Logitech 2012 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

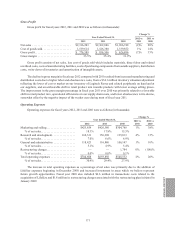

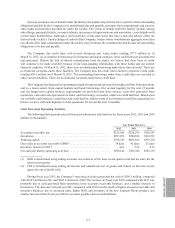

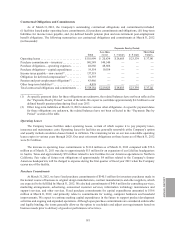

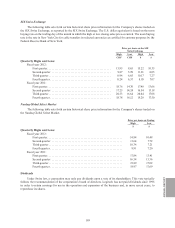

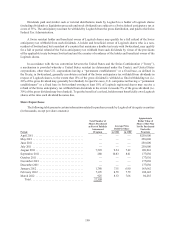

Contractual Obligations and Commitments

As of March 31, 2012, the Company’s outstanding contractual obligations and commitments included:

(i) facilities leased under operating lease commitments, (ii) purchase commitments and obligations, (iii) long-term

liabilities for income taxes payable, and (iv) defined benefit pension plan and non-retirement post-employment

benefit obligations. The following summarizes our contractual obligations and commitments at March 31, 2012

(in thousands):

Payments Due by Period

Tota l

Less than

1 year 1 - 3 years 4 - 5 years

More than

5 years

Operating leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 110,999 $20,834 $29,685 $23,339 $37,141

Purchase commitments—inventory . . . . . . . . . . . . . 140,549 140,549 — — —

Purchase obligations—operating expenses . . . . . . . 48,886 48,886 — — —

Purchase obligations—capital expenditures . . . . . . 19,554 19,554 — — —

Income taxes payable—non-current(1) . . . . . . . . . . . 137,319 — — — —

Obligation for deferred compensation(1) . . . . . . . . . . 14,393 — — — —

Pension and post-employment obligations(1). . . . . . . 43,466 — — — —

Other long-term liabilities(2) . . . . . . . . . . . . . . . . . . . 4,018 — — — —

Total contractual obligations and commitments . . . $ 519,184 $229,823 $29,685 $23,339 $37,141

(1) As specific payment dates for these obligations are unknown, the related balances have not been reflected in

the ‘‘Payments Due by Period’’ section of the table. We expect to contribute approximately $4.5 million to our

defined benefit pension plans during fiscal year 2013.

(2) Other long-term liabilities at March 31, 2012 related to various other obligations. As specific payment dates

for these obligations are unknown, the related balances have not been reflected in the ‘‘Payments Due by

Period’’ section of the table.

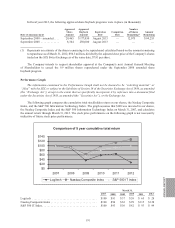

Operating Leases

The Company leases facilities under operating leases, certain of which require it to pay property taxes,

insurance and maintenance costs. Operating leases for facilities are generally renewable at the Company’s option

and usually include escalation clauses linked to inflation. The remaining terms on our non-cancelable operating

leases expire in various years through 2028. Our asset retirement obligations on these leases as of March 31, 2012

were $1.9 million.

The increase in operating lease commitments to $111.0 million as of March 31, 2012 compared with $72.6

million as of March 31, 2011 was due to approximately $13 million for an expansion of our LifeSize headquarters

in Austin, Texas and approximately $35 million related to new facilities for our Americas operations in Northern

California. Fair value of future rent obligations of approximately $4 million related to the Company’s former

Americas headquarters will be charged to expense during the first quarter of fiscal year 2013 when the Company

ceases use of the facility.

Purchase Commitments

At March 31, 2012, we have fixed purchase commitments of $140.5 million for inventory purchases made in

the normal course of business to original design manufacturers, contract manufacturers and other suppliers, which

are expected to be fulfilled by March 31, 2012. We also had commitments of $48.9 million for consulting services,

marketing arrangements, advertising, outsourced customer services, information technology maintenance and

support services, and other services. Fixed purchase commitments for capital expenditures amounted to $19.6

million at March 31, 2012, and primarily relate to commitments for tooling, computer hardware and leasehold

improvements. We expect to continue making capital expenditures in the future to support product development

activities and ongoing and expanded operations. Although open purchase commitments are considered enforceable

and legally binding, the terms generally allow us the option to reschedule and adjust our requirements based on

business needs prior to delivery of goods or performance of services.

ANNUAL REPORT

181