Kraft 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

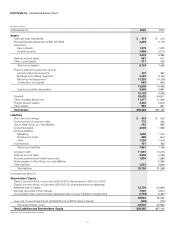

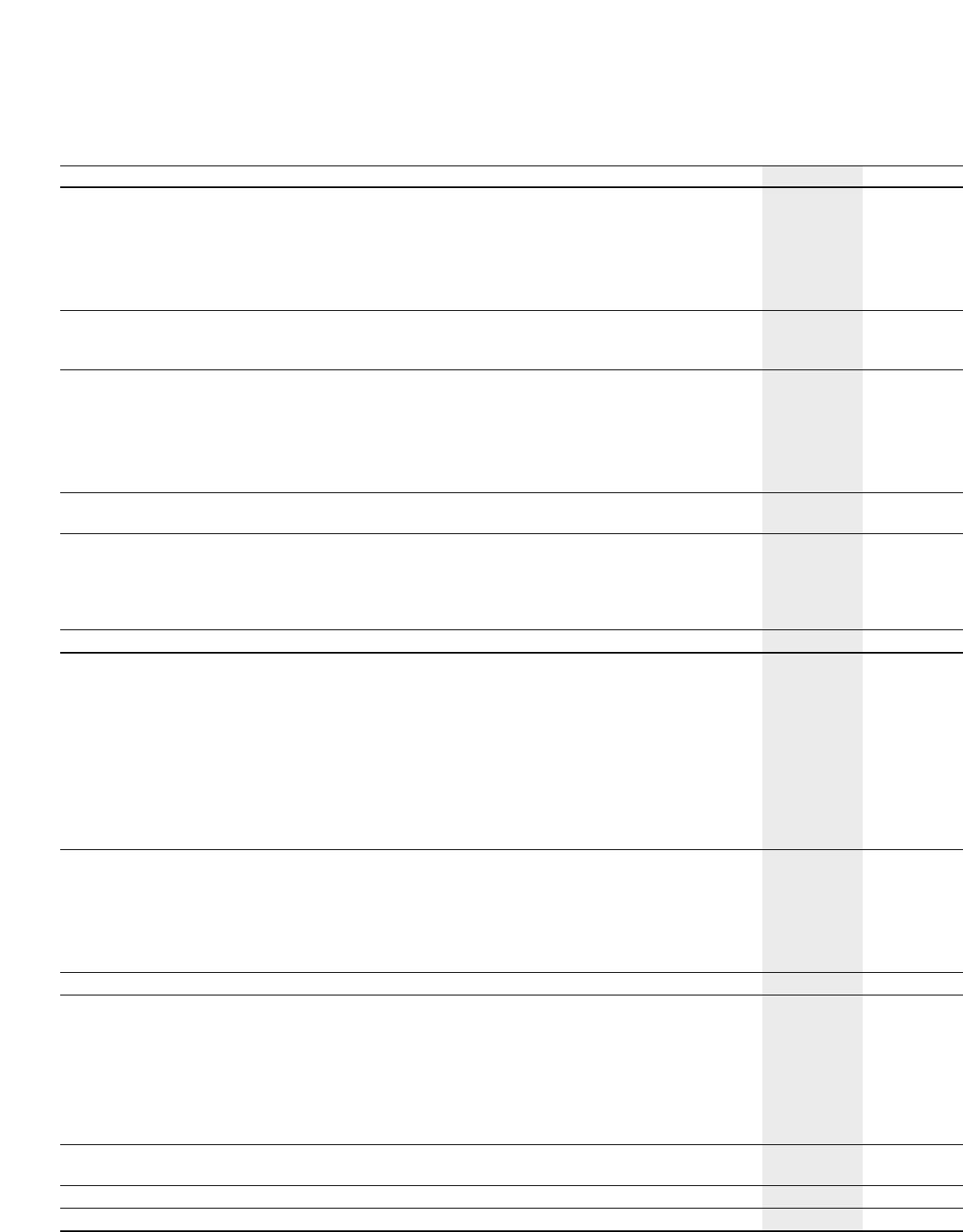

Kraft Foods Inc. Consolidated Balance Sheets

(in millions of dollars)

At December 31, 2003 2002

Assets

Cash and cash equivalents $514 $215

Receivables (less allowances of $114 and $119) 3,369 3,116

Inventories:

Raw materials 1,375 1,372

Finished product 1,968 2,010

3,343 3,382

Deferred income taxes 681 511

Other current assets 217 232

Total current assets 8,124 7,456

Property, plant and equipment, at cost:

Land and land improvements 407 387

Buildings and building equipment 3,422 3,153

Machinery and equipment 11,293 10,108

Construction in progress 683 802

15,805 14,450

Less accumulated depreciation 5,650 4,891

10,155 9,559

Goodwill 25,402 24,911

Other intangible assets, net 11,477 11,509

Prepaid pension assets 3,243 2,814

Other assets 884 851

Total Assets $59,285 $57,100

Liabilities

Short-term borrowings $553 $220

Current portion of long-term debt 775 352

Due to Altria Group, Inc. and affiliates 543 895

Accounts payable 2,005 1,939

Accrued liabilities:

Marketing 1,500 1,474

Employment costs 699 610

Other 1,335 1,316

Income taxes 451 363

To tal current liabilities 7,861 7,169

Long-term debt 11,591 10,416

Deferred income taxes 5,856 5,428

Accrued postretirement health care costs 1,894 1,889

Notes payable to Altria Group, Inc. and affiliates 2,560

Other liabilities 3,553 3,806

Total liabilities 30,755 31,268

Contingencies (Note 17)

Shareholders’ Equity

Class A common stock, no par value (555,000,000 shares issued in 2003 and 2002)

Class B common stock, no par value (1,180,000,000 shares issued and outstanding)

Additional paid-in capital 23,704 23,655

Earnings reinvested in the business 7,020 4,814

Accumulated other comprehensive losses (primarily currency translation adjustments) (1,792) (2,467)

28,932 26,002

Less cost of repurchased stock (13,062,876 and 4,381,150 Class A shares) (402) (170)

Total shareholders’ equity 28,530 25,832

Total Liabilities and Shareholders’ Equity $59,285 $57,100

See notes to consolidated financial statements.