Logitech 2012 Annual Report Download - page 270

Download and view the complete annual report

Please find page 270 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The total cash consideration paid of $382.3 million included $37.0 million deposited into an escrow account

as security for indemnification claims under the merger agreement and $0.5 million deposited in a stockholder

representative expense fund. The escrow trustee disbursed 50% of the escrow fund to the former holders of LifeSize

capital stock, vested options and warrants in December 2010, and the remaining fifty percent was disbursed in June

2011, subject to indemnification claims.

In connection with the merger, Logitech also agreed to establish a cash and stock option retention and incentive

plan for certain LifeSize employees, linked to the achievement of LifeSize performance targets. The duration of

the plan’s performance period was two years, from January 1, 2010 to December 31, 2011. The total available cash

incentive was $9.0 million over the two year performance period. The Company paid the entire $9.0 million in

available cash incentive during fiscal year 2012. In December 2009, options to purchase 850,000 Logitech shares

were issued in connection with the retention and incentive plan.

The acquisition has been accounted for using the purchase method of accounting. Accordingly, the total

consideration was allocated to the tangible and intangible assets acquired and liabilities assumed based on their

estimated fair values as of the acquisition date. Fair values were determined by Logitech management based on

information available at the date of acquisition.

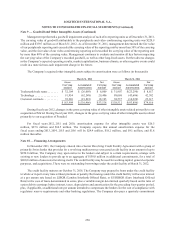

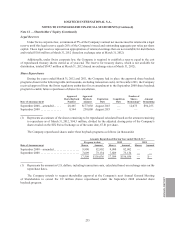

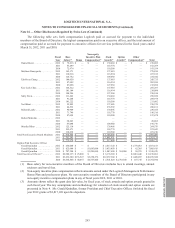

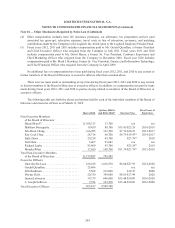

The allocation of total consideration to the assets acquired and liabilities assumed based on the estimated fair

value of LifeSize was as follows (in thousands):

December 11,

2009

Estimated

Life

Tangible assets acquired ....................................... $ 33,635

Deferred tax asset, net ......................................... 8,828

Intangible assets acquired

Existing technology ........................................ 30,000 4 years

Patents and core technology ................................. 4,500 3 years

Trademark/trade name...................................... 7,600 5 years

Customer relationships and other ............................. 31,500 5 years

Goodwill................................................. 307,241 —

423,304

Liabilities assumed ........................................... (26,985)

Debt assumed................................................ (13,505)

Total consideration......................................... $382,814

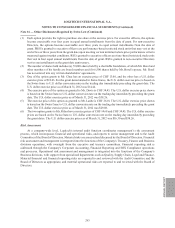

The deferred tax asset primarily relates to the tax benefit of a net operating loss carryforward, net of the deferred

tax liability related to intangible assets. The existing technology of LifeSize relates to the platform technology used

in LifeSize’s high-definition video conferencing systems. The value of the technology was determined based on the

present value of estimated expected cash flows attributable to the technology, assuming the highest and best use by

a market participant. The patents and core technology represent awarded patents, filed patent applications and core

architectures, trade secrets or processes used in LifeSize’s current and planned future products. Trademark/trade

name relates to the LifeSize brand names. The value of the patents, core technology and trademark/trade name

was estimated by capitalizing the estimated profits saved as a result of acquiring or licensing the asset. Customer

relationships and other relates to the ability to sell existing, in-process, and future versions of the technology and

services to LifeSize’s existing customer base, valued based on projected discounted cash flows generated from

customers in place. The intangible assets acquired are amortized on a straight-line basis over their estimated useful

Note 14 — Acquisitions and Divestitures (Continued)

260