Kraft 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

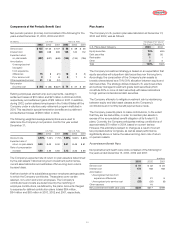

59

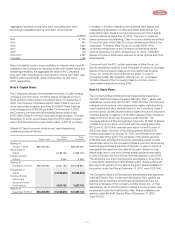

During 2003 and 2002, the Company recorded the following pre-tax

charges or (gains):

(in millions) 2003 Quarters

First Second Third Fourth

Asset impairment and

exit costs $6

Integration costs $(13)

Gains on sales

of businesses (23) (8)

$

—

$

—

$(17)$(21

(in millions) 2002 Quarters

First Second Third Fourth

Asset impairment and

exit costs $142

Integration costs and a

loss on sale of a

food factory 27 $92 $ (8)

Gains on sales

of businesses (3) (77)

$169 $89 $

—

$(85)

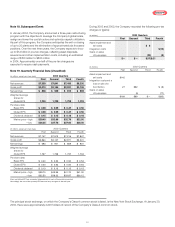

Note 18. Subsequent Event:

In January 2004, the Company announced a three-year restructuring

program with the objective to leverage the Company’s global scale,

realign and lower the cost structure and optimize capacity utilization.

As part of this program, the Company anticipates the exit or closing

of up to 20 plants and the elimination of approximately six thousand

positions. Over the next three years, the Company expects to incur

up to $1.2 billion in pre-tax charges, reflecting asset disposals,

severance and other implementation costs, including an estimated

range of $750 million to $800 million

in 2004. Approximately one-half of the pre-tax charges are

expected to require cash payments.

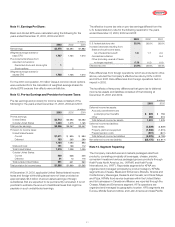

Note 19. Quarterly Financial Data (Unaudited):

(in millions, except per share data) 2003 Quarters

First Second Third Fourth

Net revenues $7,359 $7,841 $7,480 $8,330

Gross profit $3,010 $3,146 $2,921 $3,105

Net earnings $848 $ 949 $ 810 $ 869

Weighted average

shares for

diluted EPS 1,730 1,728 1,728 1,723

Per share data:

Basic EPS $0.49 $ 0.55 $ 0.47 $ 0.50

Diluted EPS $0.49 $ 0.55 $ 0.47 $ 0.50

Dividends declared $0.15 $ 0.15 $ 0.18 $ 0.18

Market price—high $39.40 $33.96 $32.79 $32.50

—low $26.35 $27.76 $27.60 $28.50

(in millions, except per share data) 2002 Quarters

First Second Third Fourth

Net revenues $7,147 $7,513 $7,216 $7,847

Gross profit $2,864 $3,127 $2,971 $3,041

Net earnings $693 $ 901 $ 869 $ 931

Weighted average

shares for

diluted EPS 1,737 1,738 1,737 1,734

Per share data:

Basic EPS $0.40 $ 0.52 $ 0.50 $ 0.54

Diluted EPS $0.40 $ 0.52 $ 0.50 $ 0.54

Dividends declared $0.13 $ 0.13 $ 0.15 $ 0.15

Market price—high $39.70 $43.95 $41.70 $41.30

—low $32.50 $38.32 $33.87 $36.12

Basic and diluted EPS are computed independently for each of the periods presented.

Accordingly, the sum of the quarterly EPS amounts may not agree to the total year.

The principal stock exchange, on which the Company’s Class A common stock is listed, is the New York Stock Exchange. At January 30,

2004, there were approximately 2,400 holders of record of the Company’s Class A common stock.