Kraft 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

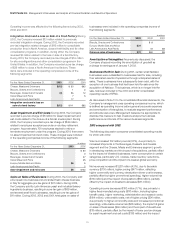

Kraft Foods Inc. Management’s Discussion and Analysis of Financial Condition and Results of Operations

evaluating tax positions. The Company establishes additional

provisions for income taxes when, despite the belief that existing tax

positions are fully supportable, there remain certain positions that

are likely to be challenged and that may not be sustained on review

by tax authorities. The Company adjusts these additional accruals

in light of changing facts and circumstances. The consolidated

tax provision includes the impact of changes to accruals that are

considered appropriate, as well as the related net interest. If the

Company’s filing positions are ultimately upheld under audits by

respective taxing authorities, it is possible that the provision for

income taxes in future years may reflect favorable adjustments.

Business Environment

The Company is subject to a number of challenges that may

adversely affect its businesses. These challenges, which are

discussed below and under the “Forward-Looking and Cautionary

Statements” section include:

• fluctuations in commodity prices;

• movements of foreign currencies against the U.S. dollar;

• competitive challenges in various products and markets, including

price gaps with competitor products and the increasing price-

consciousness of consumers;

• a rising cost environment;

• a trend toward increasing consolidation in the retail trade and

consequent inventory reductions;

• changing consumer preferences;

• competitors with different profit objectives and less susceptibility to

currency exchange rates; and

• consumer concerns about food safety, quality and health, including

concerns about genetically modified organisms, trans-fatty acids

and obesity.

To confront these challenges, the Company continues to take steps

to build the value of its brands, to improve its food business portfolio

with new product and marketing initiatives, to reduce costs through

productivity and to address consumer concerns about food safety,

quality and health. In July 2003, the Company announced a range

of initiatives addressing product nutrition, marketing practices,

consumer information, and public advocacy and dialogue.

During 2003, several factors contributed to lower than anticipated

volume growth. These factors included higher price gaps in some

key categories and countries, trade inventory reductions resulting

from several customers experiencing financial difficulty, warehouse

consolidations, store closings and retailers’ stated initiatives to

reduce working capital, as well as the combined adverse effect

of global economic weakness. To improve volume and share

trends, the Company increased spending behind certain businesses

during the second half of 2003 by approximately $200 million more

than had previously been planned. The Company also anticipates

$500 million to $600 million of increased spending in 2004 over

2003 across all its businesses.

In January 2004, the Company announced its adoption of a four-

point plan to achieve sustainable growth. The first element of the

plan is to build brand value by continuing to improve its products,

to use more value-added packaging, to develop innovative new

products, to effectively manage price gaps and to build closer

relationships with consumers.

The second element of the plan is to accelerate the shift in the

Company’s brand portfolio to address growing consumer demand

for products meeting their health and wellness concerns and their

desire for convenience. The Company is reducing trans-fat in its

products, identifying its products that are low in carbohydrates,

introducing more sugar-free products, and emphasizing positive

nutrition products. The Company is addressing convenience needs

by offering more convenient packaging, such as single-serve and

resealable packaging, and products requiring reduced preparation.

The Company is also offering packaging that is customized to suit

the needs of growing alternate channels of distribution such as

supercenters, mass merchandisers, drugstores and club stores.

The Company also plans to shift its portfolio to reflect changing

demographics, for example, by expanding the availability of

Hispanic products and bilingual packaging.

The third component of the plan is to expand the Company’s

global scale through international growth, particularly in developing

markets. These markets account for 84% of the world’s population

and 30% of its packaged food consumption, but only 11% of the

Company’s net revenues. The plan calls for the Company to capture

the growth potential of its core categories in existing markets and

to expand its core categories into new markets.

As the final component of its plan, the Company announced a three-

year restructuring program with the objectives of leveraging the

Company’s global scale, realigning and lowering the cost structure,

and optimizing capacity utilization. As part of this program, the

Company anticipates the exit or closing of up to twenty plants and

the elimination of approximately six thousand positions. Over the

next three years, the Company expects to incur up to $1.2 billion in

pre-tax charges, reflecting asset disposals, severance and other

implementation costs, including an estimated range of $750 million

to $800 million in 2004. Approximately one-half of the pre-tax

26