................ (139) — (139)

Balance, December 2013 ........................ 118,514 17,474 135,988

Additions for current year tax positions ............. 12,850 — 12,850

Additions for prior year tax positions .............. 5,252 5,033 10,285

Reductions for prior year tax positions ............. (12,898) (2,780) (15,678)

Reductions due to statute expirations .............. (9,159) (647) (9,806)

Payments in settlement ......................... (657) (1,742) (2,399)

Currency translation ............................ (298) (119) (417)

Balance, December 2014 ........................ 113,604 17,219 130,823

Additions for current year tax positions ............. 13,470 — 13,470

Additions for prior year tax positions .............. 4,396 3,188 7,584

Reductions for prior year tax positions ............. (32,432) (6,350) (38,782)

Reductions due to statute expirations .............. (11,780) (2,528) (14,308)

Payments in settlement ......................... (11,437) (2,065) (13,502)

Currency translation ............................ (144) (95) (239)

Balance, December 2015 ........................ $ 75,677 $ 9,369 $ 85,046

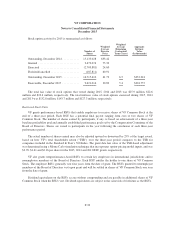

2015 2014

In thousands

Amounts included in the Consolidated Balance Sheets:

Unrecognized income tax benefits, including interest and penalties ....... $85,046 $130,823

Less deferred tax benefits ........................................ 11,973 23,290

Total unrecognized tax benefits ................................... $73,073 $107,533

The unrecognized tax benefits of $73.1 million at the end of 2015, if recognized, would reduce the annual

effective tax rate.

VF files a consolidated U.S. federal income tax return, as well as separate and combined income tax returns

in numerous state and foreign jurisdictions. In the U.S., the Internal Revenue Service (“IRS”) examinations for

F-38