Kraft 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

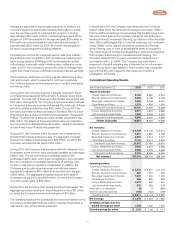

Overview

Kraft Foods Inc. (“Kraft”), together with its subsidiaries (collectively

referred to as the “Company”), is the largest branded food and

beverage company headquartered in the United States. Prior to

June 13, 2001, Kraft was a wholly-owned subsidiary of Altria Group,

Inc. On June 13, 2001, Kraft completed an initial public offering

(“IPO”) of 280,000,000 shares of its Class A common stock at a price

of $31.00 per share. The IPO proceeds, net of the underwriting

discount and expenses, of $8.4 billion were used to retire a portion

of an $11.0 billion long-term note payable to Altria Group, Inc.,

incurred in connection with the acquisition of Nabisco Holdings

Corp. (“Nabisco”). After the IPO, Altria Group, Inc. owned

approximately 83.9% of the outstanding shares of Kraft’s capital

stock through its ownership of 49.5% of Kraft’s Class A common

stock and 100% of Kraft’s Class B common stock. Kraft’s Class A

common stock has one vote per share, while Kraft’s Class B

common stock has ten votes per share. At December 31, 2003,

Altria Group, Inc. held 97.9% of the combined voting power of Kraft’s

outstanding capital stock and owned approximately 84.6% of the

outstanding shares of Kraft’s capital stock.

The Company conducts its global business through two

subsidiaries: Kraft Foods North America, Inc. (“KFNA”) and Kraft

Foods International, Inc. (“KFI”). KFNA manages its operations

principally by product category, while KFI manages its operations by

geographic region. During 2003, 2002 and 2001, KFNA’s segments

were Cheese, Meals and Enhancers; Biscuits, Snacks and

Confectionery; Beverages, Desserts and Cereals; and Oscar Mayer

and Pizza. KFNA’s food service business within the United States

and its businesses in Canada, Mexico and Puerto Rico were

reported through the Cheese, Meals and Enhancers segment. KFI’s

segments were Europe, Middle East and Africa; and Latin America

and Asia Pacific.

During January 2004, the Company announced a new global

organizational structure, which will result in new segments for

financial reporting purposes. Beginning in 2004, the Company’s

new segments will be U.S. Beverages & Grocery; U.S. Snacks; U.S.

Cheese, Canada & North America Foodservice; U.S. Convenient

Meals; Europe, Middle East & Africa; and Latin America & Asia

Pacific. The new segment structure in North America reflects a

shift of certain divisions and brands between segments to align

businesses with consumer targets. Results for the Mexico and

Puerto Rico businesses will be reported in the Latin America and

Asia Pacific segment.

The Company’s 2003, 2002 and 2001 results by segment are

discussed herein under the reporting structure in place during 2003.

The Company will report financial results in the new segment

structure beginning with the results for the first quarter of 2004, and

historical amounts will be restated.

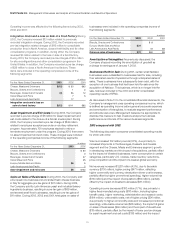

Critical Accounting Policies

Note 2 to the consolidated financial statements includes a summary

of the significant accounting policies and methods used in the

preparation of the Company’s consolidated financial statements.

In most instances, the Company must use an accounting policy

or method because it is the only policy or method permitted under

accounting principles generally accepted in the United States of

America (“U.S. GAAP”).

The preparation of all financial statements includes the use of

estimates and assumptions that affect a number of amounts

included in the Company’s financial statements, including, among

other things, employee benefit costs and income taxes. The

Company bases its estimates on historical experience and other

assumptions that it believes are reasonable. If actual amounts

are ultimately different from previous estimates, the revisions are

included in the Company’s consolidated results of operations for

the period in which the actual amounts become known. Historically,

the aggregate differences, if any, between the Company’s estimates

and actual amounts in any year have not had a significant impact

on the Company’s consolidated financial statements.

23

Kraft Foods Inc. Management’s Discussion and Analysis of Financial Condition and Results of Operations