Kraft 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Kraft Foods Inc. Notes to Consolidated Financial Statements

Pension Plans

Obligations and Funded Status

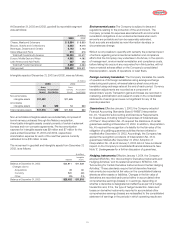

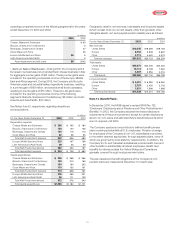

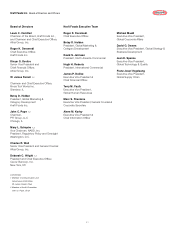

The benefit obligations, plan assets and funded status of the

Company’s pension plans at December 31, 2003 and 2002, were

as follows:

(in millions) U.S. Plans Non-U.S. Plans

2003 2002 2003 2002

Benefit obligation at

January 1 $5,245 $4,964 $2,317 $2,021

Service cost 135 120 58 49

Interest cost 338 339 136 120

Benefits paid (398) (624) (132) (115)

Settlements 29 127

Actuarial losses 199 367 124 85

Currency 392 144

Other (2) (48) 15 13

Benefit obligation at

December 31 5,546 5,245 2,910 2,317

Fair value of plan assets at

January 1 4,965 6,359 1,337 1,329

Actual return on plan assets 1,038 (803) 204 (56)

Contributions 219 26 209 81

Benefits paid (414) (636) (100) (87)

Currency 216 70

Actuarial (losses) gains (6) 19

Fair value of plan assets at

December 31 5,802 4,965 1,866 1,337

Funded status (plan assets

in excess of (less than)

benefit obligations)

at December 31 256 (280) (1,044) (980)

Unrecognized actuarial

losses 2,292 2,558 848 682

Unrecognized prior

service cost 23 13 55 50

Additional minimum

liability (85) (71) (367) (288)

Unrecognized net transition

obligation 77

Net prepaid pension

asset (liability) recognized $2,486 $2,220 $(501) $(529)

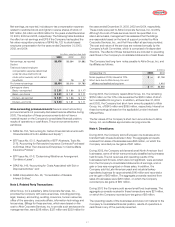

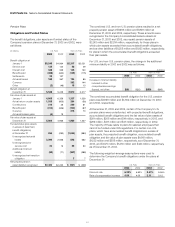

The combined U.S. and non-U.S. pension plans resulted in a net

prepaid pension asset of $1,985 million and $1,691 million at

December 31, 2003 and 2002, respectively. These amounts were

recognized in the Company’s consolidated balance sheets at

December 31, 2003 and 2002, as prepaid pension assets of

$3,243 million and $2,814 million, respectively, for those plans in

which plan assets exceeded their accumulated benefit obligations,

and as other liabilities of $1,258 million and $1,123 million, respectively,

for plans in which the accumulated benefit obligations exceeded

their plan assets.

For U.S. and non-U.S. pension plans, the change in the additional

minimum liability in 2003 and 2002 was as follows:

