JetBlue Airlines 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

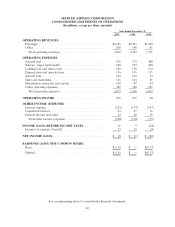

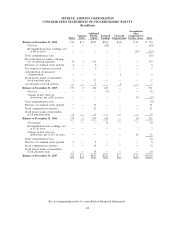

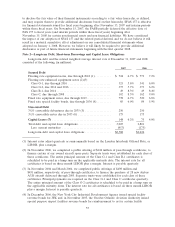

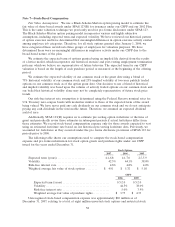

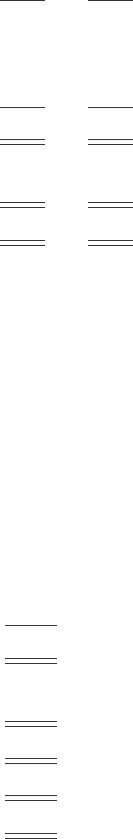

The table below summarizes the impact on our results of operations for the years ended

December 31, 2007 and 2006 of outstanding stock options and restricted stock units under our 2002

Plan and issuances under our CSPP recognized under the provisions of SFAS 123(R) (in millions,

except per share data):

2007 2006

Stock-based compensation expense:

Issuances under crewmember stock purchase plan............ $ 6 $ 13

Issuances under stock incentive plan ....................... 9 8

Income tax benefit ......................................... (3) (4)

Decrease in net income (loss) ............................... $ 12 $ 17

Decrease in earnings (loss) per common share:

Basic ................................................... $0.08 $0.09

Diluted ................................................. $0.08 $0.09

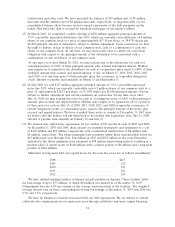

Prior to our adoption of SFAS 123(R), we presented unearned compensation as a separate

component of stockholders’ equity. In accordance with the provisions of SFAS 123(R), on

January 1, 2006, we reclassified unearned compensation to additional paid-in capital on our balance

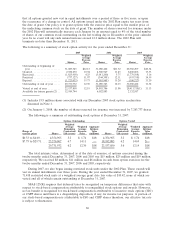

sheet. The following table illustrates the effect on net loss and loss per common share as if we had

applied the fair value method to measure stock-based compensation, which is described more fully in

Note 7, as required under the disclosure provisions of SFAS 123 for the year ended December 31,

2005 (in millions, except per share amounts):

Net income (loss), as reported .......................... $ (20)

Add: Stock-based compensation expense included

in reported net income (loss), net of tax ............... 8

Deduct: Stock-based compensation expense

determined under the fair value method, net of tax

Crewmember stock purchase plan ................... (14)

Employee stock options............................ (95)

Pro forma net income (loss) ............................ $(121)

Earnings (loss) per common share:

Basic – as reported .................................. $(0.13)

Basic – pro forma ................................... $(0.76)

Diluted – as reported ................................ $(0.13)

Diluted – pro forma ................................. $(0.76)

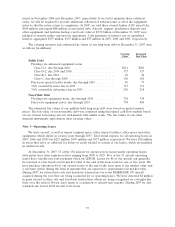

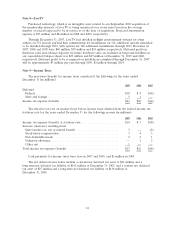

In December 2005, we accelerated the vesting of 19.9 million stock options, representing 64%of

the options then outstanding. This action resulted in non-cash, stock-based compensation expense of

$7 million in 2005. It also resulted in an increase of $72 million, net of tax, in the pro forma employee

stock option stock-based compensation expense shown above. The decision to accelerate vesting of

these options was made primarily to avoid recognizing the related compensation cost in our future

consolidated financial statements upon our adoption of SFAS 123(R).

Our policy is to issue new shares for purchases under our CSPP and issuances under our 2002

Plan.

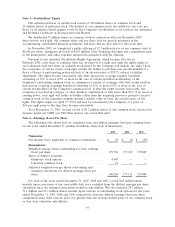

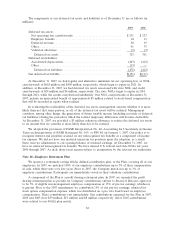

New Accounting Standards:

In September 2006, the FASB issued Statement of Financial Accounting Standards 157, Fair

Value Measurements, or SFAS 157, which defines fair value, establishes a framework for measuring fair

value and requires enhanced disclosures about fair value measurements. SFAS 157 requires companies

52