Kraft 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

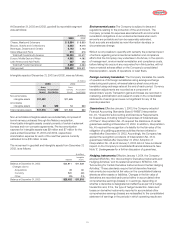

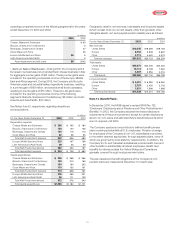

operating companies income of the following segments for the years

ended December 31, 2003 and 2002:

(in millions)

2003 2002

Cheese, Meals and Enhancers $60

Biscuits, Snacks and Confectionery 3

Beverages, Desserts and Cereals 47

Oscar Mayer and Pizza 25

Europe, Middle East and Africa $6 5

Latin America and Asia Pacific 2

Asset impairment and exit costs $6 $142

• Gains on Sales of Businesses—During 2003, the Company sold a

European rice business and a branded fresh cheese business in Italy

for aggregate pre-tax gains of $31 million. These pre-tax gains were

included in the operating companies income of the Europe, Middle

East and Africa segment. During 2002, the Company sold its Latin

American yeast and industrial bakery ingredients business, resulting

in a pre-tax gain of $69 million, and several small food businesses,

resulting in pre-tax gains of $11 million. These pre-tax gains were

included in the operating companies income of the following

segments: Biscuits, Snacks and Confectionery, $8 million; and Latin

America and Asia Pacific, $72 million.

See Notes 4 and 5, respectively, regarding divestitures

and acquisitions.

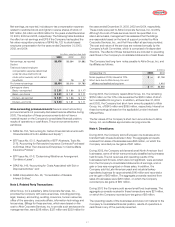

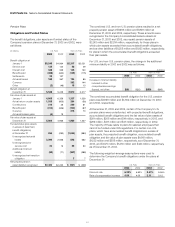

(in millions)

For the Years Ended December 31, 2003 2002 2001

Depreciation expense:

Cheese, Meals and Enhancers $206 $193 $ 180

Biscuits, Snacks and Confectionery 150 140 135

Beverages, Desserts and Cereals 124 115 113

Oscar Mayer and Pizza 62 58 55

Total Kraft Foods North America 542 506 483

Europe, Middle East and Africa 223 167 158

Latin America and Asia Pacific 39 36 39

Total Kraft Foods International 262 203 197

Total depreciation expense $804 $709 $ 680

Capital expenditures:

Cheese, Meals and Enhancers $226 $268 $ 266

Biscuits, Snacks and Confectionery 193 213 162

Beverages, Desserts and Cereals 184 194 202

Oscar Mayer and Pizza 110 133 131

Total Kraft Foods North America 713 808 761

Europe, Middle East and Africa 276 265 231

Latin America and Asia Pacific 96 111 109

Total Kraft Foods International 372 376 340

Total capital expenditures $1,085 $1,184 $1,101

Geographic data for net revenues, total assets and long-lived assets

(which consist of all non-current assets, other than goodwill, other

intangible assets, net, and prepaid pension assets) were as follows:

(in millions)

For the Years Ended December 31, 2003 2002 2001

Net revenues:

United States $19,545 $19,395 $19,193

Europe 6,752 5,908 5,667

Other 4,713 4,420 4,374

Total net revenues $31,010 $29,723 $29,234

Total assets:

United States $44,674 $44,406 $44,420

Europe 10,114 8,738 7,362

Other 4,497 3,956 4,016

Total assets $59,285 $57,100 $55,798

Long-lived assets:

United States $6,451 $6,382 $ 6,360

Europe 2,757 2,432 2,132

Other 1,831 1,596 1,668

Total long-lived assets $11,039 $10,410 $10,160

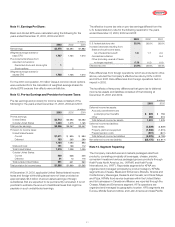

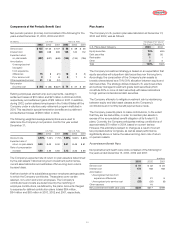

Note 14. Benefit Plans:

In December 2003, the FASB issued a revised SFAS No. 132,

“Employers’ Disclosures about Pensions and Other Postretirement

Benefits.” In 2003, the Company adopted the revised disclosure

requirements of this pronouncement, except for certain disclosures

about non-U.S. plans and estimated future benefit payments which

are not required until 2004.

The Company sponsors noncontributory defined benefit pension

plans covering substantially all U.S. employees. Pension coverage

for employees of the Company’s non-U.S. subsidiaries is provided,

to the extent deemed appropriate, through separate plans, many of

which are governed by local statutory requirements. In addition, the

Company’s U.S. and Canadian subsidiaries provide health care and

other benefits to substantially all retired employees. Health care

benefits for retirees outside the United States and Canada are

generally covered through local government plans.

The plan assets and benefit obligations of the Company’s U.S.

pension plans are measured at December 31 of each year.