Kraft 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

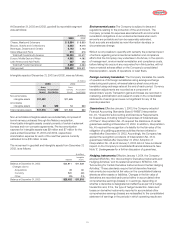

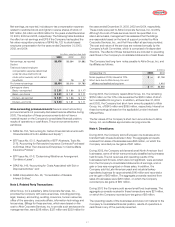

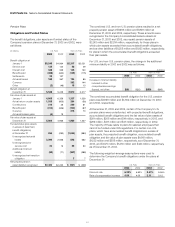

Aggregate maturities of long-term debt, excluding short-term

borrowings reclassified as long-term debt, are as follows:

(in millions)

2004 $775

2005 737

2006 1,257

2007 1,398

2008 702

2009–2013 4,502

Thereafter 1,139

Based on market quotes, where available, or interest rates currently

available to the Company for issuance of debt with similar terms and

remaining maturities, the aggregate fair value of the Company’s

long-term debt, including the current portion of long-term debt, was

$12,873 million and $11,544 million at December 31, 2003 and

2002,respectively.

Note 9. Capital Stock:

The Company’s articles of incorporation authorize 3.0 billion shares

of Class A common stock, 2.0 billion shares of Class B common

stock and 500 million shares of preferred stock. On December 3,

2003, the Company completed a $500 million Class A common

stock repurchase program, acquiring 15,308,458 Class A shares

at an average price of $32.66 per share. On December 8, 2003,

the Company commenced repurchasing shares under a new

$700 million Class A common stock repurchase program. Through

December 31, 2003, repurchases under the $700 million program

were 1,583,600 shares at a cost of $50 million, or $31.57 per share.

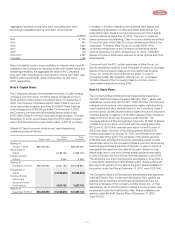

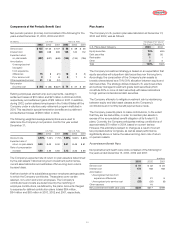

Shares of Class A common stock issued, repurchased and

outstanding were as follows:

Shares Shares

Shares Issued Repurchased Outstanding

Balance at

January 1, 2002 555,000,000 — 555,000,000

Repurchase of

shares (4,383,150) (4,383,150)

Exercise of stock

options 2,000 2,000

Balance at

December 31, 2002 555,000,000 (4,381,150) 550,618,850

Repurchase of

shares (12,508,908) (12,508,908)

Exercise of stock

options and

issuance of other

stock awards 3,827,182 3,827,182

Balance at

December 31, 2003 555,000,000 (13,062,876) 541,937,124

In addition, 1.18 billion Class B common shares were issued and

outstanding at December 31, 2003 and 2002. Altria Group, Inc.

holds 276.6 million Class A common shares and all of the Class B

common shares at December 31, 2003. There are no preferred

shares issued and outstanding. Class A common shares are entitled

to one vote each, while Class B common shares are entitled to ten

votes each. Therefore, Altria Group, Inc. holds 97.9% of the

combined voting power of the Company’s outstanding capital

stock at December 31, 2003. At December 31, 2003, 71,662,879

shares of common stock were reserved for stock options and other

stock awards.

Concurrent with the IPO, certain employees of Altria Group, Inc.

and its subsidiaries received a one-time grant of options to purchase

shares of the Company’s Class A common stock held by Altria

Group, Inc. at the IPO price of $31.00 per share. In order to

completely satisfy this obligation, Altria Group, Inc. purchased

1.6million shares of the Company’s Class A common stock in

open market transactions during 2002.

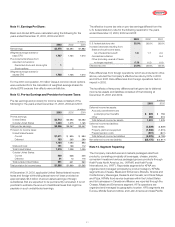

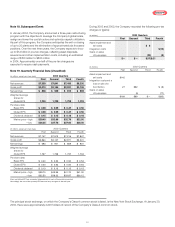

Note 10. Stock Plans:

The Company’s Board of Directors and shareholders approved

the 2001 Kraft Performance Incentive Plan (the “Plan”), which was

established concurrently with the IPO. Under the Plan, the Company

may grant stock options, stock appreciation rights, restricted stock,

reload options and other awards based on the Company’s Class A

common stock, as well as performance-based annual and long-term

incentive awards. A maximum of 75 million shares of the Company’s

Class A common stock may be issued under the Plan. The

Company’s Board of Directors granted options for 21,029,777 shares

of Class A common stock concurrent with the closing date of the

IPO (June 13, 2001) at an exercise price equal to the IPO price of

$31.00 per share. A portion of the shares granted (18,904,637)

became exercisable on January 31, 2003, and will expire ten years

from the date of the grant. The remainder of the shares granted

(2,125,140) were scheduled to become exercisable based on total

shareholder return for the Company’s Class A common stock during

the three years following the date of the grant, or were to become

exercisable five years from the date of the grant. Based on total

shareholder return, one-third of these shares became exercisable

in June 2002 and one-third will become exercisable in June 2006.

The remaining one-third could become exercisable in June 2004 or

in June 2006, depending on shareholder return. These options will

also expire ten years from the date of the grant. Shares available to

be granted under the Plan at December 31, 2003, were 51,317,940.

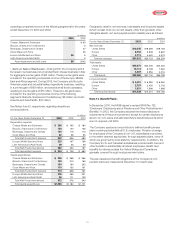

The Company’s Board of Directors and shareholders also approved

the Kraft Director Plan. Under the Kraft Director Plan, awards are

granted only to members of the Board of Directors who are not

full-time employees of the Company or Altria Group, Inc., or their

subsidiaries. Up to 500,000 shares of Class A common stock may

be awarded under the Kraft Director Plan. Shares available to be

granted under the Kraft Director Plan at December 31, 2003,

were 470,705.