Kraft 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Kraft Foods Inc. Notes to Consolidated Financial Statements

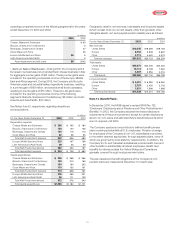

During 2002, certain salaried employees in the United States left the

Company under a voluntary early retirement program instituted in

2001. This resulted in curtailment losses of $16 million in 2002, which

are included in other expense, above.

In December 2003, the United States enacted into law the Medicare

Prescription Drug, Improvement and Modernization Act of 2003

(the “Act”). The Act establishes a prescription drug benefit under

Medicare, known as “Medicare Part D,” and a federal subsidy to

sponsors of retiree health care benefit plans that provide a benefit

that is at least actuarially equivalent to Medicare Part D.

In January 2004, the FASB issued FASB Staff Position No. 106-1,

“A ccounting and Disclosure Requirements Related to the Medicare

Prescription Drug, Improvement and Modernization Act of 2003”

(“FSP 106-1”). The Company has elected to defer accounting for

the effects of the Act, as permitted by FSP 106-1. Therefore, in

accordance with FSP 106-1, the Company’s accumulated

postretirement benefit obligation and net postretirement health

care costs included in the consolidated financial statements and

accompanying notes do not reflect the effects of the Act on the

plans. Specific authoritative guidance on the accounting for the

federal subsidy is pending, and that guidance, when issued, could

require the Company to change previously reported information.

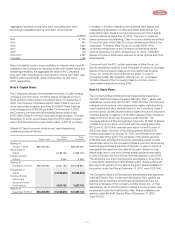

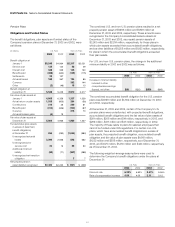

The following weighted-average assumptions were used to

determine the Company’s net postretirement cost for the years

ended December 31:

U.S. Plans Canadian Plans

2003 2002 2001 2003 2002 2001

Discount rate 6.50% 7.00% 7.75% 6.75% 6.75% 7.00%

Health care cost

trend rate 8.00 6.20 6.80 7.00 8.00 9.00

The Company’s postretirement health care plans are not funded.

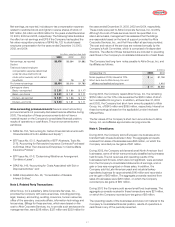

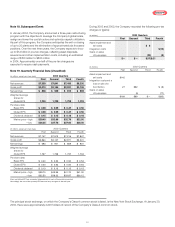

The changes in the accumulated benefit obligation and net amount

accrued at December 31, 2003 and 2002, were as follows:

(in millions)

2003 2002

Accumulated postretirement benefit obligation

at January 1 $2,712 $2,436

Service cost 41 32

Interest cost 173 168

Benefits paid (189) (199)

Curtailments 21

Plan amendments (28) (164)

Currency 18

Assumption changes 174 193

Actuarial losses 54 225

Accumulated postretirement benefit obligation

at December 31 2,955 2,712

Unrecognized actuarial losses (1,064) (848)

Unrecognized prior service cost 202 197

Accrued postretirement health care costs $2,093 $2,061

The current portion of the Company’s accrued postretirement health

care costs of $199 million and $172 million at December 31, 2003 and

2002, respectively, are included in other accrued liabilities on the

consolidated balance sheets.

The following weighted-average assumptions were used to

determine the Company’s postretirement benefit obligations at

December 31:

U.S. Plans Canadian Plans

2003 2002 2003 2002

Discount rate 6.25% 6.50% 6.50% 6.75%

Health care cost trend rate

assumed for next year 10.00 8.00 8.00 7.00

Ultimate trend rate 5.00 5.00 5.00 4.00

Year that the rate reaches

the ultimate trend rate 2006 2006 2010 2006

Assumed health care cost trend rates have a significant effect on the

amounts reported for the health care plans. A one-percentage-point

change in assumed health care cost trend rates would have the

following effects as of December 31, 2003:

One-Percentage- One-Percentage-

Point Increase Point Decrease

Effect on total of service and

interest cost 14.0% (11.2)%

Effect on postretirement

benefit obligation 10.2 (8.5)

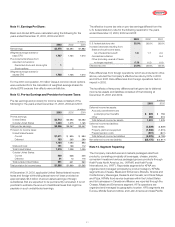

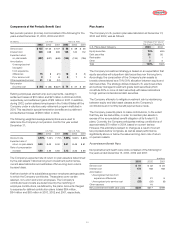

Postemployment Benefit Plans

Kraft and certain of its affiliates sponsor postemployment benefit

plans covering substantially all salaried and certain hourly

employees. The cost of these plans is charged to expense over the

working lives of the covered employees. Net postemployment costs

consisted of the following for the years ended December 31, 2003,

2002 and 2001:

(in millions)

2003 2002 2001

Service cost $10 $19 $20

Amortization of unrecognized net gains (5) (7) (8)

Other expense 123

Net postemployment costs $6 $35 $12

During 2002, certain salaried employees in the United States left the

Company under voluntary early retirement and integration programs.

These programs resulted in incremental postemployment costs of

$23 million, which are included in other expense, above.