Kraft 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Operating income was affected by the following items during 2003,

2002 and 2001:

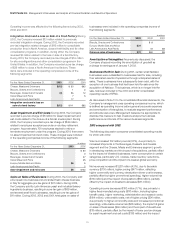

Integration Costs and a Loss on Sale of a Food Factory: During

2003, the Company reversed $13 million related to previously

recorded integration charges. During 2002, the Company recorded

pre-tax integration related charges of $115 million to consolidate

production lines in North America, close a Kraft facility and for other

consolidation programs. In addition, during 2002, the Company

reversed $4 million related to the loss on sale of a food factory.

During 2001, the Company recorded pre-tax charges of $53 million

for site reconfigurations and other consolidation programs in the

United States. In addition, the Company recorded a pre-tax charge

of $29 million to close a North American food factory. These

items were included in the operating companies income of the

following segments:

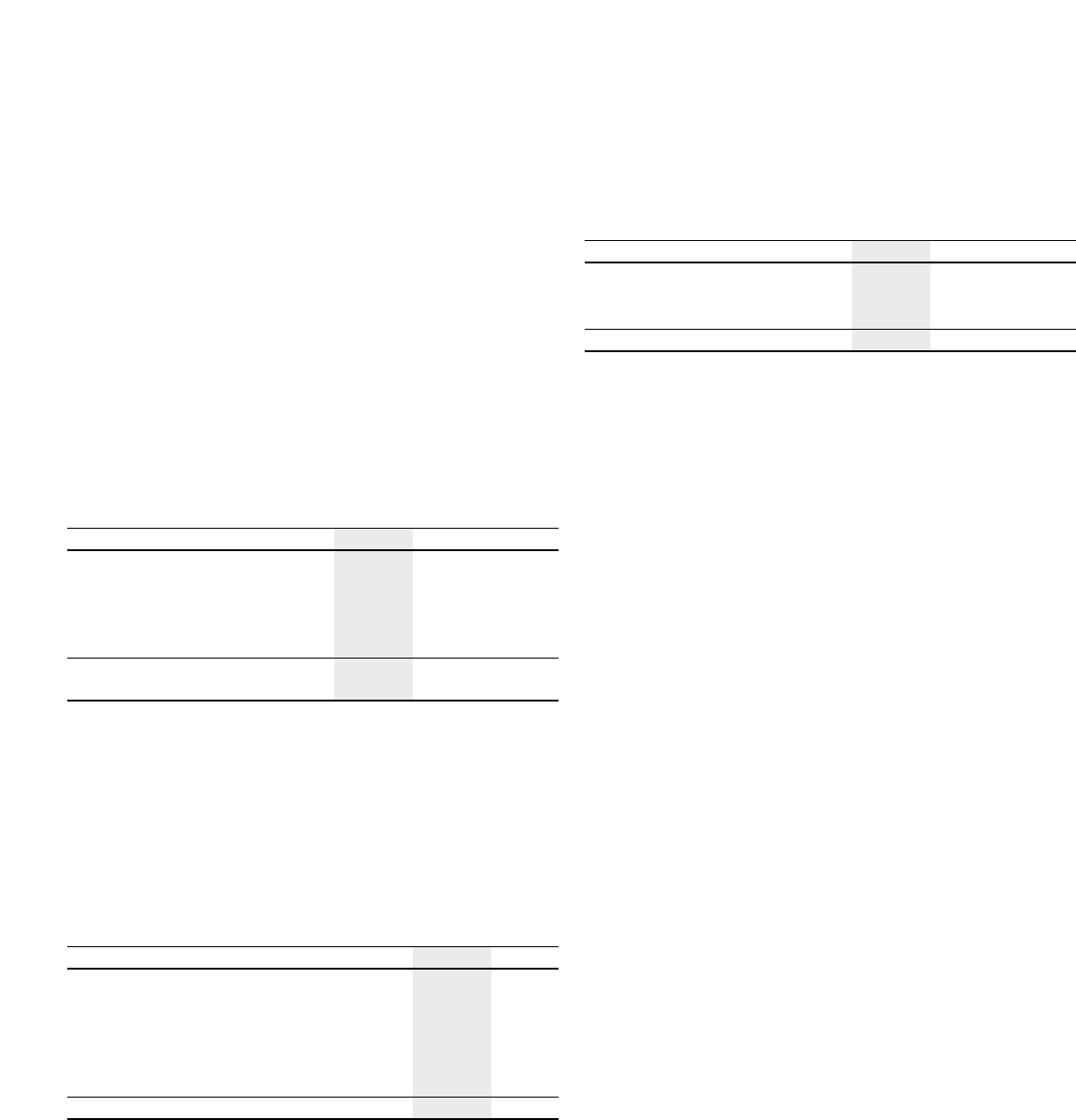

(in millions)

