Logitech 2012 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In fiscal year 2011, we sold our equity interest in certain 3Dconnexion subsidiaries and the related intellectual

property rights for $9.1 million, not including cash retained. The loss resulting from the sale was not material.

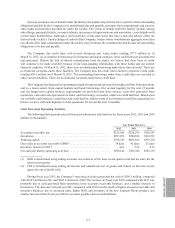

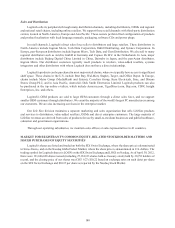

Cash Flow from Financing Activities

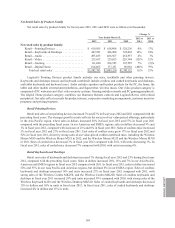

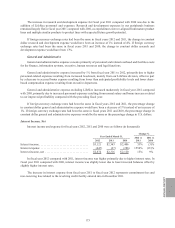

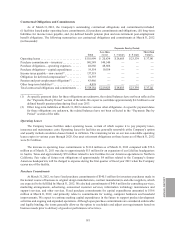

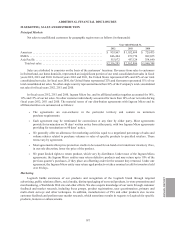

The following tables present information on our cash flows from financing activities, including information

on our share repurchases during fiscal years 2012, 2011 and 2010 (in thousands except per share amounts):

Year Ended March 31,

2012 2011 2010

Purchases of treasury shares(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (156,036) $ — $ (126,301)

Proceeds from sale of shares upon exercise of options

and purchase rights . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,591 43,001 28,917

Tax withholdings related to net share settlements of

restricted stock units . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (966)(223) —

Excess tax benefits from share-based compensation . . . . . . . . . . . . . . . . . 37 3,455 2,814

Repayments of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (13,630)

Net cash provided by (used in) financing activities . . . . . . . . . . . . . . . $ (139,374) $46,233 $(108,200)

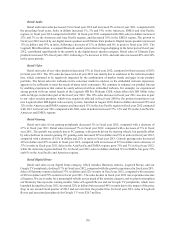

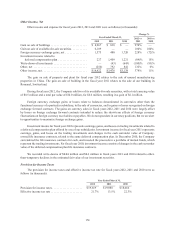

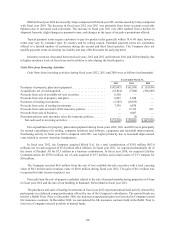

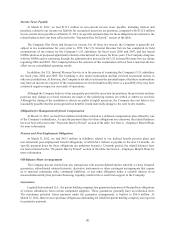

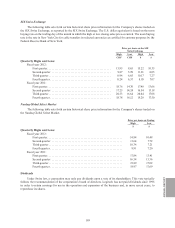

Year Ended March 31,

2012 2011 2010

Number of shares repurchased . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,509 —7,425

Value of shares repurchased(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156,036 $ — $ 126,301

Average price per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8.91 $ — $ 17.01

(1) Represents the amount in U.S. dollars, including transaction costs, calculated based on exchange rates on the

repurchase dates.

During fiscal year 2012, we repurchased 17.5 million shares for $156.0 million under the Company’s September

2008 buyback program. In fiscal year 2010, we repurchased 7.4 million shares for $126.3 million under the buyback

program announced in June 2007. The amounts of the repurchases include transaction costs incurred as part of the

repurchase. The June 2007 buyback program was completed in March 2010. No share repurchases were made in

fiscal year 2011 under the September 2008 buyback program.

Cash of $17.6 million, $43.0 million and $28.9 million was provided during the fiscal years 2012, 2011 and

2010 from the sale of shares upon exercise of options and purchase rights pursuant to the Company’s stock plans.

The payment of tax withholdings related to net share settlements of RSUs (restricted stock units) required the use of

$1.0 million and $0.2 million in cash in fiscal years 2012 and 2011. Tax benefits recognized on the exercise of share-

based payment awards provided $0.04 million, $3.5 million and $2.8 million in fiscal years 2012, 2011 and 2010.

In fiscal year 2010, we repaid $13.6 million of short and long-term debt assumed when we acquired

LifeSize Communications.

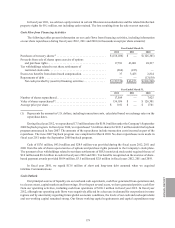

Cash Outlook

Our principal sources of liquidity are our cash and cash equivalents, cash flow generated from operations and,

to a lesser extent, capital markets and borrowings. Over the past several years, we have generated positive cash flow

from our operating activities, including cash from operations of $196.1 million in fiscal year 2012. In fiscal year

2012, although our operating cash flows were negatively affected by a decrease in demand for our products in some

regions and by uncertainty regarding future global economic conditions, the levels of our cash and cash equivalents

and our working capital remained strong. Our future working capital requirements and capital expenditures may

ANNUAL REPORT

179