JetBlue Airlines 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

units under our 2002 Plan and purchase rights under our CSPP. We expect to recognize this

stock-based compensation expense over a weighted average period of approximately three years. The

total fair value of stock options vested during the years ended December 31, 2007, 2006 and 2005 was

approximately $6 million, $2 million and $126 million, respectively.

Crewmember Stock Purchase Plan: Our CSPP, which is available to all employees, had

5.1 million shares of our common stock initially reserved for issuance at its inception in April 2002.

The reserve automatically increases each January by an amount equal to 3%of the total number of

shares of our common stock outstanding on the last trading day in December of the prior calendar

year. In no event will any such annual increase exceed 9.1 million shares. The plan will terminate no

later than the last business day of April 2012.

The plan has a series of successive overlapping 24-month or 6-month offering periods, with a new

offering period beginning on the first business day of May and November each year. Employees can

only join an offering period on the start date and participate in one offering period at a time.

Employees may contribute up to 10%of their pay, through payroll deductions, toward the purchase of

common stock. Purchase dates occur on the last business day of April and October each year.

Effective May 1, 2007, all new CSPP participation is considered non-compensatory following the

elimination of the 24-month offering period and the reduction of the purchase price discount from

15%to 5%. Participants previously enrolled will be allowed to continue to purchase shares in their

current compensatory offering periods until these offering periods expire in 2008. The modification to

our CSPP plan was done in conjunction with the modifications to our employee retirement plan

discussed in Note 10.

Prior to the 2007 amendment, if the fair market value per share of our common stock on any

purchase date within a particular offering period is less than the fair market value per share on the

start date of that offering period, then the participants in that offering period were automatically

transferred and enrolled in the new two-year offering period which began on the next business day

following such purchase date and the related purchase of shares. During 2006 and 2005, certain

participants were automatically transferred and enrolled in new offering periods due to decreases in

our stock price.

Should we be acquired by merger or sale of substantially all of our assets or more than 50%of

our outstanding voting securities, then all outstanding purchase rights will automatically be exercised

immediately prior to the effective date of the acquisition at a price equal to either a) the lower of 85%

of the fair market value per share on the start date of the offering period in which the participant is

enrolled or 85%of the fair market value per share immediately prior to the acquisition or b) 95%of

the fair market value per share immediately prior to the acquisition.

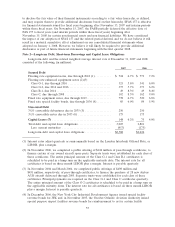

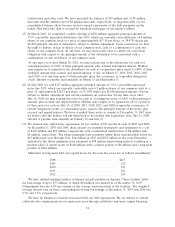

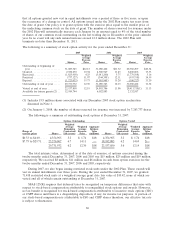

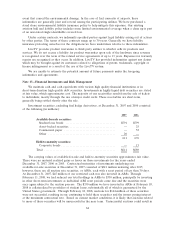

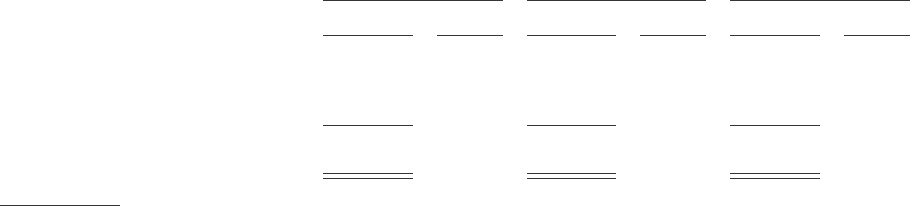

The following is a summary of CSPP share reserve activity for the years ended December 31:

2007 2006 2005

Shares

Weighted

Average Shares

Weighted

Average Shares

Weighted

Average

Available for future purchases,

beginning of year............. 16,908,852 13,706,245 10,577,175

Shares reserved for issuance (1) . . 5,328,277 5,178,659 4,690,645

Common stock purchased ....... (2,160,284) $8.15 (1,976,052) $8.73 (1,561,575) $10.83

Available for future purchases,

end of year .................. 20,076,845 16,908,852 13,706,245

(1) On January 1, 2008, the number of shares reserved for issuance was increased by 5,447,803 shares.

Stock Incentive Plan: The 2002 Plan, which includes stock options issued during 1999 through

2001 under a previous plan as well as all options issued since, provides for incentive and non-qualified

stock options to be granted to certain employees and members of our Board of Directors. The 2002

Plan became effective following our initial public offering. Prior to January 1, 2006, stock options

under the 2002 Plan became exercisable when vested, which occurred in annual installments of three

to seven years. For issuances under the 2002 Plan beginning in 2006, we revised the vesting terms so

59