Kraft 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Kraft Foods Inc. Notes to Consolidated Financial Statements

Note 1. Background and Basis of Presentation:

Background: Kraft Foods Inc. (“Kraft”) was incorporated in 2000 in

the Commonwealth of Virginia. Kraft, through its subsidiaries (Kraft

and its subsidiaries are hereinafter referred to as the “Company”),

is engaged in the manufacture and sale of branded foods and

beverages in the United States, Canada, Europe, Latin America,

Asia Pacific and Middle East and Africa.

Prior to June 13, 2001, the Company was a wholly-owned subsidiary

of Altria Group, Inc. On June 13, 2001, the Company completed an

initial public offering (“IPO”) of 280,000,000 shares of its Class A

common stock at a price of $31.00 per share. The IPO proceeds, net

of the underwriting discount and expenses, of $8.4 billion were used

to retire a portion of an $11.0 billion long-term note payable to Altria

Group, Inc., incurred in connection with the acquisition of Nabisco

Holdings Corp. (“Nabisco”). After the IPO, Altria Group, Inc. owned

approximately 83.9% of the outstanding shares of the Company’s

capital stock through its ownership of 49.5% of the Company’s Class

A common stock and 100% of the Company’s Class B common

stock. The Company’s Class A common stock has one vote per

share, while the Company’s Class B common stock has ten votes

per share. At December 31, 2003, Altria Group, Inc. held 97.9% of

the combined voting power of the Company’s outstanding capital

stock and owned approximately 84.6% of the outstanding shares of

the Company’s capital stock.

Basis of presentation: The consolidated financial statements

include Kraft, as well as its wholly-owned and majority-owned

subsidiaries. Investments in which the Company exercises significant

influence (20%–50% ownership interest) are accounted for under the

equity method of accounting. Investments in which the Company

has an ownership interest of less than 20%, or does not exercise

significant influence, are accounted for with the cost method of

accounting. All intercompany transactions and balances between

and among Kraft’s subsidiaries have been eliminated. Transactions

between any of the Company’s businesses and Altria Group, Inc.

and its affiliates are included in these financial statements.

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of

America requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities, the

disclosure of contingent liabilities at the dates of the financial

statements and the reported amounts of net revenues and expenses

during the reporting periods. Significant estimates and assumptions

include, among other things, pension and benefit plan assumptions

and income taxes. Actual results could differ from those estimates.

The Company’s operating subsidiaries report year-end results as of

the Saturday closest to the end of each year.

Certain prior years’ amounts have been reclassified to conform with

the current year’s presentation, due primarily to the disclosure of

more detailed information on the consolidated balance sheets and

the consolidated statements of cash flows, as well as the transfer

of Canadian Biscuits and Pet Snacks from the Biscuits, Snacks

and Confectionery segment to the Cheese, Meals and Enhancers

segment, which contains the Company’s other Canadian businesses.

Note 2. Summary of Significant Accounting Policies:

Cash and cash equivalents:Cash equivalents include demand

deposits with banks and all highly liquid investments with original

maturities of three months or less.

Depreciation, amortization and goodwill valuation: Property,

plant and equipment are stated at historical cost and depreciated by

the straight-line method over the estimated useful lives of the assets.

Machinery and equipment are depreciated over periods ranging

from 3 to 20 years and buildings and building improvements over

periods up to 40 years.

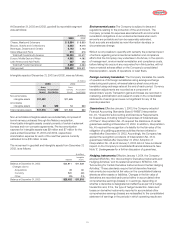

On January 1, 2002, the Company adopted Statement of Financial

Accounting Standards (“SFAS”) No. 141, “Business Combinations,”

and SFAS No. 142, “Goodwill and Other Intangible Assets.” As a

result, the Company stopped recording the amortization of goodwill

as a charge to earnings as of January 1, 2002. Net earnings and

diluted earnings per share (“EPS”) would have been as follows

had the provisions of the new standards been applied as of

January 1, 2001:

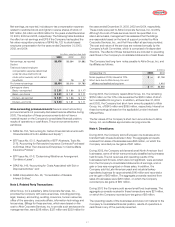

(in millions, except per share amounts)

For the year ended December 31, 20

Net earnings, as previously reported $1,882

Adjustment for amortization of goodwill 955

Net earnings, as adjusted 2,837

Diluted EPS, as previously reported $1.17

Adjustment for amortization of goodwill 0.59

Diluted EPS, as adjusted $1.76

In addition, the Company is required to conduct an annual review

of goodwill and intangible assets for potential impairment. Goodwill

impairment testing requires a comparison between the carrying

value and fair value of a reportable goodwill asset. If the carrying

value exceeds the fair value, goodwill is considered impaired. The

amount of impairment loss is measured as the difference between

the carrying value and implied fair value of goodwill, which is

determined using discounted cash flows. Impairment testing for

non-amortizable intangible assets requires a comparison between

fair value and carrying value of the intangible asset. If the carrying

value exceeds fair value, the intangible asset is considered impaired

and is reduced to fair value. In 2003, the Company did not have to

record a charge to earnings for an impairment of goodwill or other

intangible assets as a result of its annual review.