Kraft 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

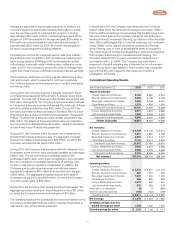

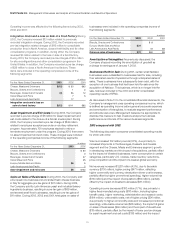

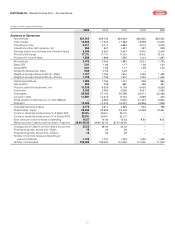

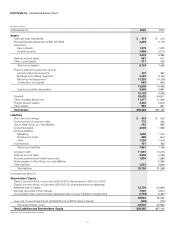

Kraft Foods Inc. Management’s Discussion and Analysis of Financial Condition and Results of Operations

new $700 million Class A common stock repurchase authority

approved by its Board of Directors in 2003. Through December 31,

2003, repurchases under the $700 million program were 1,583,600

shares at a cost of $50 million, or $31.57 per share. During 2003,

Kraft repurchased 12.5 million shares at a cost of $380 million, and in

2002 Kraft repurchased 4.4 million shares at a cost of $170 million.

Concurrently with the IPO, certain employees of Altria Group, Inc.

and its subsidiaries received a one-time grant of options to purchase

shares of Kraft’s Class A common stock held by Altria Group, Inc. at

the IPO price of $31.00 per share. In order to completely satisfy this

obligation, Altria Group, Inc. purchased 1.6 million shares of Kraft’s

Class A common stock in open market transactions during 2002.

During the first quarter of 2003, the Company granted shares of

restricted stock and rights to receive shares of stock to eligible

employees, giving them in most instances all of the rights of

stockholders, except that they may not sell, assign, pledge or

otherwise encumber such shares and rights. Such shares and

rights are subject to forfeiture if certain employment conditions are

not met. During the first quarter of 2003, the Company granted

approximately 3.7 million restricted Class A shares to eligible U.S.-

based employees and also issued to eligible non-U.S. employees

rights to receive approximately 1.6 million Class A equivalent shares.

Restrictions on the stock and rights lapse in the first quarter of 2006.

The market value per restricted share or right was $36.56 on the

date of grant.

The fair value of the shares of restricted stock and rights to receive

shares of stock at the date of grant is amortized to expense ratably

over the restriction period. The Company recorded compensation

expense related to the restricted stock and rights of $57 million

for the year ended December 31, 2003. The unamortized portion,

which is reported on the consolidated balance sheet as a reduction

of earnings reinvested in the business, was $129 million at December

31, 2003.

Dividends paid in 2003 and 2002 were $1,089 million and $936 mil-

lion, respectively, reflecting a higher dividend rate in 2003, partially

offset by lower shares outstanding as a result of Class A share

repurchases. During the third quarter of 2003, Kraft’s Board of

Directors approved a 20% increase in the quarterly dividend rate

to $0.18 per share on its Class A and Class B common stock. As a

result, the present annualized dividend rate is $0.72 per common

share. The declaration of dividends is subject to the discretion of

Kraft’s Board of Directors and will depend on various factors,

including the Company’s net earnings, financial condition, cash

requirements, future prospects and other factors deemed relevant

by Kraft’s Board of Directors.

Market Risk

The Company operates globally, with manufacturing and sales

facilities in various locations around the world, and utilizes

certain financial instruments to manage its foreign currency

and commodity exposures, which primarily relate to forecasted

transactions. Derivative financial instruments are used by the

Company, principally to reduce exposures to market risks resulting

from fluctuations in foreign exchange rates and commodity prices

by creating offsetting exposures. The Company is not a party

to leveraged derivatives and, by policy, does not use financial

instruments for speculative purposes.

Substantially all of the Company’s derivative financial instruments

are effective as hedges. During the year ended December 31, 2003,

ineffectiveness related to cash flow hedges resulted in a gain of

$13million, which was recorded in cost of sales on the consolidated

statement of earnings. Ineffectiveness related to cash flow hedges

during the year ended December 31, 2002 was not material.

At December 31, 2003, the Company was hedging forecasted

transactions for periods not exceeding twelve months and

expects substantially all amounts reported in accumulated

other comprehensive earnings (losses) to be reclassified to the

consolidated statement of earnings within the next twelve months.

Foreign Exchange Rates: The Company uses forward foreign

exchange contracts and foreign currency options to mitigate its

exposure to changes in foreign currency exchange rates from third-

party and intercompany forecasted transactions. The primary

currencies to which the Company is exposed, based on the size

and location of its businesses, include the euro, Swiss franc, British

pound and Canadian dollar. At December 31, 2003 and 2002, the

Company had option and forward foreign exchange contracts with

aggregate notional amounts of $2,486 million and $575 million,

respectively, which are comprised of contracts for the purchase and

sale of foreign currencies. The effective portion of unrealized gains

and losses associated with forward contracts is deferred as a

component of accumulated other comprehensive earnings (losses)

until the underlying hedged transactions are reported on the

Company’s consolidated statement of earnings.

36