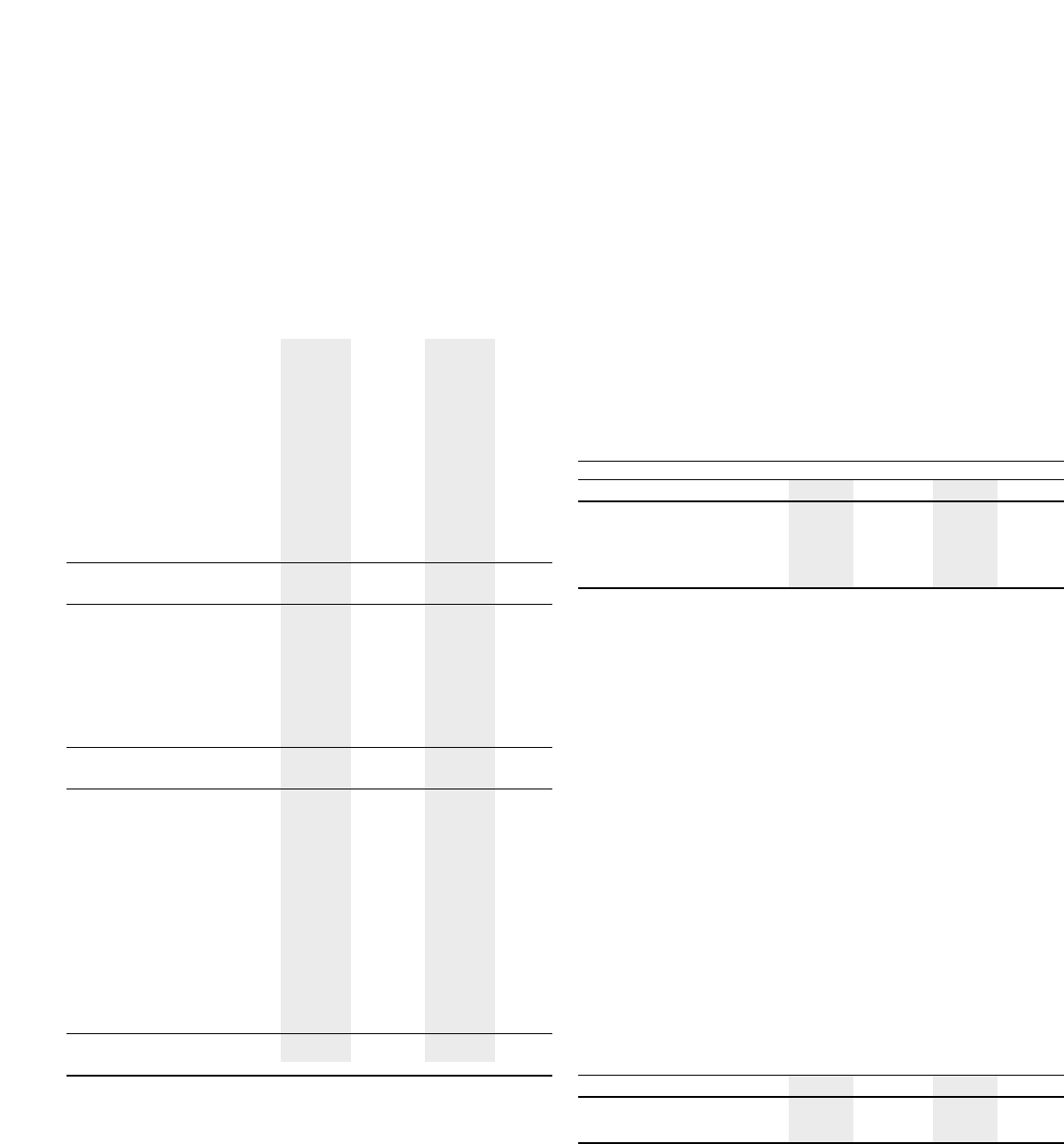

(in millions)

U.S. Plans Non-U.S. Plans

2003 2002 2003 2002

Increase in minimum liability

included in other

comprehensive earnings

(losses), net of tax $(9) $(22) $(59) $(95)

The combined accumulated benefit obligation for the U.S. pension

plans was $4,898 million and $4,562 million at December 31, 2003

and 2002, respectively.

At December 31, 2003 and 2002, certain of the Company’s U.S.

pension plans were underfunded, with projected benefit obligations,

accumulated benefit obligations and the fair value of plan assets of

$261 million, $208 million and $14 million, respectively, in 2003, and

$269 million, $217 million and $45 million, respectively, in 2002.

The majority of these relate to plans for salaried employees that

cannot be funded under IRS regulations. For certain non-U.S.

plans, which have accumulated benefit obligations in excess of

plan assets, the projected benefit obligation, accumulated benefit

obligation and fair value of plan assets were $1,648 million,

$1,532 million and $588 million, respectively, as of December 31,

2003, and $1,375 million, $1,250 million and $424 million, respectively,

as of December 31, 2002.

The following weighted-average assumptions were used to

determine the Company’s benefit obligations under the plans at

December 31:

U.S. Plans Non-U.S. Plans

2003 2002 2003 2002

Discount rate 6.25% 6.50% 5.41% 5.56%

Rate of compensation increase 4.00 4.00 3.11 3.12