Kraft 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

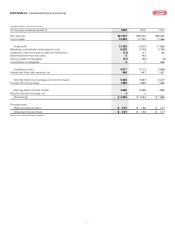

Operating companies income increased $157 million (3.3%), due

primarily to higher volume/mix ($174 million), favorable margins

($176 million, driven by lower commodity-related costs and

productivity) and Nabisco synergy savings, partially offset by

higher benefit expense, including the 2002 charge for asset

impairment and exit costs ($135 million).

The following discusses operating results within each of KFNA’s

reportable segments.

Cheese, Meals and Enhancers: Volume increased 12.5%, due

primarily to the inclusion in 2002 of a business that was previously

held for sale and volume gains in enhancers, meals and food

service, partially offset by a decline in cheese. Volume gains in

enhancers and meals were led by Kraft pourable dressings,

barbecue sauce, macaroni & cheese dinners and the 2001

acquisition of It’s Pasta Anytime. In cheese, volume declined as

lower dairy costs resulted in aggressive competitive activity by

private label manufacturers as they reduced prices and increased

merchandising levels.

Net revenues increased $158 million (1.8%), due primarily to the

inclusion in 2002 of a business that was previously held for sale

($252 million) and higher volume/mix ($34 million), partially offset

by lower net pricing ($118 million, primarily related to lower dairy

commodity costs).

Operating companies income increased $78 million (3.7%), due

primarily to favorable margins ($63 million, due primarily to lower

cheese commodity costs and productivity savings), lower integration

related costs in 2002 ($33 million), higher volume/mix ($31 million)

and the inclusion in 2002 of a business that was previously held

for sale ($23 million), partially offset by higher benefit expenses,

including the 2002 charge for asset impairment and exit costs

($60 million).

Biscuits, Snacks and Confectionery: Volume increased 0.9%,

as volume gains in biscuits and snacks were partially offset by a

decline in confectionery shipments. In biscuits, volume increased,

driven by new product initiatives in both cookies and crackers.

In snacks, volume also increased, due primarily to promotional

initiatives. Confectionery volume declined, resulting primarily from

competitive activity in the breath-freshening category, partially

offset by new product introductions in the non-chocolate

confectionery business.

Net revenues increased $98 million (2.0%), due primarily to higher

volume/mix ($61 million) and higher net pricing ($35 million).

Operating companies income increased $118 million (12.6%), due

primarily to favorable margins ($81 million, due primarily to higher

net pricing and lower commodity costs for nuts), Nabisco synergy

savings and higher volume/mix.

Beverages, Desserts and Cereals: Volume increased 8.4%, due

primarily to growth in ready-to-drink beverages. In coffee, volume

increased, driven by merchandising programs and packaging

innovation. In the desserts business, volume increases were led

by dry packaged desserts and frozen toppings, which benefited

from holiday programs, and in ready-to-eat desserts, aided by

new products.

Net revenues increased $175 million (4.1%), due primarily to higher

volume/mix ($245 million), partially offset by lower net pricing

($58 million).

Operating companies income decreased $56 million (4.7%),

primarily reflecting the 2002 charge for asset impairment and exit

costs ($47 million), higher integration-related costs ($44 million),

higher marketing, administration and research costs ($36 million,

including higher benefit costs) and lower margins ($18 million),

partially offset by higher volume/mix ($98 million) and productivity

savings.

Oscar Mayer and Pizza: Volume increased 2.3%, due to volume

gains in processed meats and pizza. The increase in processed

meats was driven by gains in hot dogs, bacon and soy-based meat

alternatives, aided by new product introductions. The pizza business

also benefited from new products.

Net revenues increased $84 million (2.9%), due to higher volume/mix

($97 million), partially offset by lower net pricing ($13 million).

Operating companies income increased $17 million (3.2%), primarily

reflecting favorable costs ($50 million, due primarily to lower meat

and cheese commodity costs and productivity savings) and higher

volume/mix ($30 million), partially offset by the 2002 charge for asset

impairment and exit costs ($25 million), higher marketing,

administration and research costs ($24 million, including higher

benefit costs) and higher manufacturing costs.

Kraft Foods International

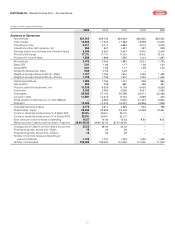

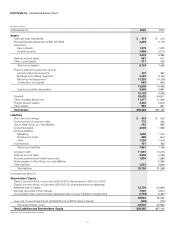

(in millions)

For the Years Ended December 31, 2003 2002 2001

Volume (in pounds):

Europe, Middle East and Africa 2,971 2,961 2,826

Latin America and Asia Pacific 1,969 2,059 2,057

Volume (in pounds) 4,940 5,020 4,883

Net revenues:

Europe, Middle East and Africa $7,045 $6,203 $5,936

Latin America and Asia Pacific 2,058 2,035 2,328

Net revenues $9,103 $8,238 $8,264

Operating companies income:

Europe, Middle East and Africa $1,012 $962 $ 861

Latin America and Asia Pacific 270 368 378

Operating companies income $1,282 $1,330 $1,239

31