JetBlue Airlines 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

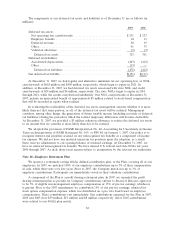

event that caused the environmental damage. In the case of fuel consortia at airports, these

indemnities are generally joint and several among the participating airlines. We have purchased a

stand alone environmental liability insurance policy to help mitigate this exposure. Our existing

aviation hull and liability policy includes some limited environmental coverage when a clean up is part

of an associated single identifiable covered loss.

Under certain contracts, we indemnify specified parties against legal liability arising out of actions

by other parties. The terms of these contracts range up to 30 years. Generally, we have liability

insurance protecting ourselves for the obligations we have undertaken relative to these indemnities.

LiveTV provides product warranties to third party airlines to which it sells its products and

services. We do not accrue a liability for product warranties upon sale of the hardware since revenue

is recognized over the term of the related service agreements of up to 13 years. Expenses for warranty

repairs are recognized as they occur. In addition, LiveTV has provided indemnities against any claims

which may be brought against its customers related to allegations of patent, trademark, copyright or

license infringement as a result of the use of the LiveTV system.

We are unable to estimate the potential amount of future payments under the foregoing

indemnities and agreements.

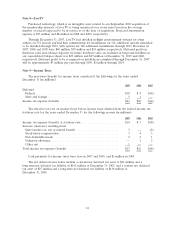

Note 13—Financial Instruments and Risk Management

We maintain cash and cash equivalents with various high quality financial institutions or in

short-term duration high quality debt securities. Investments in highly liquid debt securities are stated

at fair value, which approximates cost. The majority of our receivables result from the sale of tickets

to individuals, mostly through the use of major credit cards. These receivables are short-term,

generally being settled shortly after the sale.

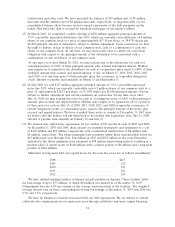

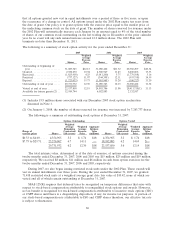

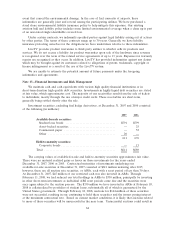

Investment securities, excluding fuel hedge derivatives, at December 31, 2007 and 2006 consisted

of the following (in millions):

2007 2006

Available-for-sale securities:

Student loan bonds ................................... $591 $599

Asset-backed securities................................. — 25

Commerical paper .................................... — 52

Other ............................................... 20 —

611 676

Held-to-maturity securities:

Corporate bonds ...................................... — 13

Total .................................................. $611 $689

The carrying values of available-for-sale and held-to-maturity securities approximates fair value.

There were no material realized gains or losses on these investments for the years ended

December 31, 2007, 2006 or 2005. Contractual maturities of investments underlying our

available-for-sale securities at December 31, 2007 consisted of $611 million maturing after 2015;

however, these are all auction rate securities, or ARSs, each with a reset period of less than 30 days.

At December 31, 2007, $45 million of our restricted cash was also invested in ARSs. Through

February 11, 2008, we had reduced our total holdings in ARSs to $330 million, principally by investing

in other short-term investments as individual ARS reset periods came due and the securities were

once again subject to the auction process. The $330 million we have invested in ARSs at February 18,

2008 is collateralized by portfolios of student loans, substantially all of which is guaranteed by the

United States government. Through February 18, 2008, auctions for $144 million of these securities

were not successful, resulting in our continuing to hold these securities and the issuers paying interest

at the maximum contractual rate. Based on current market conditions, it is likely that auctions related

to more of these securities will be unsuccessful in the near term. Unsuccessful auctions could result in

64