JetBlue Airlines 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

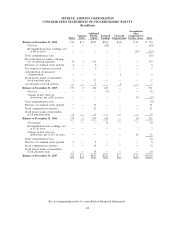

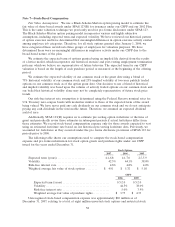

Note 5—Stockholders’ Equity

Our authorized shares of capital stock consist of 500 million shares of common stock and

25 million shares of preferred stock. The holders of our common stock are entitled to one vote per

share on all matters which require a vote by the Company’s stockholders as set forth in our Amended

and Restated Certificate of Incorporation and Bylaws.

We distributed 57 million shares of common stock in connection with our December 2005

three-for-two stock split. All common share and per share data for periods presented in the

accompanying consolidated financial statements and notes thereto give effect to this stock split.

In November 2005, we completed a public offering of 12.9 million shares of our common stock at

$12.00 per share, raising net proceeds of $153 million, after deducting discounts and commissions paid

to the underwriters and other expenses incurred in connection with the offering.

Pursuant to our amended Stockholder Rights Agreement, which became effective in

February 2002, each share of common stock has attached to it a right and, until the rights expire or

are redeemed, each new share of common stock issued by the Company will include one right. Upon

the occurrence of certain events, each right entitles the holder to purchase one one-thousandth of a

share of Series A participating preferred stock at an exercise price of $35.55, subject to further

adjustment. The rights become exercisable only after any person or group acquires beneficial

ownership of 15%or more (25%or more in the case of certain specified stockholders) of the

Company’s outstanding common stock or commences a tender or exchange offer that would result in

such person or group acquiring beneficial ownership of 15%or more (25%or more in the case of

certain stockholders) of the Company’s common stock. If after the rights become exercisable, the

Company is involved in a merger or other business combination or sells more than 50%of its assets or

earning power, each right will entitle its holder (other than the acquiring person or group) to receive

common stock of the acquiring company having a market value of twice the exercise price of the

rights. The rights expire on April 17, 2012 and may be redeemed by the Company at a price of

$.01 per right prior to the time they become exercisable.

As of December 31, 2007, we had a total of 83.2 million shares of our common stock reserved for

issuance under our CSPP, our 2002 Plan and for our convertible debt.

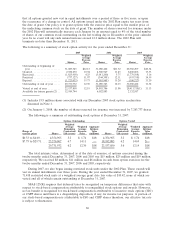

Note 6—Earnings (Loss) Per Share

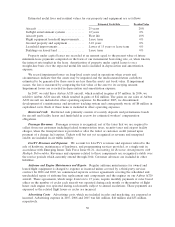

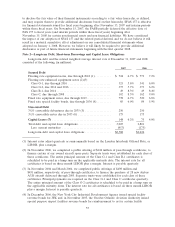

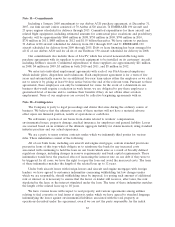

The following table shows how we computed basic and diluted earnings (loss) per common share

for the years ended December 31 (dollars in millions; share data in thousands):

2007 2006 2005

Numerator:

Net income (loss) applicable to common stockholders ..... $ 18 $ (1) $ (20)

Denominator:

Weighted-average shares outstanding for basic earnings

(loss) per share ..................................... 179,766 175,113 159,889

Effect of dilutive securities:

Employee stock options.............................. 4,483 — —

Unvested common stock ............................. 11 — —

Adjusted weighted-average shares outstanding and

assumed conversions for diluted earnings (loss) per

share .............................................. 184,260 175,113 159,889

For each of the years ended December 31, 2007, 2006 and 2005, a total 20.8 million shares

issuable upon conversion of our convertible debt were excluded from the diluted earnings per share

calculation since the assumed conversions would be anti-dilutive. We also excluded 24.7 million,

31.1 million and 31.1 million shares issuable upon exercise of outstanding stock options for the years

ended December 31, 2007, 2006 and 2005, respectively, from the diluted earnings (loss) per share

computation since their exercise price was greater than the average market price of our common stock

or they were otherwise anti-dilutive.

57