Kraft 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

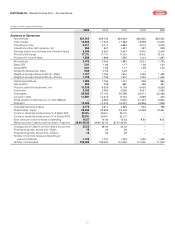

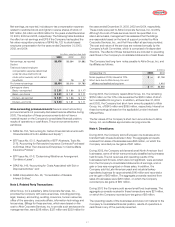

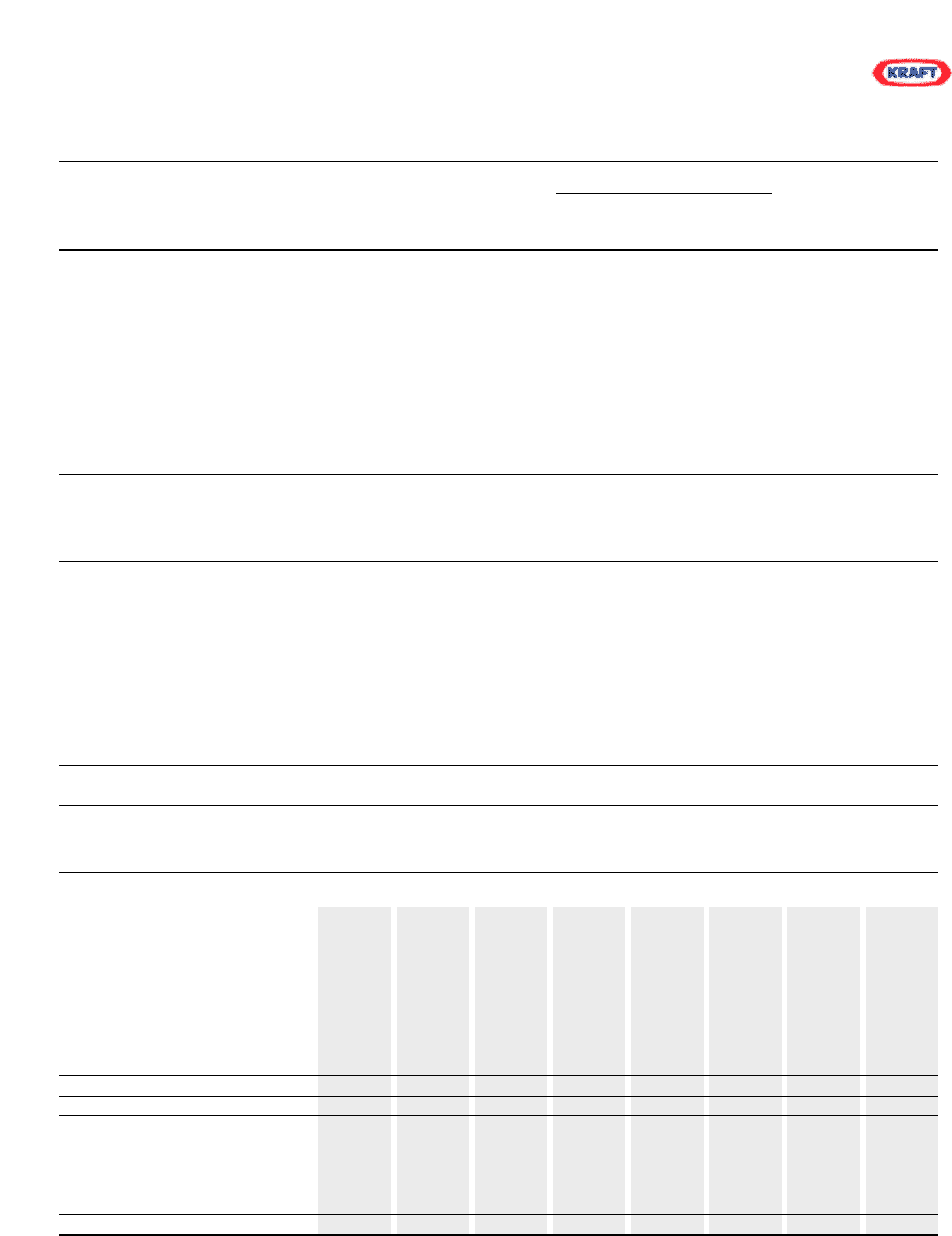

Kraft Foods Inc. Consolidated Statements of Shareholders’ Equity

(in millions of dollars, except per share data)

Accumulated Other

Comprehensive Earnings (Losses)

Class A Earnings

and B Additional Reinvested Currency Cost of Total

Common Paid-in in the Translation Repurchased Shareholders’

Stock Capital Business Adjustments Other Total Stock Equity

Balances, January 1, 2001 $

—

$15,230 $ 992 $(2,138) $ (36) $(2,174) $

—

$14,048

Comprehensive earnings:

Net earnings 1,882 1,882

Other comprehensive losses,

net of income taxes:

Currency translation

adjustments (298) (298) (298)

Additional minimum

pension liability (78) (78) (78)

Change in fair value of

derivatives accounted

for as hedges (18) (18) (18)

Total other comprehensive losses (394)

To tal comprehensive earnings 1,488

Sale of Class A common stock

to public 8,425 8,425

Cash dividends declared

($0.26 per share) (483) (483)

Balances, December 31, 2001

—

23,655 2,391 (2,436) (132) (2,568)

—

23,478

Comprehensive earnings:

Net earnings 3,394 3,394

Other comprehensive earnings

(losses), net of income taxes:

Currency translation

adjustments 187 187 187

Additional minimum

pension liability (117) (117) (117)

Change in fair value of

derivatives accounted

for as hedges 31 31 31

Total other comprehensive earnings 101

To tal comprehensive earnings 3,495

Cash dividends declared

($0.56 per share) (971) (971)

Class A common stock

repurchased (170) (170)

Balances, December 31, 2002

—

23,655 4,814 (2,249) (218) (2,467) (170) 25,832

Comprehensive earnings:

Net earnings 3,476 3,476

Other comprehensive earnings

(losses), net of income taxes:

Currency translation

adjustments 755 755 755

Additional minimum

pension liability (68) (68) (68)

Change in fair value of

derivatives accounted

for as hedges (12) (12) (12)

Total other comprehensive earnings 675

To tal comprehensive earnings 4,151

Exercise of stock options and

issuance of other stock awards 49 (129) 148 68

Cash dividends declared

($0.66 per share) (1,141) (1,141)

Class A common stock

repurchased (380) (380)

Balances, December 31, 2003 $

—

$23,704 $ 7,020 $(1,494) $(298) $(1,792) $(402) $28,530

See notes to consolidated financial statements.

43