Kraft 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

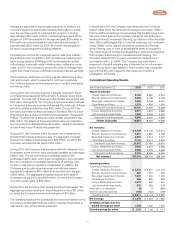

Company’s pension and postretirement expense by approximately

$65 million, while a fifty-basis-point increase in the discount rate

would decrease pension and postretirement expense by

approximately $55 million. Similarly, a fifty-basis-point decrease

(increase) in the expected return on plan assets would increase

(decrease) the Company’s pension expense for the U.S. pension

plans by approximately $30 million. See Note 14 to the consolidated

financial statements for a sensitivity discussion of the assumed

health care cost trend rates.

Revenue Recognition: As required by U.S. GAAP, the Company

recognizes revenues, net of sales incentives, and including shipping

and handling charges billed to customers, upon shipment of

goods when title and risk of loss pass to customers. Shipping and

handling costs are classified as part of cost of sales. Provisions

and allowances for estimated sales returns and bad debts are also

recorded in the Company’s consolidated financial statements. The

amounts recorded for these provisions and related allowances are

not significant to the Company’s consolidated financial position or

results of operations.

Depreciation and Amortization: The Company depreciates

property, plant and equipment and amortizes definite life intangibles

using straight-line methods over the estimated useful lives of

the assets. As discussed in Note 2 to the consolidated financial

statements, on January 1, 2002, the Company adopted the

provisions of a new accounting standard and, as a result, stopped

recording the amortization of goodwill as a charge to earnings as

of January 1, 2002.

Marketing and Advertising Costs: As required by U.S. GAAP,

the Company records marketing costs as an expense in the year to

which such costs relate. The Company does not defer amounts on

its year-end consolidated balance sheet with respect to marketing

costs. The Company expenses advertising costs in the year

incurred. The Company records consumer incentive and trade

promotion costs as a reduction of revenues in the year in which

these programs are offered, based on estimates of utilization and

redemption rates that are developed from historical information.

Related Party Transactions: As discussed in Note 3 to the

consolidated financial statements, Altria Group, Inc.’s subsidiary,

Altria Corporate Services, Inc., provides the Company with various

services, including planning, legal, treasury, accounting, auditing,

insurance, human resources, office of the secretary, corporate

affairs, information technology and tax services. Billings for these

services, which were based on the cost to Altria Corporate

Services, Inc. to provide such services and a management fee,

were $318 million, $327 million and $339 million for the years ended

December 31, 2003, 2002 and 2001, respectively. Although the

cost of these services cannot be quantified on a stand-alone basis,

management has assessed that the billings are reasonable based on

the level of support provided by Altria Corporate Services, Inc., and

that they reflect all services provided. The cost and nature of the

services are reviewed annually by the Company’s Audit Committee,

which consists solely of independent directors. The effects of these

transactions are included in operating cash flows in the Company’s

consolidated statements of cash flows.

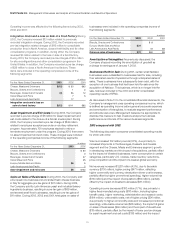

The Company had long-term notes payable to Altria Group, Inc. and

its affiliates as follows:

(in millions)

At December 31, 2003 2002

Notes payable in 2009, interest at 7.0% $— $1,150

Short-term due to Altria Group, Inc. and affiliates

reclassified as long-term 1,410

$— $2,560

During 2003, the Company repaid Altria Group, Inc. the remaining

$1,150 million on the 7.0% note, as well as the $1,410 million of short-

term borrowings reclassified to long-term. In addition, at December

31, 2003 and 2002, the Company had short-term amounts payable

to Altria Group, Inc. of $543 million and $895 million, respectively.

Interest on these borrowings is based on the applicable London

Interbank Offered Rate.

Income Taxes: The Company accounts for income taxes in

accordance with Statement of Financial Accounting Standards

(“SFAS”) No. 109, “Accounting for Income Taxes.” The accounts of

the Company are included in the consolidated federal income tax

return of Altria Group, Inc. Income taxes are generally computed

on a separate company basis. To the extent that foreign tax credits,

capital losses and other credits generated by the Company, which

cannot currently be utilized on a separate company basis, are

utilized in Altria Group, Inc.’s consolidated federal income tax return,

the benefit is recognized in the calculation of the Company’s

provision for income taxes. Based on the Company’s current

estimate, this benefit is calculated to be approximately $100 million,

$240 million and $220 million for the years ended December 31,

2003, 2002 and 2001, respectively. The benefit is dependent on a

variety of tax attributes which have a tendency to vary year to year.

The Company makes payments to, or is reimbursed by, Altria Group,

Inc. for the tax effects resulting from its inclusion in Altria Group,

Inc.’s consolidated federal income tax return. The provision for

income taxes is based on domestic and international statutory

income tax rates and tax planning opportunities available to the

Company in the jurisdictions in which it operates. Significant

judgment is required in determining income tax provisions and in

25