Kraft 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

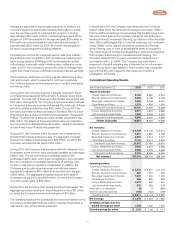

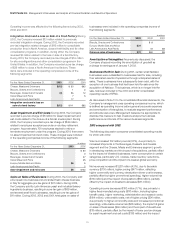

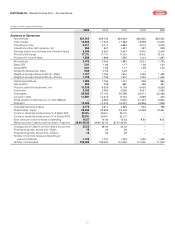

Kraft Foods Inc. Management’s Discussion and Analysis of Financial Condition and Results of Operations

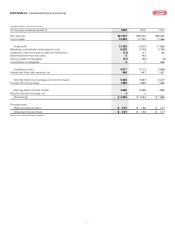

During 2003, 2002 and 2001, net cash used in investing activities

was $1.0 billion, $1.1 billion and $1.2 billion, respectively. The

decrease in 2003 primarily reflected lower capital expenditures

and lower purchases of businesses, partially offset by the reduction

in the cash received from the sales of businesses. The decrease

in 2002 primarily reflected lower purchases of businesses and

an increase in the cash received from the sales of businesses,

partially offset by higher capital expenditures related to the

integration of Nabisco.

Capital expenditures, which were funded by operating activities,

were $1.1 billion, $1.2 billion and $1.1 billion in 2003, 2002 and 2001,

respectively. The capital expenditures were primarily to modernize

manufacturing facilities, lower cost of production and expand

production capacity for growing product lines. In 2004, capital

expenditures are currently expected to be at or slightly above

2003 expenditures, including capital expenditures required for

the restructuring program announced in January 2004. These

expenditures are expected to be funded from operations.

Net Cash Used in Financing Activities

During 2003, net cash of $2.8 billion was used in financing activities,

compared with $2.6 billion during 2002. The increase in cash used in

2003 was due primarily to an increase in the Company’s Class A

share repurchases and an increase in dividend payments, partially

offset by a decrease in net debt repayments in 2003 (including

amounts due to Altria Group, Inc. and affiliates). During 2003, the

Company issued $1.5 billion of third-party long-term debt, the net

proceeds of which were used to repay outstanding related party

indebtedness. Financing activities included net debt repayments

of approximately $1.4 billion in 2003.

During 2002, net cash of $2.6 billion was used in financing activities,

compared with $2.1 billion during 2001. The increase in cash used

was due primarily to dividends paid during 2002 and repurchases of

the Company’s Class A common stock. During 2002, Kraft issued

$2.5 billion of global bonds and $750 million of floating rate notes,

the net proceeds of which were used to repay outstanding related

party indebtedness. Financing activities included net debt

repayments of approximately $1.5 billion in 2002.

Debt and Liquidity

Financial Reporting Release No. 61 sets forth the views of the

Securities and Exchange Commission (“SEC”) regarding enhanced

disclosures relating to liquidity and capital resources. The

information provided below about the Company’s debt, credit

facilities, guarantees and future commitments is included here to

facilitate a review of the Company’s liquidity.

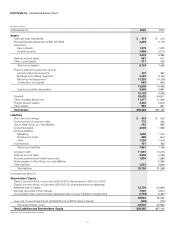

Debt: The Company’s total debt, including amounts due to Altria

Group, Inc. and affiliates, was $13.5 billion at December 31, 2003

and $14.4 billion at December 31, 2002. The decrease in total debt is

due primarily to the repayment of amounts due to Altria Group, Inc.

and affiliates, partially offset by an increase in third-party borrowings.

The Company’s debt-to-equity ratio was 0.47 at December 31, 2003

and 0.56 at December 31, 2002.

During 2003, the Company repaid the remaining $1,150 million of the

7.0% long-term notes payable to Altria Group, Inc. and affiliates, as

well as the $1,410 million of short-term borrowings reclassified to

long-term. In September 2003, Kraft issued $1.5 billion of third-party

long-term debt, including $700 million of 5-year notes bearing

interest at a rate of 4.0% and $800 million of 10-year notes bearing

interest at 5.25%. The net proceeds from the offering were used

to repay outstanding related party indebtedness. At December 31,

2003 and 2002, the Company had short-term amounts payable

to Altria Group, Inc. of $543 million and $895 million, respectively.

Interest on these borrowings is based on the applicable London

Interbank Offered Rate.

Credit Ratings: Following a $10.1 billion judgment on March 21,

2003 against Altria Group, Inc.’s domestic tobacco subsidiary,

Philip Morris USA Inc., the three major credit rating agencies took a

series of ratings actions resulting in the lowering of the Company’s

short-term and long-term debt ratings, despite the fact the

Company is neither a party to, nor has exposure to, this litigation.

Moody’s lowered the Company’s short-term debt rating from “P-1”

to “P-2” and its long-term debt rating from “A2” to “A3,” with stable

outlook. Standard & Poor’s lowered the Company’s short-term debt

rating from “A-1” to “A-2” and its long-term debt rating from “A-” to

“BBB+,” with stable outlook. Fitch Rating Services lowered the

Company’s short-term debt rating from “F-1” to “F-2” and its long-

term debt rating from “A” to “BBB+,” with stable outlook. As a result

of the credit rating agencies’ actions, the Company temporarily

lost access to the commercial paper market, and borrowing costs

increased. None of the Company’s debt agreements requires

accelerated repayment in the event of a decrease in credit ratings.

Credit Lines: The Company maintains revolving credit facilities that

have historically been used to support the issuance of commercial

paper. At December 31, 2003, credit lines for the Company and the

related activity were as follows:

(in billions of dollars)

Commercial

Credit Amount Paper

Type Lines Drawn Outstanding

364-day (expires July 2004) $2.5 $ — $0.3

Multi-year (expires July 2006) 2.0 1.9

$4.5 $ — $2.2

34