Kraft 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

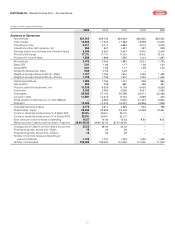

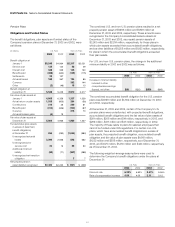

47

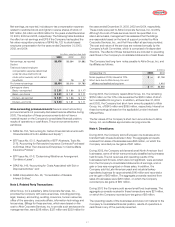

Net earnings, as reported, includes pre-tax compensation expense

related to restricted stock and rights to receive shares of stock of

$57 million, $4 million and $39 million for the years ended December

31, 2003, 2002 and 2001, respectively. The following table illustrates

the effect on net earnings and EPS if the Company had applied the

fair value recognition provisions of SFAS No. 123 to stock-based

employee compensation for the years ended December 31, 2003,

2002, and 2001:

(in millions, except per share data)

2003 2002 2001

Net earnings, as reported $3,476 $3,394 $1,882

Deduct:

Total stock-based employee

compensation expense determined

under fair value method for all

stock option awards, net of related

tax effects 12 78 97

Pro forma net earnings $3,464 $3,316 $1,785

Earnings per share:

Basic—as reported $2.01 $1.96 $ 1.17

Basic—pro forma $2.01 $1.91 $ 1.11

Diluted—as reported $2.01 $1.96 $ 1.17

Diluted—pro forma $2.00 $1.91 $ 1.11

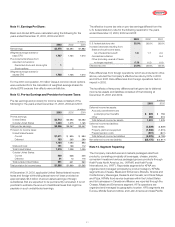

New accounting pronouncements: Several recent accounting

pronouncements not previously discussed became effective during

2003. The adoption of these pronouncements did not have a

material impact on the Company’s consolidated financial position,

results of operations or cash flows. The pronouncements were

as follows:

•SFAS No. 150, “Accounting for Certain Financial Instruments with

Characteristics of both Liabilities and Equity”;

•EITF Issue No. 03-3, “Applicability of EITF Abstracts, Topic No.

D-79, ‘Accounting for Retroactive Insurance Contracts Purchased

by Entities Other Than Insurance Enterprises,’ to Claims-Made

Insurance Policies”;

•EITF Issue No. 01-8, “Determining Whether an Arrangement

Contains a Lease”;

•SFAS No. 146, “Accounting for Costs Associated with Exit or

Disposal Activities”; and

•FASB Interpretation No. 46, “Consolidation of Variable

Interest Entities.”

Note 3. Related Party Transactions:

Altria Group, Inc.’s subsidiary, Altria Corporate Services, Inc.,

provides the Company with various services, including planning,

legal, treasury, accounting, auditing, insurance, human resources,

office of the secretary, corporate affairs, information technology and

tax services. Billings for these services, which were based on the

cost to Altria Corporate Services, Inc. to provide such services and a

management fee, were $318 million, $327 million and $339 million for

the years ended December 31, 2003, 2002 and 2001, respectively.

These costs were paid to Altria Corporate Services, Inc. monthly.

Although the cost of these services cannot be quantified on a

stand-alone basis, management has assessed that the billings

are reasonable based on the level of support provided by Altria

Corporate Services, Inc., and that they reflect all services provided.

The cost and nature of the services are reviewed annually by the

Company’s Audit Committee, which is comprised of independent

directors. The effects of these transactions are included in operating

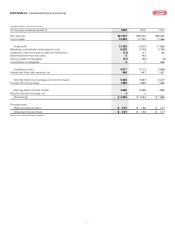

cash flows in the Company’s consolidated statements of cash flows.

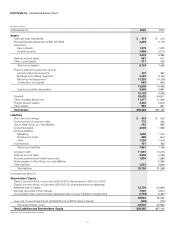

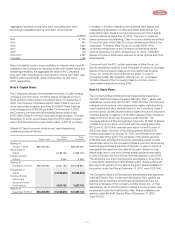

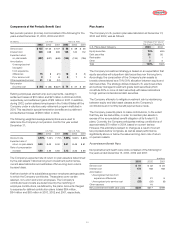

The Company had long-term notes payable to Altria Group, Inc. and

its affiliates as follows:

(in millions)

At December 31, 2003 2002

Notes payable in 2009, interest at 7.0% $— $1,150

Short-term due to Altria Group, Inc. and

affiliates reclassified as long-term 1,410

$— $2,560

During 2003, the Company repaid Altria Group, Inc. the remaining

$1,150 million on the 7.0% note as well as the $1,410 million of short-

term reclassified to long-term. In addition, at December 31, 2003

and 2002, the Company had short-term amounts payable to Altria

Group, Inc. of $543 million and $895 million, respectively. Interest on

these borrowings is based on the applicable London Interbank

Offered Rate.

The fair values of the Company’s short-term amounts due to Altria

Group, Inc. and affiliates approximate carrying amounts.

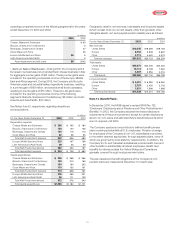

Note 4. Divestitures:

During 2003, the Company sold a European rice business and a

branded fresh cheese business in Italy. The aggregate proceeds

received from sales of businesses were $96 million, on which the

Company recorded pre-tax gains of $31 million.

During 2002, the Company sold several small North American food

businesses, some of which were previously classified as businesses

held for sale. The net revenues and operating results of the

businesses held for sale, which were not significant, were excluded

from the Company’s consolidated statements of earnings, and no

gain or loss was recognized on these sales. In addition, the

Company sold its Latin American yeast and industrial bakery

ingredients business for approximately $110 million and recorded a

pre-tax gain of $69 million. The aggregate proceeds received from

sales of businesses were $219 million, on which the Company

recorded pre-tax gains of $80 million.

During 2001, the Company sold several small food businesses. The

aggregate proceeds received in these transactions were $21 million,

on which the Company recorded pre-tax gains of $8 million.

The operating results of the businesses sold were not material to the

Company’s consolidated financial position, results of operations or

cash flows in any of the periods presented.