Lenovo 2016 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2016 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247

|

|

185

2015/16 Annual Report Lenovo Group Limited

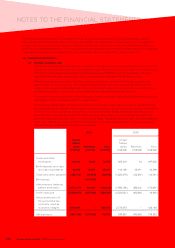

3 FINANCIAL RISK MANAGEMENT (continued)

(b) Market risks sensitivity analysis

HKFRS 7 “Financial instruments: Disclosures” requires the disclosure of a sensitivity analysis for market risks

that show the effects of a hypothetical change in the relevant market risk variable to which the Group is

exposed to at the balance sheet date on profit or loss and total equity.

The sensitivity analysis for each type of market risks does not reflect inter-dependencies between risk

variables. The sensitivity analysis assumes that a hypothetical change of the relevant risk variable had

occurred at the balance sheet date and had been applied to the relevant risk variable in existence on that

date. The bases and assumptions adopted in the preparation of the analyses will by definition, seldom equal

to the related actual results.

The disclosure of the sensitivity analysis on market risks is solely for compliance with HKFRS 7 disclosure

requirements in respect of financial instruments, and are for illustration purposes only; and it should be noted

that the hypothetical amounts so generated do not represent a projection of likely future events and profits

or losses of the Group.

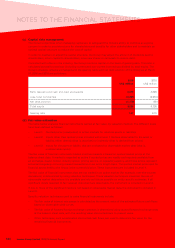

(i) Foreign currency exchange rate sensitivity analysis

At March 31, 2016, if United States dollar had weakened/strengthened by one percent against the major

currencies with all other variables held constant, post-tax loss for the year would have been US$2.2

million lower/higher (2015: post-tax profit for the year would have been US$2.7 million higher/lower),

mainly as a result of foreign exchange gains/losses on translation of unhedged portion of receivable and

payable balances.

The analysis above is based on the assumption that United States dollar weakened or strengthened

against all other currencies in the same direction and magnitude, but it may not be necessarily true in

reality.

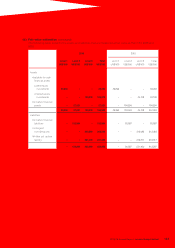

(ii) Interest rate sensitivity analysis

At March 31, 2016, if interest rate on borrowings had been 25 basis points higher/lower with all other

variables held constant, post-tax loss for the year would have been US$3.2 million higher/lower (2015:

post tax profit for the year would have been US$1.5 million lower/higher).

At March 31, 2016, if interest rates on customer financing programs had been 25 basis points higher/

lower with all other variables held constant, post-tax loss for the year would have been US$3.7 million

higher/lower (2015: post tax profit for the year would have been US$2.8 million lower/higher). This

analysis is based on the assumption that the interest rates of all the currencies covered by the customer

financing programs go up and down at the same time and with the same magnitude; however, such

assumptions may not be necessarily true in reality.