Kraft 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

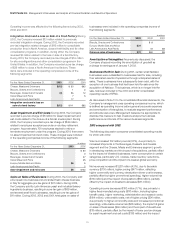

charges are expected to require cash payments. In addition, the

Company expects to spend approximately $140 million in capital

over the next three years to implement the program, including

approximately $50 million in 2004. Cost savings as a result of this

program in 2004 are expected to be approximately $120 million to

$140 million and are anticipated to reach annual cost savings of

approximately $400 million by 2006, all of which are expected to

be used in supporting brand-building initiatives.

Fluctuations in commodity prices can lead to retail price volatility

and intensive price competition, and can influence consumer and

trade buying patterns. KFNA’s and KFI’s businesses are subject

to fluctuating commodity costs, including dairy, coffee and cocoa

costs. In 2003, the Company’s commodity costs on average were

higher than those incurred in 2002 and adversely affected earnings.

The Company’s performance in 2003 was also affected by a rising

cost environment, which is expected to continue. In particular,

the Company experienced increased pension, medical, packaging

and energy costs.

During 2003, the Company acquired a biscuits business in Egypt

and trademarks associated with a small U.S.-based natural foods

business. The total cost of these and other smaller acquisitions was

$98 million. During 2002, the Company acquired a snacks business

in Turkey and a biscuits business in Australia. The total cost of these

and other smaller acquisitions was $122 million. During 2001, the

Company purchased coffee businesses in Romania, Morocco and

Bulgaria and also acquired confectionery businesses in Russia and

Poland. The total cost of these and other smaller acquisitions was

$194 million. The effects of these acquisitions were not material to

the Company’s consolidated financial position, results of operations

or cash flows in any of the periods presented.

During 2003, the Company sold a European rice business and a

branded fresh cheese business in Italy. The aggregate proceeds

received from sales of businesses were $96 million, on which the

Company recorded pre-tax gains of $31 million.

During 2002, the Company sold several small North American food

businesses, some of which were previously classified as businesses

held for sale. The net revenues and operating results of the

businesses held for sale, which were not significant, were excluded

from the Company’s consolidated statements of earnings, and

no gain or loss was recognized on these sales. In addition, the

Company sold its Latin American yeast and industrial bakery

ingredients business for $110 million and recorded a pre-tax gain

of $69 million. The aggregate proceeds received from sales of

businesses during 2002 were $219 million, on which the Company

recorded pre-tax gains of $80 million.

During 2001, the Company sold several small food businesses. The

aggregate proceeds received in these transactions were $21 million,

on which the Company recorded pre-tax gains of $8 million.

The operating results of the businesses sold were not material to the

Company’s consolidated financial position, results of operations or

cash flows in any of the periods presented.

In November 2003, the Company was advised by the Fort Worth

District Office of the Securities and Exchange Commission (“SEC”)

that the staff is considering recommending that the SEC bring a civil

injunctive action against the Company charging it with aiding and

abetting Fleming Companies (“Fleming”) in violations of the securities

laws. District staff alleges that a Company employee, who received a

similar “Wells” notice, signed documents requested by Fleming,

which Fleming used in order to accelerate its revenue recognition.

The notice does not contain any allegations or statements regarding

the Company’s accounting for transactions with Fleming. The

Company believes that it properly recorded the transactions in

accordance with U.S. GAAP. The Company has submitted a

response to the staff indicating why it believes that no enforcement

action should be brought against it. The Company has cooperated

fully with the SEC with respect to this matter and the SEC’s

investigation of Fleming.

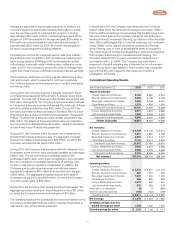

Consolidated Operating Results

(in millions, except per share data)

Year Ended December 31, 2003 2002 2001

Volume (in pounds):

Cheese, Meals and Enhancers 6,183 6,082 5,404

Biscuits, Snacks and Confectionery 2,083 2,185 2,165

Beverages, Desserts and Cereals 3,905 3,708 3,421

Oscar Mayer and Pizza 1,570 1,554 1,519

Total Kraft Foods North America 13,741 13,529 12,509

Europe, Middle East and Africa 2,971 2,961 2,826

Latin America and Asia Pacific 1,969 2,059 2,057

Total Kraft Foods International 4,940 5,020 4,883

Volume (in pounds) 18,681 18,549 17,392

Net revenues:

Cheese, Meals and Enhancers $9,439 $9,172 $ 9,014

Biscuits, Snacks and Confectionery 4,801 4,887 4,789

Beverages, Desserts and Cereals 4,567 4,412 4,237

Oscar Mayer and Pizza 3,100 3,014 2,930

Total Kraft Foods North America 21,907 21,485 20,970

Europe, Middle East and Africa 7,045 6,203 5,936

Latin America and Asia Pacific 2,058 2,035 2,328

Total Kraft Foods International 9,103 8,238 8,264

Net revenues $31,010 $29,723 $29,234

Operating income:

Operating companies income:

Cheese, Meals and Enhancers $2,230 $2,210 $ 2,132

Biscuits, Snacks and Confectionery 887 1,051 933

Beverages, Desserts and Cereals 1,247 1,136 1,192

Oscar Mayer and Pizza 556 556 539

Europe, Middle East and Africa 1,012 962 861

Latin America and Asia Pacific 270 368 378

Amortization of intangibles (9) (7) (962)

General corporate expenses (182) (162) (189)

Operating income $6,011 $6,114 $ 4,884

Net earnings $ 3,476 $3,394 $ 1,882

Weighted average shares for

diluted earnings per share 1,728 1,736 1,610

Diluted earnings per share $ 2.01 $1.96 $ 1.17