Lenovo 2016 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2016 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

180 Lenovo Group Limited 2015/16 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

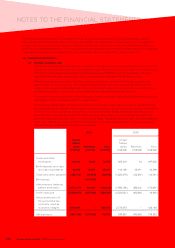

2 SIGNIFICANT ACCOUNTING POLICIES (continued)

(x) Employee benefits (continued)

(iii) Long-term incentive program

The Group operates a long-term incentive program to recognize employees’ individual and collective

contributions, and includes two types of awards, namely share appreciation rights and restricted share

units (“Long-term Incentive Awards”). The Company reserves the right, at its discretion, to pay the

award in cash or ordinary shares of the Company. The fair value of the employee services received in

exchange for the grant of the Long-term Incentive Awards is recognized as employee benefit expense.

The total amount to be expensed over the vesting period is determined by reference to the fair value of

the Long-term Incentive Awards granted, including any market performance conditions (for example, an

entity’s share price); excluding the impact of any service and non-market performance vesting conditions

(for example, profitability and sales growth targets); and including the impact of non-vesting conditions.

Non-market performance and service conditions are included in assumptions about the number of

Long-term Incentive Awards that are expected to become exercisable/vested. The total expense is

recognized over the vesting period, which is the period over which all of the specified vesting conditions

are to be satisfied.

At each balance sheet date, the Group revises its estimates of the number of Long-term Incentive

Awards that are expected to become exercisable. It recognizes the impact of the revision of

original estimates, if any, in the income statement, with a corresponding adjustment to share-based

compensation reserve under equity.

Employee share trusts are established for the purposes of awarding shares to eligible employees under

the long-term incentive program. The employee share trusts are administered by independent trustees

and are funded by the Group’s cash contributions and recorded as contributions to employee share

trusts, an equity component. The administrator of the employee share trusts buys the Company’s shares

in the open market for award to employees upon vesting.

Upon vesting, the corresponding amounts in the share-based compensation reserve will be transferred

to share capital for new allotment of shares to employees, or to the employee share trusts for shares

awarded to employees by the employee share trusts.

(iv) Termination benefit

Termination benefits are payable when employment is terminated by the Group before the normal

retirement date, or whenever an employee accepts voluntary redundancy in exchange for these benefits.

The Group recognises termination benefits at the earlier of the following dates: (a) when the Group

can no longer withdraw the offer of those benefits; and (b) when the entity recognises costs for a

restructuring that is within the scope of HKAS 37 and involves the payment of termination benefits. In

the case of an offer made to encourage voluntary redundancy, the termination benefits are measured

based on the number of employees expected to accept the offer. Benefits falling due more than 12

months after the end of the reporting period are discounted to their present value.

(v) Share options

The proceeds received net of any directly attributable transaction costs are credited to share capital

when the options are exercised.

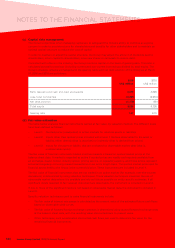

(y) Government grants

Grants from the government are recognized at their fair value where there is a reasonable assurance that the

grant will be received and the Group will comply with all attached conditions.

Government grants relating to costs are deferred and recognized as “Other operating expenses – net” in

the consolidated income statement over the period necessary to match them with the costs that they are

intended to compensate.

Government grants relating to property, plant and equipment are included in other non-current liabilities as

deferred government grants and are credited to the consolidated income statement on a straight-line basis

over the expected lives of the related assets.