Kraft 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

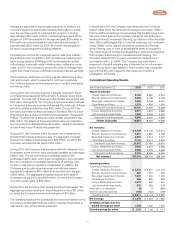

from integration costs and a loss on sale of a food factory ($124 mil-

lion) and favorable currency ($94 million). The higher benefit costs

were primarily related to pension and stock compensation costs.

Currency movements increased net revenues by $730 million and

operating income by $94 million. These increases were due primarily

to the further weakening of the U.S. dollar against the euro, the

Canadian dollar and other currencies, partially offset by the strength

of the U.S. dollar against certain Latin American currencies.

Interest and other debt expense, net, decreased $182 million. This

decrease is due to the Company’s refinancing of notes payable to

Altria Group, Inc. and the use of free cash flow to pay down debt.

The Company’s reported effective tax rate decreased by 0.6

percentage points to 34.9%, due primarily to rate differences from

foreign operations.

Net earnings of $3,476 million increased $82 million (2.4%), due

primarily to lower interest expense and a lower effective tax rate,

partially offset by lower operating income. Diluted and basic earnings

per share (“EPS”), which were both $2.01, increased by 2.6%.

2002 compared with 2001

The following discussion compares consolidated operating results

for 2002 with 2001.

Volume increased 1,157 million pounds (6.7%), due primarily to the

inclusion in 2002 of a business previously considered held for sale,

new product introductions, geographic expansion and acquisitions.

Net revenues increased $489 million (1.7%), due primarily to higher

volume/mix ($401 million), the inclusion in 2002 of a business

previously considered held for sale ($252 million) and the impact of

acquisitions ($191 million), partially offset by the adverse effect of

currency exchange rates ($291 million) and lower sales prices on

cheese and coffee products (driven by commodity-related declines).

Operating income increased $1,230 million (25.2%), due primarily

to the elimination of substantially all goodwill amortization, volume

growth and favorable margins.

Currency movements decreased net revenues by $291 million and

operating income by $4 million. These decreases in net revenues

and operating income were due primarily to the strength of the

U.S. dollar against certain Latin American currencies, partially

offset by the weakness of the U.S. dollar against the euro and

other currencies.

Interest and other debt expense, net, decreased $590 million. This

decrease was due primarily to lower debt levels after the repayment

of Nabisco acquisition borrowings with the proceeds from the

Company’s IPO, as well as the Company’s refinancing of notes

payable to Altria Group, Inc. and lower short-term interest rates.

The Company’s effective tax rate decreased by 9.9 percentage

points to 35.5%, due primarily to the adoption of SFAS No. 141 and

SFAS No. 142, under which the Company is no longer required to

amortize goodwill as a charge to earnings.

Net earnings of $3,394 million increased $1,512 million (80.3%), due

primarily to growth in operating income and lower interest expense.

Diluted and basic EPS, which were both $1.96, increased by 67.5%.

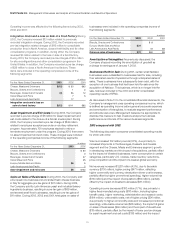

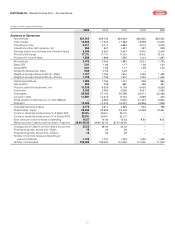

Operating Results by Reportable Segment

Kraft Foods North America

(in millions)

For the Years Ended December 31, 2003 2002 2001

Volume (in pounds):

Cheese, Meals and Enhancers 6,183 6,082 5,404

Biscuits, Snacks and Confectionery 2,083 2,185 2,165

Beverages, Desserts and Cereals 3,905 3,708 3,421

Oscar Mayer and Pizza 1,570 1,554 1,519

Volume (in pounds) 13,741 13,529 12,509

Net revenues:

Cheese, Meals and Enhancers $9,439 $9,172 $ 9,014

Biscuits, Snacks and Confectionery 4,801 4,887 4,789

Beverages, Desserts and Cereals 4,567 4,412 4,237

Oscar Mayer and Pizza 3,100 3,014 2,930

Net revenues $21,907 $21,485 $20,970

Operating companies income:

Cheese, Meals and Enhancers $2,230 $2,210 $ 2,132

Biscuits, Snacks and Confectionery 887 1,051 933

Beverages, Desserts and Cereals 1,247 1,136 1,192

Oscar Mayer and Pizza 556 556 539

Operating companies income $ 4,920 $4,953 $ 4,796

2003 compared with 2002

The following discussion compares KFNA’s operating results for

2003 with 2002.

During the first quarter of 2003, the Company transferred

management responsibility of its Canadian Biscuits and Pet Snacks

operations from the Biscuits, Snacks and Confectionery segment to

the Cheese, Meals and Enhancers segment, which contains the

Company’s other Canadian businesses. Accordingly, all prior period

amounts have been reclassified to reflect the transfer.

Volume increased 1.6%, due primarily to contributions from new

products and increased shipments in the Beverages, Desserts and

Cereals segment and the Cheese, Meals and Enhancers segment,

partially offset by the divestiture of a small confectionery business in

2002, consumption weakness in certain categories, primarily

cookies, and trade inventory reductions.

29