JetBlue Airlines 2007 Annual Report Download - page 44

Download and view the complete annual report

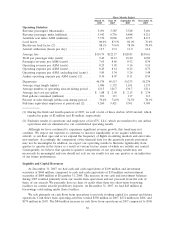

Please find page 44 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Aircraft fuel expense increased 54%, or $264 million, due to 74 million more gallons of aircraft

fuel consumed resulting in $119 million of additional fuel expense and a 24%increase in average fuel

cost per gallon, or $145 million. Aircraft fuel prices remained at or near historically high levels in

2006, with our average fuel price per gallon at $1.99 compared to $1.61 for the year ended

December 31, 2005. Our fuel costs represented 34%and 30%of our operating expenses in 2006 and

2005, respectively. Our fuel consumption per block hour decreased 5%due to utilization of the lighter

EMBRAER 190 aircraft and various fuel conservation initiatives. Based on our expected fuel volume

for 2007, a $0.10 per gallon increase in the cost of aircraft fuel would increase our annual fuel expense

by approximately $45 million. Cost per available seat mile increased 28%primarily due to the increase

in average fuel cost per gallon.

Salaries, wages and benefits increased 29%, or $125 million, due primarily to an increase in

average full-time equivalent employees of 25%in 2006 compared to 2005 and a $12 million increase in

non-cash stock-based compensation expense. We recorded $3 million of profit sharing in 2006

compared to none in 2005. Cost per available seat mile increased 7%as a result of stock-based

compensation expense and profit sharing.

Effective January 1, 2006, we adopted Statement of Financial Accounting Standards No. 123(R),

Share-Based Payment, and related interpretations, or SFAS 123(R), which requires us to record the

fair value of stock options granted under our 2002 Stock Incentive Plan and purchase rights issued

under our stock purchase plan. Because we elected to use the modified prospective transition method,

results for prior periods have not been restated. At December 31, 2006, there was $35 million of total

unrecognized compensation cost related to non-vested share-based compensation arrangements

granted under all of our equity compensation plans. Total unrecognized compensation cost will be

adjusted for future changes in estimated forfeitures. We expect to recognize that cost over the

remaining vesting period of five years. See Notes 1 and 7 to our consolidated financial statements for

more information regarding the adoption of this accounting standard.

Landing fees and other rents increased 41%, or $46 million, due to a 42%increase in departures

over 2005 and increased airport rents associated with opening 16 new cities in 2006. Cost per available

seat mile increased 17%due to ground rents associated with our new terminal under construction at

JFK.

Depreciation and amortization increased 32%, or $36 million, primarily due to having an average

of 67 owned and capital leased aircraft in 2006 compared to 52 in 2005 and the associated

depreciation of our seven-gate temporary facility at JFK, which was placed into service in June 2006.

Cost per available seat mile increased 9%primarily due to our temporary facility at JFK, partially

offset by a lower percentage of our fleet being owned or under capital lease.

Aircraft rent increased 39%, or $29 million, due to 16 new EMBRAER 190 aircraft leases. Cost

per available seat mile increased 15%due to a higher percentage of our fleet being leased.

Sales and marketing expense increased 27%, or $23 million, primarily due to $16 million in higher

credit card fees resulting from increased passenger revenues and $6 million in increased advertising

expenses. On a cost per available seat mile basis, sales and marketing expense increased 5%primarily

due to higher credit card fees resulting from higher average fares. We book the majority of our

reservations through a combination of our website and our agents (79%and 19%in 2006,

respectively).

Maintenance materials and repairs increased 36%, or $23 million, due to 29 more average

operating aircraft in 2006 compared to 2005 and a gradual aging of our fleet. Cost per available seat

mile increased 13%year-over-year due primarily to operating under airframe parts maintenance

third-party contracts in 2006, one-time warranty coverage on our engines in 2005 and outsourced line

maintenance for the 16 new cities we opened in 2006. Maintenance costs are expected to increase

significantly as our fleet ages.

Other operating expenses increased 13%, or $37 million, due to higher variable costs associated

with increased capacity and number of passengers served. Cost per available seat mile decreased 7%

34