Kraft 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s revolving credit facilities, which are for its sole use,

require the maintenance of a minimum net worth of $18.2 billion.

The Company met this covenant at December 31, 2003 and expects

to continue to meet this covenant. The foregoing revolving credit

facilities do not include any other financial tests, any credit rating

triggers or any provisions that could require the posting of collateral.

The multi-year revolving credit facility enables the Company to

reclassify short-term debt on a long-term basis. At December 31,

2003, $1.9 billion of commercial paper borrowings that the Company

intends to refinance were reclassified as long-term debt. The

Company expects to continue to refinance long-term and short-term

debt from time to time. The nature and amount of the Company’s

long-term and short-term debt and the proportionate amount of

each can be expected to vary as a result of future business

requirements, market conditions and other factors.

In addition to the above, certain international subsidiaries of

Kraft maintain uncommitted credit lines to meet the short-term

working capital needs of the international businesses. These

credit lines, which amounted to approximately $658 million as

of December 31, 2003, are for the sole use of the Company’s

international businesses. Borrowings on these lines were

approximately $220 million at December 31, 2003 and 2002.

Off-Balance Sheet Arrangements and Aggregate

Contractual Obligations

The Company has no off-balance sheet arrangements other than the

guarantees and contractual obligations that are discussed below.

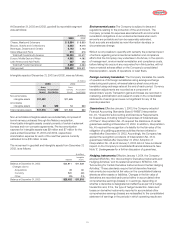

Guarantees: As discussed in Note 17 to the consolidated financial

statements, the Company had third-party guarantees, which are

primarily derived from acquisition and divestiture activities, of

approximately $38 million at December 31, 2003. Substantially all

of these guarantees expire through 2014, with $13 million expiring

during 2004. The Company is required to perform under these

guarantees in the event that a third party fails to make contractual

payments or achieve performance measures. The Company has

aliability of $26 million on its consolidated balance sheet at

December 31, 2003, relating to these guarantees.

In addition, at December 31, 2003, the Company was contingently

liable for $123 million of guarantees related to its own performance.

These include surety bonds related to dairy commodity purchases

and guarantees related to the payment of customs duties and taxes,

and letters of credit.

Guarantees do not have, and are not expected to have, a significant

impact on the Company’s liquidity.

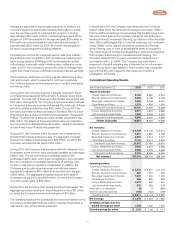

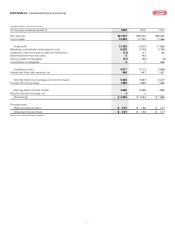

Aggregate Contractual Obligations: The following table

summarizes the Company’s contractual obligations at

December 31, 2003:

Payments Due

2009 and

(in millions) Total 2004 2005–06 2007–08 Thereafter

Long-term debt(1) $10,510 $ 775 $1,994 $2,100 $5,641

Operating leases(2) 1,187 307 397 247 236

Purchase obligations(3):

Inventory and

production costs 5,611 2,643 1,162 578 1,228

Other 781 617 111 46 7

6,392 3,260 1,273 624 1,235

Other long-term

liabilities(4) 41 20 11 10

$18,130 $4,342 $3,684 $2,982 $7,122

(1) Amounts represent the expected cash payments of the Company’s long-term debt and do not

include short-term borrowings reclassified as long-term debt, bond premiums or discounts.

(2) Operating leases represent the minimum rental commitments under non-cancelable operating

leases. The Company has no significant capital lease obligations.

(3) Purchase obligations for inventory and production costs (such as raw materials, indirect materials

and supplies, packaging, co-manufacturing arrangements, storage and distribution) are

commitments for projected needs to be utilized in the normal course of business. Other purchase

obligations include commitments for marketing, advertising, capital expenditures, information

technology and professional services. Arrangements are considered purchase obligations if a

contract specified all significant terms, including fixed or minimum quantities to be purchased, a

pricing structure and approximate timing of the transaction. Most arrangements are cancelable

without a significant penalty, and with short notice (usually 30 days). Any amounts reflected on

the consolidated balance sheet as accounts payable and accrued liabilities are excluded from

the table above.

(4) Other long-term liabilities primarily consist of certain specific severance and incentive compensation

arrangements. The following long-term liabilities included on the consolidated balance sheet are

excluded from the table above: accrued pension, postretirement health care and postemployment

costs, income taxes, minority interest, insurance accruals and other accruals. The Company is

unable to estimate the timing of the payments for these items. Currently, the Company anticipates

making U.S. pension contributions of approximately $70 million in 2004, based on current tax law

(as discussed in Note 14 to the consolidated financial statements).

The Company believes that its cash from operations and existing

credit facilities will provide sufficient liquidity to meet its working

capital needs, planned capital expenditures, future contractual

obligations and payment of its anticipated quarterly dividends.

Equity and Dividends

In 2002, Kraft’s Board of Directors approved the repurchase from

time to time of up to $500 million of Kraft’s Class A common stock

solely to satisfy the obligations of Kraft to provide shares under its

2001 Performance Incentive Plan, 2001 Director Plan for non-

employee directors, and other plans where options to purchase

Kraft’s Class A common stock are granted to employees of the

Company. On December 3, 2003, Kraft completed the $500 million

Class A common stock repurchase program, acquiring 15,308,458

Class A shares at an average price of $32.66 per share. On

December 8, 2003, Kraft commenced repurchasing shares under a

35