JetBlue Airlines 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

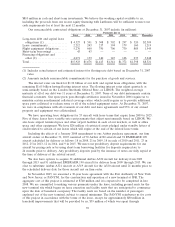

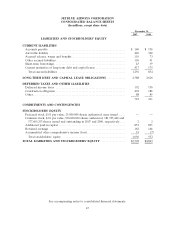

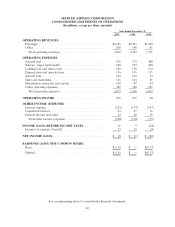

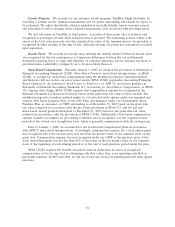

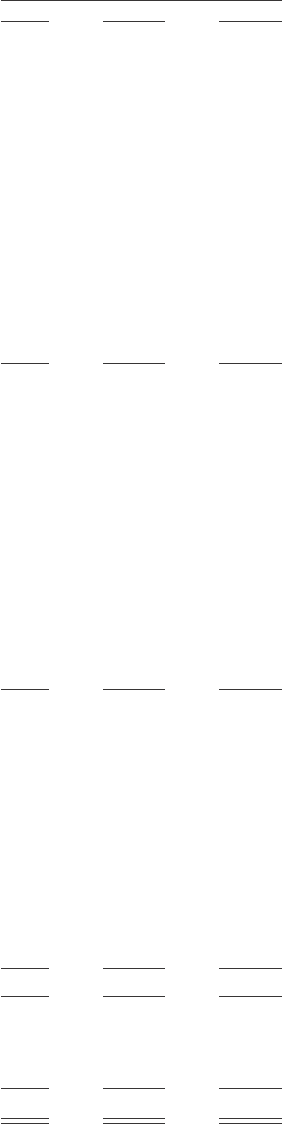

JETBLUE AIRWAYS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

Year Ended December 31,

2007 2006 2005

CASH FLOWS FROM OPERATING ACTIVITIES

Net income (loss) ........................................ $ 18 $ (1) $ (20)

Adjustments to reconcile net income (loss) to net cash

provided by operating activities:

Deferred income taxes ................................. 23 10 (4)

Depreciation .......................................... 161 136 101

Amortization .......................................... 19 18 16

Stock-based compensation .............................. 15 21 9

Changes in certain operating assets and liabilities:

Increase in receivables................................ (14) (12) (28)

Increase in inventories, prepaid and other............... 3 (28) (20)

Increase in air traffic liability .......................... 86 97 69

Increase in accounts payable and other accrued liabilities . 36 33 54

Other, net............................................. 11 — (7)

Net cash provided by operating activities ............. 358 274 170

CASH FLOWS FROM INVESTING ACTIVITIES

Capital expenditures ..................................... (617) (996) (917)

Predelivery deposits for flight equipment ................... (128) (106) (183)

Assets constructed for others .............................. (242) (149) (24)

Proceeds from sale of flight equipment ..................... 100 154 —

Refund of predelivery deposits for flight equipment .......... 12 19 —

Purchase of held-to-maturity investments ................... (11) (23) (5)

Proceeds from maturities of held-to-maturity investments ..... 24 15 18

Purchase of available-for-sale securities ..................... (654) (1,002) (758)

Sale of available-for-sale securities ......................... 719 797 679

Return of security deposits................................ 72 — —

Increase in restricted cash and other assets, net .............. (9) (16) (86)

Net cash used in investing activities .................. (734) (1,307) (1,276)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from:

Issuance of common stock .............................. 26 28 178

Issuance of long-term debt .............................. 376 855 872

Aircraft sale and leaseback transactions .................. 183 406 152

Short-term borrowings.................................. 48 45 68

Construction obligation ................................. 242 179 —

Repayment of long-term debt and capital lease obligations.... (265) (390) (117)

Repayment of short-term borrowings....................... (44) (71) (47)

Other, net............................................... (10) (15) (13)

Net cash provided by financing activities .............. 556 1,037 1,093

INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS ........................................ 180 4 (13)

Cash and cash equivalents at beginning of period .............. 10 6 19

Cash and cash equivalents at end of period ................... $ 190 $ 10 $ 6

See accompanying notes to consolidated financial statements.

47