JetBlue Airlines 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In the third quarter of 2008, we plan on opening our new 26-gate terminal at JFK’s Terminal 5, or

T5. T5 has an optimal airside location, which we believe will increase the efficiency of our

operations. Although we will be limited in the number of flights we can operate out of JFK during the

airport’s peak hours, we believe that T5 will allow us to continue to grow our operations at the

airport. We also believe that our customers will have an improved overall experience in T5, including

approximately 200 self-service kiosks, a 20-lane security checkpoint and a wide variety of high quality

concessions and wireless hotspots, which should differentiate us from our competitors in much the

same way that our onboard flight experience has distinguished us from other airlines.

We have increased our revenues through the use of various distribution channels. During 2007,

we began selling tickets through several online travel agencies, including Expedia, Travelocity and

Orbitz. We also began collecting a $10 telephonic reservation fee, with the goal of directing more

traffic through jetblue.com, our lowest cost distribution channel, in addition to generating more

ancillary revenue. We also introduced our Cashless Cabin initiative in November 2007 in order to help

monetize ancillary revenue opportunities onboard our aircraft. We are continuing to evaluate

additional revenue generating options to improve the JetBlue Experience for our customers without

compromising the JetBlue brand.

In December 2007, we announced plans to issue and sell approximately 42 million shares of our

common stock to Deutsche Lufthansa AG for approximately $300 million, net of transaction costs.

Following the consummation of this transaction in January 2008, Deutsche Lufthansa AG currently

owns approximately 19%of our total outstanding shares of common stock. We believe that this

investment by one of the most highly respected leaders and most recognized brands in the global

airline industry is an affirmation of the JetBlue brand and business model. The proceeds of this

financing will be used to fund working capital and for other corporate purposes.

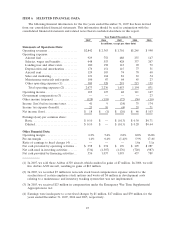

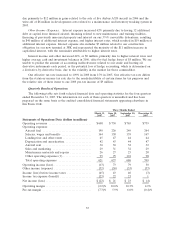

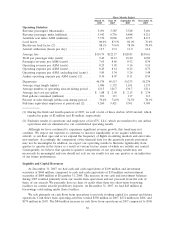

We derive our revenue primarily from transporting passengers on our aircraft. Passenger revenue

was 92.7%of our total operating revenues for the year ended December 31, 2007. Revenues generated

from international routes, excluding Puerto Rico, accounted for 4%of our total passenger revenues in

2007. Revenue is recognized either when transportation is provided or after the ticket or customer

credit expires. We measure capacity in terms of available seat miles, which represents the number of

seats available for passengers multiplied by the number of miles the seats are flown. Yield, or the

average amount one passenger pays to fly one mile, is calculated by dividing passenger revenue by

revenue passenger miles.

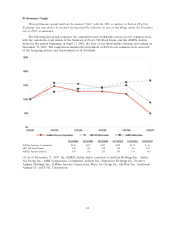

We strive to increase passenger revenue primarily by increasing our yield per flight, which

produces higher revenue per available seat mile, or RASM. Our objective is to optimize our fare mix

to increase our overall average fare and, in certain markets, utilize our network to maximize

connecting opportunities while continuing to provide our customers with low fares. When we enter a

new market, our low fares are designed to stimulate demand, particularly from fare-conscious leisure

and business travelers who might otherwise have used alternate forms of transportation or would not

have traveled at all. In addition to our regular fare structure, we frequently offer sale fares with

shorter advance purchase requirements in most of the markets we serve and match the sale fares

offered by other airlines.

Other revenue consists primarily of fees charged to customers in accordance with our published

policies relating to reservation changes and baggage limitations, the marketing component of TrueBlue

point sales, concession revenues and revenues earned by our subsidiary, LiveTV, LLC, for the sale of,

and on-going services provided for, in-flight entertainment systems sold to other airlines.

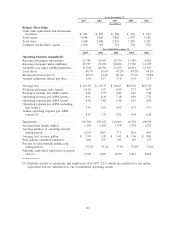

We maintain one of the lowest cost structures in the industry due to the young average age of our

fleet, a productive workforce, and a strong commitment to cost discipline. In 2008, we plan to continue

our focus on cost control while improving the JetBlue Experience for our customers. The largest

components of our operating expenses are aircraft fuel and salaries, wages and benefits provided to

our employees, including provisions for our profit sharing plan. Unlike most airlines, we have a

non-union workforce, which we believe provides us with more flexibility and allows us to be more

productive, although we are subject to ongoing attempts at unionization. The price and availability of

aircraft fuel, which is our single largest operating expense, are extremely volatile due to global

29