JetBlue Airlines 2007 Annual Report Download - page 64

Download and view the complete annual report

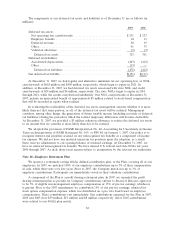

Please find page 64 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.construction and other costs. We have recorded the issuance of $39 million (net of $1 million

discount) and $45 million (net of $2 million discount), respectively, as long-term debt on our

consolidated balance sheet because we have issued a guarantee of the debt payments on the

bonds. This fixed rate debt is secured by leasehold mortgages of our airport facilities.

(5) In March 2005, we completed a public offering of $250 million aggregate principal amount of

3

3

⁄

4

%convertible unsecured debentures due 2035, which are currently convertible into 14.6 million

shares of our common stock at a price of approximately $17.10 per share, or 58.4795 shares per

$1,000 principal amount of debentures, subject to further adjustment. Upon conversion, we have

the right to deliver, in lieu of shares of our common stock, cash or a combination of cash and

shares of our common stock. At any time, we may irrevocably elect to satisfy our conversion

obligation with respect to the principal amount of the debentures to be converted with a

combination of cash and shares of our common stock.

At any time on or after March 20, 2010, we may redeem any of the debentures for cash at a

redemption price of 100%of their principal amount, plus accrued and unpaid interest. Holders

may require us to repurchase the debentures for cash at a repurchase price equal to 100%of their

principal amount plus accrued and unpaid interest, if any, on March 15, 2010, 2015, 2020, 2025

and 2030, or at any time prior to their maturity upon the occurrence of a specified designated

event. Interest is payable semi-annually on March 15 and September 15.

(6) In July 2003, we sold $175 million aggregate principal amount of 3

1

⁄

2

%convertible unsecured

notes due 2033, which are currently convertible into 6.2 million shares of our common stock at a

price of approximately $28.33 per share, or 35.2941 shares per $1,000 principal amount of notes,

subject to further adjustment and certain conditions on conversion. At any time on or after

July 18, 2008, we may redeem the notes for cash at a redemption price of 100%of their principal

amount, plus accrued and unpaid interest. Holders may require us to repurchase all or a portion

of their notes for cash on July 15 of 2008, 2013, 2018, 2023, and 2028 or upon the occurrence of

certain designated events at a repurchase price equal to the principal amount of the notes, plus

accrued and unpaid interest. We have classified these notes as current at December 31, 2007 since

we believe that the holders will put them back to us on their first repurchase date, July 15, 2008.

Interest is payable semi-annually on January 15 and July 15.

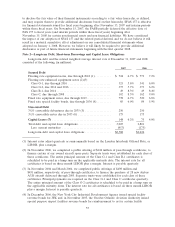

(7) We entered into capital lease agreements for two Airbus A320 aircraft in each of 2007 and 2006.

At December 31, 2007 and 2006, these aircraft are included in property and equipment at a cost

of $152 million and $75 million, respectively, with accumulated amortization of $4 million and

$1 million, respectively. The future minimum lease payments under these noncancelable leases are

$15 million per year through 2011, $14 million in 2012 and $152 million in the years thereafter.

Included in the future minimum lease payments is $78 million representing interest, resulting in a

present value of capital leases of $148 million with a current portion of $6 million and a long-term

portion of $142 million.

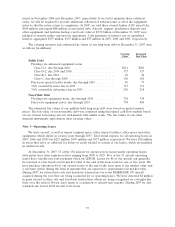

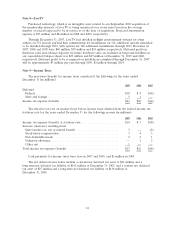

Maturities of long-term debt and capital leases for the next five years are as follows (in millions):

2008.......................................... $417

2009.......................................... 152

2010.......................................... 156

2011.......................................... 162

2012.......................................... 195

We have utilized funding facilities to finance aircraft predelivery deposits. These facilities allow

for borrowings of up to $77 million, of which $34 million was unused as of December 31, 2007.

Commitment fees are 0.5%per annum on the average unused portion of the facilities. The weighted

average interest rate on these outstanding short-term borrowings at December 31, 2007 and 2006 was

6.7%and 7.1%, respectively.

We have no financial covenants associated with our debt agreements. We are subject to certain

collateral ratio requirements in our spare parts pass-through certificates and spare engine financing

54