For the Years Ended December 31, 2003 2002 2001

Cheese, Meals and Enhancers $(10) $30 $63

Biscuits, Snacks and Confectionery 12

Beverages, Desserts and Cereals (3) 56 12

Oscar Mayer and Pizza 75

Latin America and Asia Pacific 17

Integration costs and a loss on

sale of a food factory $(13) $111 $82

Asset Impairment and Exit Costs: During 2003, the Company

recorded a pre-tax charge of $6 million for asset impairment and

exit costs related to the closure of a Nordic snacks plant. During

2002, the Company recorded a pre-tax charge of $142 million

related to employee acceptances under a voluntary retirement

program. Approximately 700 employees elected to retire or

terminate employment under the program. During 2001, there were

no asset impairment and exit costs. These charges were included

in the operating companies income of the following segments:

(in millions)

For the Years Ended December 31, 2003 2002

Cheese, Meals and Enhancers $60

Biscuits, Snacks and Confectionery 3

Beverages, Desserts and Cereals 47

Oscar Mayer and Pizza 25

Europe, Middle East and Africa $6 5

Latin America and Asia Pacific 2

Asset impairment and exit costs $6 $142

Gains on Sales of Businesses: During 2003, the Company sold

aEuropean rice business and a branded fresh cheese business

in Italy for aggregate pre-tax gains of $31 million. During 2002,

the Company sold its Latin American yeast and industrial bakery

ingredients business, resulting in a pre-tax gain of $69 million,

and several small food businesses, resulting in pre-tax gains of

$11 million. During 2003, 2002 and 2001, total gains on sales of

businesses were included in the operating companies income of

the following segments:

(in millions)

For the Years Ended December 31, 2003 2002 2001

Biscuits, Snacks and Confectionery $8

Europe, Middle East and Africa $31

Latin America and Asia Pacific 72 $8

Gains on sales of businesses $31 $80 $8

Amortization of Intangibles: As previously discussed, the

Company stopped recording the amortization of goodwill as

acharge to earnings as of January 1, 2002.

Businesses Held for Sale: During 2001, certain small Nabisco

businesses were reclassified to businesses held for sale, including

their estimated results of operations through anticipated dates of

sales. These businesses have subsequently been sold, with the

exception of one business that had been held for sale since the

acquisition of Nabisco. This business, which is no longer held for

sale, has been included in the 2003 and 2002 consolidated

operating results of KFNA.

As discussed in Note 13 to the consolidated financial statements, the

Company’s management uses operating companies income, which

is defined as operating income before general corporate expenses

and amortization of intangibles, to evaluate segment performance

and allocate resources. Management believes it is appropriate to

disclose this measure to help investors analyze the business

performance and trends of the various business segments.

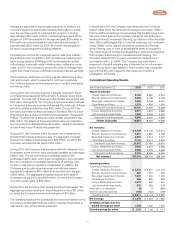

2003 compared with 2002

The following discussion compares consolidated operating results

for 2003 with 2002.

Volume increased 132 million pounds (0.7%), due primarily to

increased shipments in the Beverages, Desserts and Cereals

segment and the Cheese, Meals and Enhancers segment, growth

in developing markets and the impact of acquisitions, partially offset

by the impact of divested businesses, lower consumption in certain

categories, particularly U.S. cookies, trade inventory reductions,

price competition and the impact of a weaker global economy.

Net revenues increased $1,287 million (4.3%), due to favorable

currency ($730 million), higher pricing ($471 million, reflecting

higher commodity and currency devaluation-driven cost increases,

partially offset by higher promotional spending), higher volume/mix

($114 million) and the impact of acquisitions ($59 million), partially

offset by the impact of divested businesses ($87 million).

Operating income decreased $103 million (1.7%), due primarily to

higher fixed manufacturing costs ($110 million, including higher

benefit costs), higher marketing, administration and research costs

($104 million), unfavorable costs, net of higher pricing ($94 million,

due primarily to higher commodity costs and increased promotional

spending), unfavorable volume/mix ($66 million), the impact of gains

on sales of businesses ($49 million) and the impact of divestitures

($18 million), partially offset by the impact of lower pre-tax charges

for asset impairment and exit costs ($136 million) and the impact

28