Lenovo 2016 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2016 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

189

2015/16 Annual Report Lenovo Group Limited

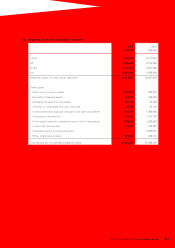

4 CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of financial statements often requires the use of judgment to select specific accounting

methods and policies from several acceptable alternatives. Estimates and judgments used in preparing the

financial statements are continually evaluated and are based on historical experience and other factors, including

expectations of future events that are believed to be reasonable under the circumstances. The Group makes

estimates and assumptions concerning the future. The resulting accounting estimates will, by definition, seldom

equal the related actual results. The following are the more significant assumptions and estimates, as well as the

accounting policies and methods used in the preparation of the financial statements:

(a) Impairment of non-financial assets

The Group tests at least annually whether goodwill and other assets that have indefinite useful lives have

suffered any impairment. Other assets that are subject to depreciation and amortization are reviewed for

impairment whenever events or changes in circumstances indicate that the carrying amount of the asset

exceeds its recoverable amount. The recoverable amounts of an asset or a cash-generating unit have been

determined based on value-in-use calculations. These calculations require the use of estimates.

The value-in-use calculations primarily use cash flow projections based on financial budgets, in general

covered five years, were approved by management and estimated terminal values at the end of the five-year

period. There are a number of assumptions and estimates involved for the preparation of cash flow projections

for the period covered by the approved budget and the estimated terminal value. Key assumptions include

the expected growth in revenues and operating margin, growth rates and selection of discount rates, to

reflect the risks involved and the earnings multiple that can be realized for the estimated terminal value.

Management prepared the financial budgets reflecting actual and prior year performance and market

development expectations. Judgment is required to determine key assumptions adopted in the cash flow

projections and changes to key assumptions can significantly affect these cash flow projections and therefore

the results of the impairment reviews.

(b) Income taxes

The Group is subject to income taxes in numerous jurisdictions. Significant judgment is required in

determining the worldwide provision for income taxes. There are certain transactions and calculations for

which the ultimate tax determination is uncertain during the ordinary course of business. The tax liabilities

recognized are based on management’s assessment of the likely outcome.

The Group recognizes liabilities for anticipated tax audit issues based on estimates of whether additional

taxes will be due.

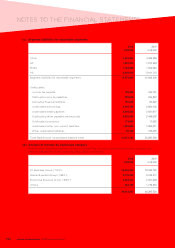

Deferred income tax is provided in full, using the liability method, on temporary differences arising between

the tax bases of assets and liabilities and their carrying values in the financial statements.

Deferred income tax assets are mainly recognized for temporary differences such as warranty provision,

accrued sales rebates, bonus accruals, and other accrued expenses, and unused tax losses carried forward

to the extent it is probable that future taxable profits will be available against which deductible temporary

differences and the unused tax losses can be utilized, based on all available evidence. Recognition primarily

involves judgment regarding the future financial performance of the particular legal entity or tax group in

which the deferred income tax asset has been recognized. A variety of other factors are also evaluated in

considering whether there is convincing evidence that it is probable that some portion or all of the deferred

income tax assets will ultimately be realized, such as the existence of taxable temporary differences, group

relief, tax planning strategies and the periods in which estimated tax losses can be utilized. The carrying

amount of deferred income tax assets and related financial models and budgets are reviewed at each balance

sheet date and to the extent that there is insufficient convincing evidence that sufficient taxable profits will be

available within the utilization periods to allow utilization of the carry forward tax losses, the asset balance will

be reduced and the difference charged to the income statement.

Where the final tax outcome of these matters is different from the amounts that were initially recorded, such

differences will impact the income tax provisions and deferred income tax assets and liabilities in the period in

which such determination is made.