Kraft 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

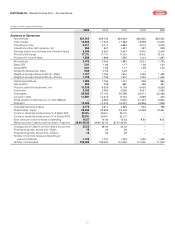

45

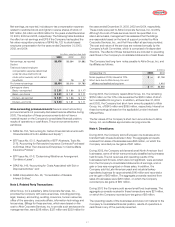

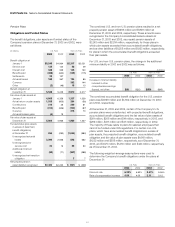

At December 31, 2003 and 2002, goodwill by reportable segment

was as follows:

(in millions)

2003 2002

Cheese, Meals and Enhancers $8,834 $8,803

Biscuits, Snacks and Confectionery 8,963 9,015

Beverages, Desserts and Cereals 2,143 2,143

Oscar Mayer and Pizza 613 616

To tal Kraft Foods North America 20,553 20,577

Europe, Middle East and Africa 4,562 4,082

Latin America and Asia Pacific 287 252

To tal Kraft Foods International 4,849 4,334

Total goodwill $25,402 $24,911

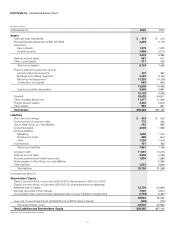

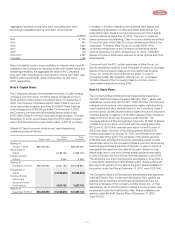

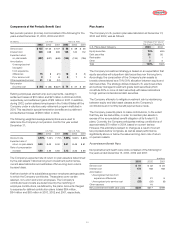

Intangible assets at December 31, 2003 and 2002, were as follows:

(in millions)

2003 2002

Gross Gross

Carrying Accumulated Carrying Accumulated

Amount Amortization Amount Amortization

Non-amortizable

intangible assets $11,432 $11,485

Amortizable

intangible assets 84 $39 54 $30

Total intangible assets $11,516 $39 $11,539 $30

Non-amortizable intangible assets are substantially comprised of

brand names purchased through the Nabisco acquisition.

Amortizable intangible assets consist primarily of certain trademark

licenses and non-compete agreements. Pre-tax amortization

expense for intangible assets was $9 million and $7 million for the

years ended December 31, 2003 and 2002, respectively.

Amortization expense for each of the next five years is currently

estimated to be $10 million or less.

The movement in goodwill and intangible assets from December 31,

2002, is as follows:

(in millions)

Intangible

Goodwill Assets

Balance at December 31, 2002 $24,911 $11,539

Changes due to:

Acquisitions 49 30

Currency 520 (40)

Other (78) (13)

Balance at December 31, 2003 $25,402 $11,516

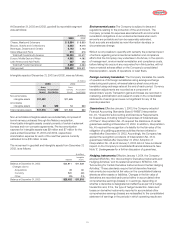

Environmental costs: The Company is subject to laws and

regulations relating to the protection of the environment. The

Company provides for expenses associated with environmental

remediation obligations on an undiscounted basis when such

amounts are probable and can be reasonably estimated.

Such accruals are adjusted as new information develops or

circumstances change.

While it is not possible to quantify with certainty the potential impact

of actions regarding environmental remediation and compliance

efforts that the Company may undertake in the future, in the opinion

of management, environmental remediation and compliance costs,

before taking into account any recoveries from third parties, will not

have a material adverse effect on the Company’s consolidated

financial position, results of operations or cash flows.

Foreign currency translation:The Company translates the results

of operations of its foreign subsidiaries using average exchange

rates during each period, whereas balance sheet accounts are

translated using exchange rates at the end of each period. Currency

translation adjustments are recorded as a component of

shareholders’ equity. Transaction gains and losses are recorded in

marketing, administration and research costs on the consolidated

statements of earnings and were not significant for any of the

periods presented.

Guarantees: Effective January 1, 2003, the Company adopted

Financial Accounting Standards Board (“FASB”) Interpretation

No. 45, “Guarantor’s Accounting and Disclosure Requirements

for Guarantees, Including Indirect Guarantees of Indebtedness

of Others.” Interpretation No. 45 required the disclosure of certain

guarantees existing at December 31, 2002. In addition, Interpretation

No. 45 required the recognition of a liability for the fair value of the

obligation of qualifying guarantee activities that are initiated or

modified after December 31, 2002. Accordingly, the Company has

applied the recognition provisions of Interpretation No. 45 to

guarantees initiated after December 31, 2002. Adoption of

Interpretation No. 45 as of January 1, 2003 did not have a material

impact on the Company’s consolidated financial statements. See

Note 17. Contingencies for a further discussion of guarantees.

Hedging instruments: Effective January 1, 2001, the Company

adopted SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities,” and its related amendment, SFAS No. 138,

“A ccounting for Certain Derivative Instruments and Certain Hedging

Activities.” These standards require that all derivative financial

instruments be recorded at fair value on the consolidated balance

sheets as either assets or liabilities. Changes in the fair value of

derivatives are recorded each period either in accumulated other

comprehensive earnings (losses) or in earnings, depending on

whether a derivative is designated and effective as part of a hedge

transaction and, if it is, the type of hedge transaction. Gains and

losses on derivative instruments reported in accumulated other

comprehensive earnings (losses) are reclassified to the consolidated

statement of earnings in the periods in which operating results are