Logitech 2012 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2012 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Recoverability of investments, property, plant and equipment, and other intangible assets is measured by

comparing the projected undiscounted cash flows the asset is expected to generate with its carrying amount. If an

asset is considered impaired, the impairment to be recognized is measured by the excess of the carrying amount of

the asset over its fair value.

We perform our annual goodwill impairment test annually as of December 31, or more frequently, if certain

events or circumstances warrant. Events or changes in circumstances which might indicate potential impairment

in goodwill include the company specific factors described in our Form 10-K, volatility in stock price, a sustained

decline in market capitalization relative to net book value, and lower than projected revenue, market growth,

or operating results. Management performed a goodwill impairment analysis, as described in Note 9 to our

consolidated financial statements, of each of our reporting units as of December 31, 2011, and determined that the

fair value of our peripherals reporting unit exceeded the carrying value of the reporting unit by more than 30%

of the carrying value, and the fair value of our video conferencing reporting unit exceeded the carrying value of

the reporting unit by more than 80% of the carrying value. Management continues to evaluate and monitor all key

factors impacting the carrying value of our recorded goodwill, as well as other long lived assets. Adverse changes

in the Company’s expected operating results, market capitalization, business climate, or other negative events could

result in a material non-cash impairment charge in the future.

In determining fair value, we consider various factors including estimates of future market growth and

trends, forecasted revenue and costs, expected periods over which our assets will be utilized, and other variables.

We calculate the Company’s fair value based on the present value of projected cash flows using a discount rate

determined by management to be commensurate to the risk inherent in the Company’s current business model.

We also consider the Company’s operating results, market capitalization, business climate, and other factors. To

date, we have not recognized any impairment of goodwill. Logitech bases its fair value estimates on assumptions

it believes to be reasonable, but which are inherently uncertain.

Recent Accounting Pronouncements

In September 2011, the FASB issued ASU 2011-08, Intangibles—Goodwill and Other (Topic 350). ASU 2011-08

provides entities the option to first assess qualitatively whether it is necessary to perform the two-step goodwill

impairment test. If an entity concludes, as a result of its qualitative assessment, that it is more likely than not that

the fair value of a reporting unit is less than its carrying amount, the quantitative two-step goodwill impairment

test is required. An entity may elect to bypass the qualitative assessment and proceed to perform the first step of

the two-step goodwill impairment test. ASU 2011-08 is effective for annual and interim goodwill impairment

tests performed for fiscal years beginning after December 15, 2011. The Company will adopt ASU 2011-08 in the

first quarter of fiscal year 2013. The adoption of ASU 2011-08 is not expected to have a material impact on the

consolidated financial statements and footnote disclosures.

Results of Operations

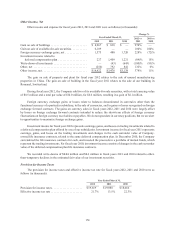

Net Sales

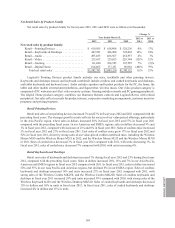

Net sales by channel for fiscal years 2012, 2011 and 2010 were as follows (in thousands):

Year Ended March 31, Change %

2012 vs

2011

2011 vs

20102012 2011 2010

Retail ................................... $1,982,783 $2,005,210 $1,745,152 (1)% 15%

OEM.................................... 185,959 223,775 198,364 (17)% 13%

LifeSize ................................. 147,461 133,901 23,232 10%476%

Total net sales.......................... $2,316,203 $2,362,886 $1,966,748 (2)% 20%

166