Kraft 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Kraft Foods Inc. Notes to Consolidated Financial Statements

The Company’s management uses operating companies income,

which is defined as operating income before general corporate

expenses and amortization of intangibles, to evaluate segment

performance and allocate resources. Interest and other debt

expense, net, and provision for income taxes are centrally managed

and, accordingly, such items are not presented by segment since

they are not included in the measure of segment profitability

reviewed by management. The Company’s assets, which are

principally in the United States and Europe, are managed

geographically. The accounting policies of the segments are the

same as those described in Note 2. Summary of Significant

Accounting Policies.

During the first quarter of 2003, the Company transferred

management responsibility of its Canadian Biscuits and Pet Snacks

operations from the Biscuits, Snacks and Confectionery segment to

the Cheese, Meals and Enhancers segment, which contains the

Company’s other Canadian businesses. Accordingly, all prior period

amounts have been reclassified to reflect the transfer. During

January 2004, the Company announced a new global organizational

structure, which will result in new segments for financial reporting

purposes. Beginning in 2004, the Company’s new segments will be

U.S. Beverages & Grocery; U.S. Snacks; U.S. Cheese, Canada &

North America Foodservice; U.S. Convenient Meals; Europe, Middle

East and Africa; and Latin America and Asia Pacific.

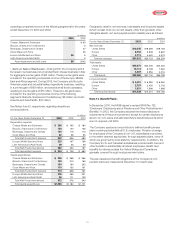

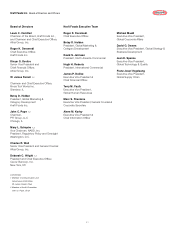

Segment data were as follows:

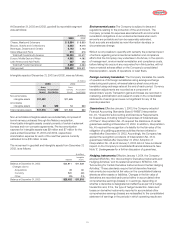

(in millions)

For the Years Ended December 31, 2003 2002 2001

Net revenues:

Cheese, Meals and Enhancers $9,439 $9,172 $ 9,014

Biscuits, Snacks and Confectionery 4,801 4,887 4,789

Beverages, Desserts and Cereals 4,567 4,412 4,237

Oscar Mayer and Pizza 3,100 3,014 2,930

Total Kraft Foods North America 21,907 21,485 20,970

Europe, Middle East and Africa 7,045 6,203 5,936

Latin America and Asia Pacific 2,058 2,035 2,328

Total Kraft Foods International 9,103 8,238 8,264

Net revenues $31,010 $29,723 $29,234

Earnings before income taxes and

minority interest:

Operating companies income:

Kraft Foods North America:

Cheese, Meals and Enhancers $2,230 $2,210 $2,132

Biscuits, Snacks and Confectionery 887 1,051 933

Beverages, Desserts and Cereals 1,247 1,136 1,192

Oscar Mayer and Pizza 556 556 539

Kraft Foods International:

Europe, Middle East and Africa 1,012 962 861

Latin America and Asia Pacific 270 368 378

Amortization of intangibles (9) (7) (962)

General corporate expenses (182) (162) (189)

Operating income 6,011 6,114 4,884

Interest and other debt expense, net (665) (847) (1,437)

Earnings before income taxes and

minority interest $5,346 $5,267 $ 3,447

The Company’s largest customer, Wal-Mart Stores, Inc. and its

affiliates, accounted for approximately 12%, 12% and 11% of

consolidated net revenues for 2003, 2002 and 2001, respectively.

These net revenues occurred primarily in the United States and were

across all segments.

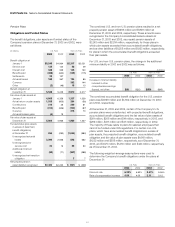

As previously noted, the Company’s international operations are

managed by geographic location. Within its two geographic regions,

KFI’s brand portfolio spans five core consumer sectors. Net

revenues by consumer sector for KFI were as follows:

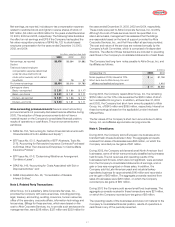

Consumer Sector

(in millions)

For the Years Ended December 31, 2003 2002 2001

Snacks $3,622 $3,179 $3,077

Beverages 3,124 2,832 2,900

Cheese 1,302 1,202 1,208

Grocery 741 752 826

Convenient Meals 314 273 253

Total $9,103 $8,238 $8,264

Items affecting the comparability of the Company’s results were

as follows:

• Integration Costs and a Loss on Sale of a Food Factory—During

2003, the Company reversed $13 million related to the previously

recorded integration charges. During 2002, the Company recorded

pre-tax integration-related charges of $115 million to consolidate

production lines in North America, close a Kraft facility and for other

consolidation programs. In addition, during 2002, the Company

reversed $4 million related to the loss on sale of a food factory.

During 2001, the Company recorded pre-tax charges of $53 million

for site reconfigurations and other consolidation programs in the

United States. In addition, the Company recorded a pre-tax charge

of $29 million to close a North American food factory. These items

were included in the operating companies income of the

following segments:

(in millions)

For the Years Ended December 31, 2003 2002 2001

Cheese, Meals and Enhancers $(10) $30 $63

Biscuits, Snacks and Confectionery 12

Beverages, Desserts and Cereals (3) 56 12

Oscar Mayer and Pizza 75

Latin America and Asia Pacific 17

Integration costs and a loss

on sale of a food factory $(13) $111 $82

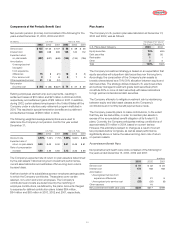

• Asset Impairment and Exit Costs—During 2003, the Company

recorded a pre-tax charge of $6 million for asset impairment and exit

costs related to the closure of a Nordic snacks plant. During 2002,

the Company recorded a pre-tax charge of $142 million related to

employee acceptances under a voluntary retirement program.

Approximately 700 employees elected to retire or terminate

employment under the program. These charges were included in the